On March 31, 2025, Wolverine Asset Management LLC made a strategic move by acquiring an additional 206,713 shares of Spark I Acquisition Corp (SPKL, Financial). This transaction increased the firm's total holdings in the company to 682,588 shares. The trade was executed at a price of $10.8 per share, reflecting a calculated trade impact of 0.04. This acquisition signifies Wolverine Asset Management's continued interest in Spark I Acquisition Corp, a blank check company, and positions the stock as 0.12% of the firm's overall portfolio.

Wolverine Asset Management LLC: A Profile

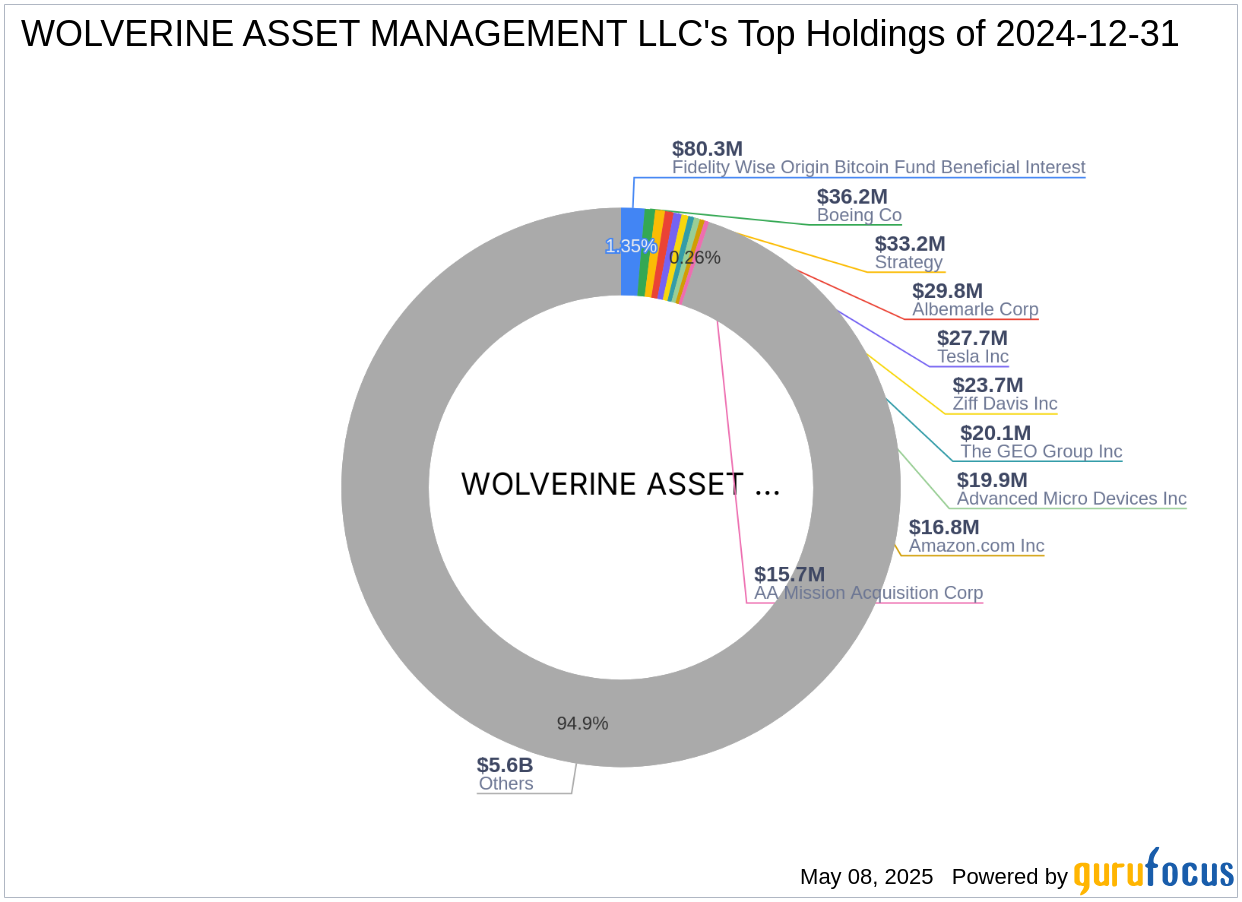

Wolverine Asset Management LLC, based in Chicago, IL, is a prominent investment firm known for its strategic and diversified investment approach. The firm manages a substantial equity portfolio valued at $5.95 billion, with a focus on sectors such as Financial Services and Technology. Among its top holdings are Strategy (MSTR, Financial), Tesla Inc (TSLA, Financial), and Boeing Co (BA, Financial), showcasing a preference for high-growth and innovative companies. Wolverine Asset Management's investment philosophy emphasizes identifying opportunities with significant growth potential and strategic value.

Understanding Spark I Acquisition Corp

Spark I Acquisition Corp is a blank check company, which typically means it is formed for the purpose of acquiring or merging with an existing company. As of the latest data, Spark I Acquisition Corp has a market capitalization of $178.138 million and a current stock price of $10.8475. The company's [GF-Score](https://www.gurufocus.com/term/gf-score/SPKL) is 24/100, indicating a poor potential for future performance. Despite this, the stock's [Financial Strength](https://www.gurufocus.com/term/rank-balancesheet/SPKL) is relatively strong with a rank of 8/10, suggesting a solid balance sheet.

Impact of the Transaction

The acquisition of additional shares in Spark I Acquisition Corp by Wolverine Asset Management LLC is a noteworthy development. The trade price of $10.8 per share aligns closely with the current market price, indicating a stable valuation. The stock now represents 6.83% of the firm's holdings in Spark I Acquisition Corp, highlighting its strategic importance within the portfolio. This move could be seen as a calculated risk, given the company's low [Profitability Rank](https://www.gurufocus.com/term/rank-profitability/SPKL) of 2/10 and [Growth Rank](https://www.gurufocus.com/term/rank-growth/SPKL) of 0/10.

Financial Performance and Valuation Insights

Spark I Acquisition Corp's financial metrics present a mixed picture. The stock's PE percentage stands at 58.01, suggesting a high valuation relative to earnings. However, the absence of [GF Valuation](https://www.gurufocus.com/term/rank-gf-value/SPKL) data makes it challenging to assess its intrinsic value accurately. The company's [Piotroski F-Score](https://www.gurufocus.com/term/fscore/SPKL) is 4, indicating moderate financial health. Despite these challenges, the stock has shown a year-to-date price change of 1.95% and an IPO price change of 6.87%, reflecting some positive momentum.

Stock Performance Metrics

Analyzing Spark I Acquisition Corp's performance metrics reveals areas of concern. The stock's [Momentum Rank](https://www.gurufocus.com/term/rank-momentum/SPKL) is 0/10, and its [Operating Margin](https://www.gurufocus.com/term/operating-margin/SPKL) growth is stagnant. Additionally, the company's [interest coverage](https://www.gurufocus.com/term/interest-coverage/SPKL) is notably high, indicating a strong ability to meet interest obligations. However, the [Altman Z score](https://www.gurufocus.com/term/zscore/SPKL) is 0.00, suggesting potential financial distress.

Conclusion

Wolverine Asset Management LLC's decision to increase its stake in Spark I Acquisition Corp reflects a strategic addition to its portfolio. While the stock presents certain risks, such as low profitability and growth ranks, the firm's investment could be driven by the potential for future mergers or acquisitions. For value investors, this transaction highlights the importance of thorough analysis and consideration of both risks and opportunities in the evolving financial landscape.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.