Summary Highlights:

- Infineon Technologies AG (IFNNY, Financial) posts a strong 5% quarterly revenue increase in Q2 FY 2025.

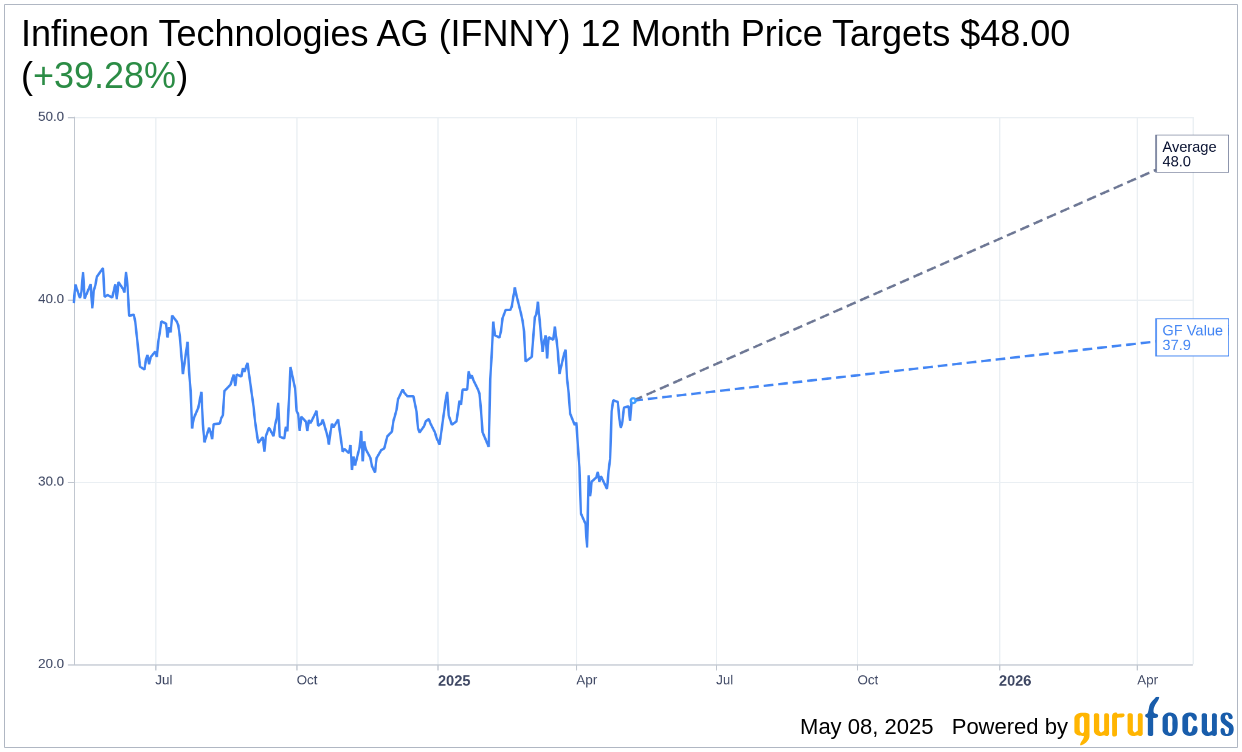

- Analysts project a significant 39.28% upside potential from the current stock price.

- The company's GF Value estimate suggests a moderate upside of 10.06%.

Infineon Technologies AG (IFNNY) showcased robust financial performance in its Q2 report, delivering a non-GAAP EPS of €0.34 alongside a revenue figure of €3.59 billion—a commendable 5% rise on a quarterly basis. The segment result climbed to €601 million, resulting in a healthy margin of 16.7%. As the company looks forward to Q3 FY 2025, expectations are set for revenues to reach €3.7 billion.

Analyst Insights and Price Target

According to projections from a solitary analyst, the average price target for Infineon Technologies AG (IFNNY, Financial) stands at $48.00, representing both the high and low estimate. This target suggests a notable upside of 39.28% from its current trading price of $34.46. Investors seeking more detailed estimates can explore further on the Infineon Technologies AG (IFNNY) Forecast page.

Aligning with a "Buy" recommendation, the average brokerage advice from one firm rates Infineon Technologies AG (IFNNY, Financial) at 1.0 on a scale of 1 to 5, where 1 signifies a Strong Buy and 5 indicates a Sell. This presents a bullish outlook on the stock's potential.

GuruFocus Value Estimation

The GF Value for Infineon Technologies AG (IFNNY, Financial) over the next year is estimated at $37.93, indicating a moderate upside potential of 10.06% from its present stock price of $34.4635. The GF Value is calculated using historical trading multiples, past growth patterns, and future business forecasts, offering a comprehensive view of the stock's fair market value. Detailed insights are available on the Infineon Technologies AG (IFNNY) Summary page.