Diebold Nixdorf (DBD, Financial) reported first-quarter revenue of $841.1 million, slightly below the expected $844.1 million. Despite missing the consensus, the company highlighted a robust operational performance with significant growth in order entries, mainly due to increased demand for cash recyclers and retail self-service solutions. Notably, Diebold achieved a milestone by recording positive free cash flow for the first quarter in its history, demonstrating strong execution by its global teams.

Looking forward, Diebold Nixdorf is confident in maintaining its 2025 financial projections, accounting for the anticipated effects of U.S. tariff policies. The company's local-to-local manufacturing strategy is seen as a crucial factor in mitigating tariff impacts and supporting continuous operational improvement. The leadership expressed pride in the company's ability to adapt and prioritize customer satisfaction, showing optimism in meeting future business goals.

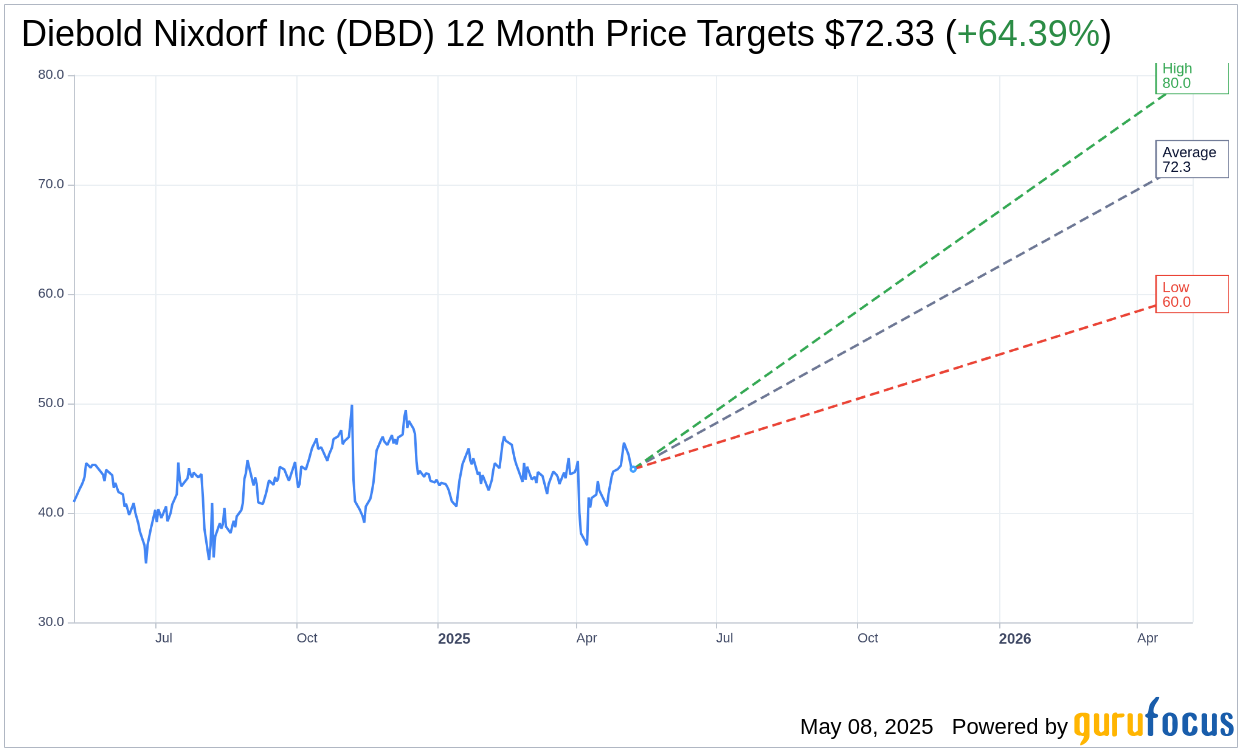

Wall Street Analysts Forecast

Based on the one-year price targets offered by 3 analysts, the average target price for Diebold Nixdorf Inc (DBD, Financial) is $72.33 with a high estimate of $80.00 and a low estimate of $60.00. The average target implies an upside of 64.39% from the current price of $44.00. More detailed estimate data can be found on the Diebold Nixdorf Inc (DBD) Forecast page.

Based on the consensus recommendation from 3 brokerage firms, Diebold Nixdorf Inc's (DBD, Financial) average brokerage recommendation is currently 1.7, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

DBD Key Business Developments

Release Date: May 07, 2025

- Product Orders Growth: 36% year-over-year increase in product orders.

- Gross Margin Expansion: Increased by 20 basis points year over year and 140 basis points sequentially.

- Free Cash Flow: Generated $6 million in positive free cash flow, the best first quarter in company history.

- Share Repurchase: Initiated a $100 million share repurchase program, repurchasing $8 million of shares.

- Product Backlog: Increased to approximately $900 million from $800 million at year-end.

- Adjusted EBITDA: $87 million in the first quarter.

- Banking Order Entry: Up approximately 50% year over year.

- Retail Order Entry: Up approximately 10% with stronger demand for self-service solutions.

- Net Leverage Ratio: 1.5 times, within the target range of 1.3 to 1.7 times.

- Liquidity: More than $635 million, including $328 million in cash and short-term investments.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Diebold Nixdorf Inc (DBD, Financial) reported a strong start to 2025 with Q1 performance on track with expectations.

- The company saw a significant 36% year-over-year growth in product orders, driven by automation and self-service technologies.

- Gross margin expanded by 20 basis points year over year and 140 basis points sequentially.

- Diebold Nixdorf Inc (DBD) generated $6 million in positive free cash flow, marking the best first quarter in the company's history.

- The company initiated a $100 million share repurchase program, repurchasing $8 million of DN shares in March.

Negative Points

- The geopolitical backdrop and new tariff policy pose potential impacts on the supply chain.

- There is a $20 million estimated gross impact from tariffs for 2025, with mitigation efforts only expected to cover up to 50%.

- The macro environment continues to impact Retail product revenue, with signs of stabilization only pointing to a second-half recovery.

- Foreign exchange expenses were significant, with an $8.5 million impact due to currency fluctuations.

- Operating expenses increased year over year due to higher incentive compensation and investments in strategic growth initiatives.