On March 31, 2025, WOLVERINE ASSET MANAGEMENT LLC (Trades, Portfolio) executed a notable transaction by acquiring 1,077,085 shares of Translational Development Acquisition Corp (TDAC, Financial) at a price of $10.08 per share. This acquisition marks a new holding in the firm's portfolio, reflecting its strategic interest in the financial services sector. The transaction represents a 0.18% impact on the firm's overall portfolio, with TDAC now holding a 6.24% position in the firm's total holdings.

Profile of WOLVERINE ASSET MANAGEMENT LLC (Trades, Portfolio)

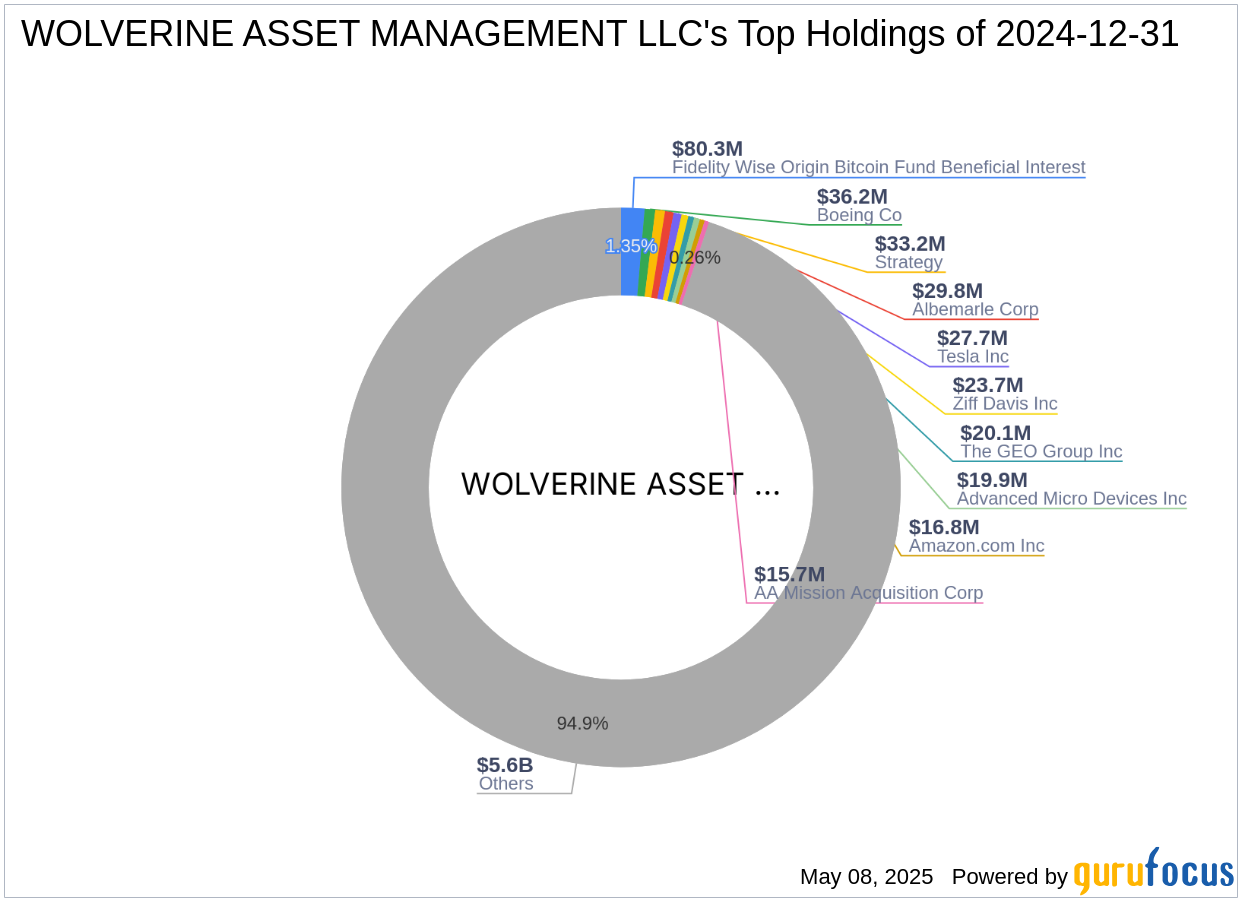

WOLVERINE ASSET MANAGEMENT LLC (Trades, Portfolio) is a prominent investment firm headquartered in Chicago, IL. The firm is well-regarded for its focus on the financial services and technology sectors, managing an equity portfolio valued at approximately $5.95 billion. Among its top holdings are companies such as Strategy (MSTR, Financial), Tesla Inc (TSLA, Financial), and Boeing Co (BA, Financial). The firm's investment philosophy emphasizes identifying opportunities within these sectors, leveraging its expertise to maximize returns.

Understanding Translational Development Acquisition Corp

Translational Development Acquisition Corp is a newly organized blank check company that went public on February 13, 2025. Based in the USA, the company operates within the diversified financial services industry and has a market capitalization of $222.799 million. As a blank check company, TDAC is primarily focused on mergers, capital stock exchanges, asset acquisitions, stock purchases, reorganizations, or similar business combinations with one or more businesses.

Financial Metrics and Valuation of TDAC

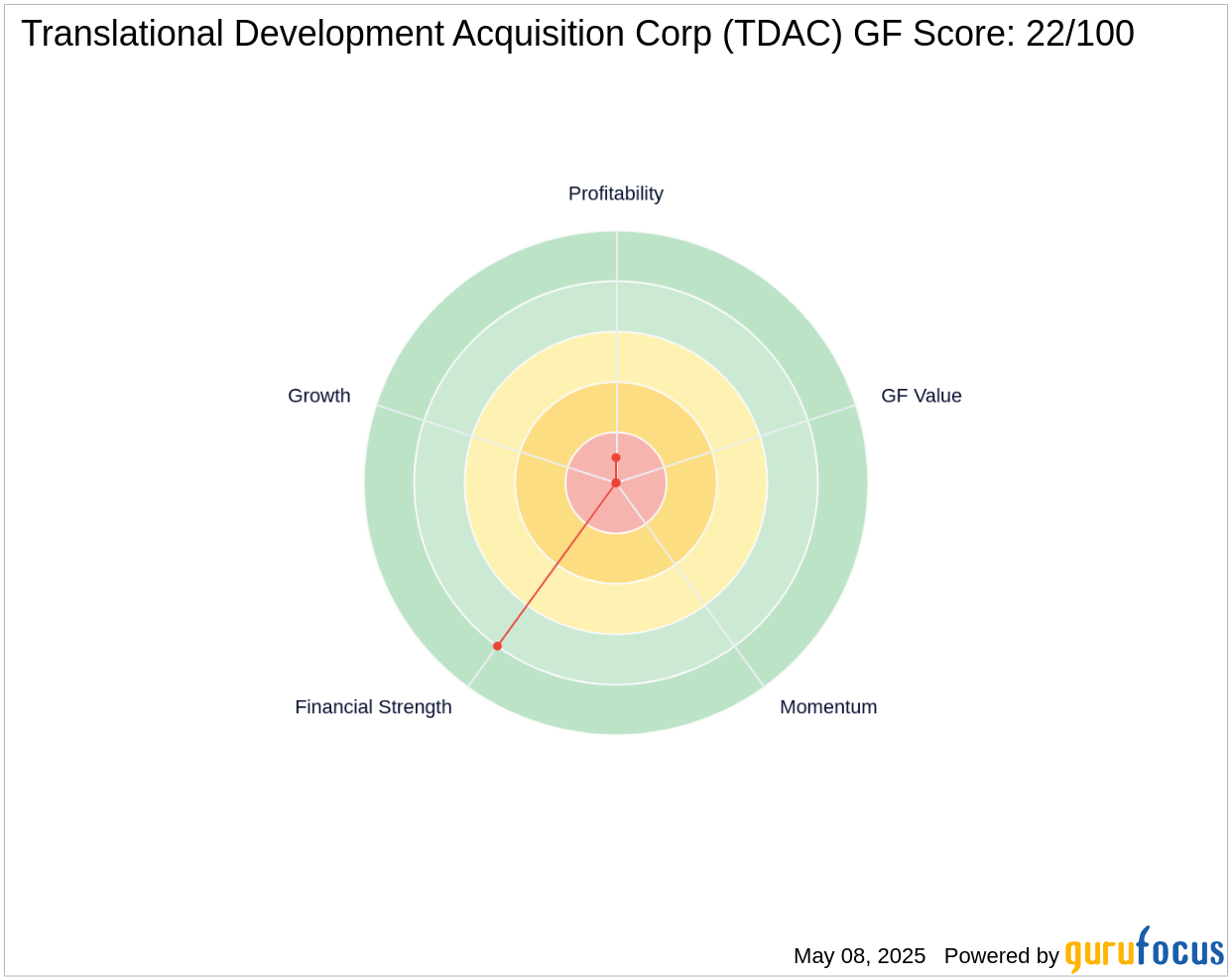

Currently, TDAC's stock price stands at $10.17, reflecting a slight gain of 0.89% since the transaction. The stock's GF Score is 22/100, indicating a poor future performance potential. Despite a strong balance sheet rank of 8/10, the company struggles with low profitability and growth ranks. The lack of profitability is further highlighted by a negative operating margin and a Piotroski F-Score of 3, suggesting limited financial health.

Impact on WOLVERINE ASSET MANAGEMENT LLC (Trades, Portfolio)'s Portfolio

The acquisition of TDAC shares is a strategic move that aligns with WOLVERINE ASSET MANAGEMENT LLC (Trades, Portfolio)'s investment philosophy. By adding TDAC to its portfolio, the firm continues to explore emerging opportunities within the financial services sector. This transaction, representing 0.18% of the firm's portfolio, underscores its commitment to diversifying its holdings and capitalizing on potential growth in the industry.

Market Performance and Potential of TDAC

Since its IPO, TDAC has experienced a price change of 1.7%, with a year-to-date increase of 1.6%. Despite its low profitability and growth ranks, TDAC's interest coverage is notably high, suggesting potential for future financial stability. However, the company's Altman Z score and momentum rank remain low, indicating challenges in achieving sustainable growth.

Conclusion

WOLVERINE ASSET MANAGEMENT LLC (Trades, Portfolio)'s investment in Translational Development Acquisition Corp highlights a strategic addition to its diversified portfolio. Despite the current challenges faced by TDAC, the transaction reflects the firm's continued interest in emerging opportunities within the financial services sector. As TDAC navigates its early stages as a public company, its future performance will be closely monitored by investors and analysts alike.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.