H.C. Wainwright analyst Heiko Ihle has boosted the price target for Sandstorm Gold (SAND, Financial) from $11.50 to $11.75. This decision follows the company's recent first-quarter report. Despite the adjustment in price target, the analyst maintains a Buy rating on the stock.

Wall Street Analysts Forecast

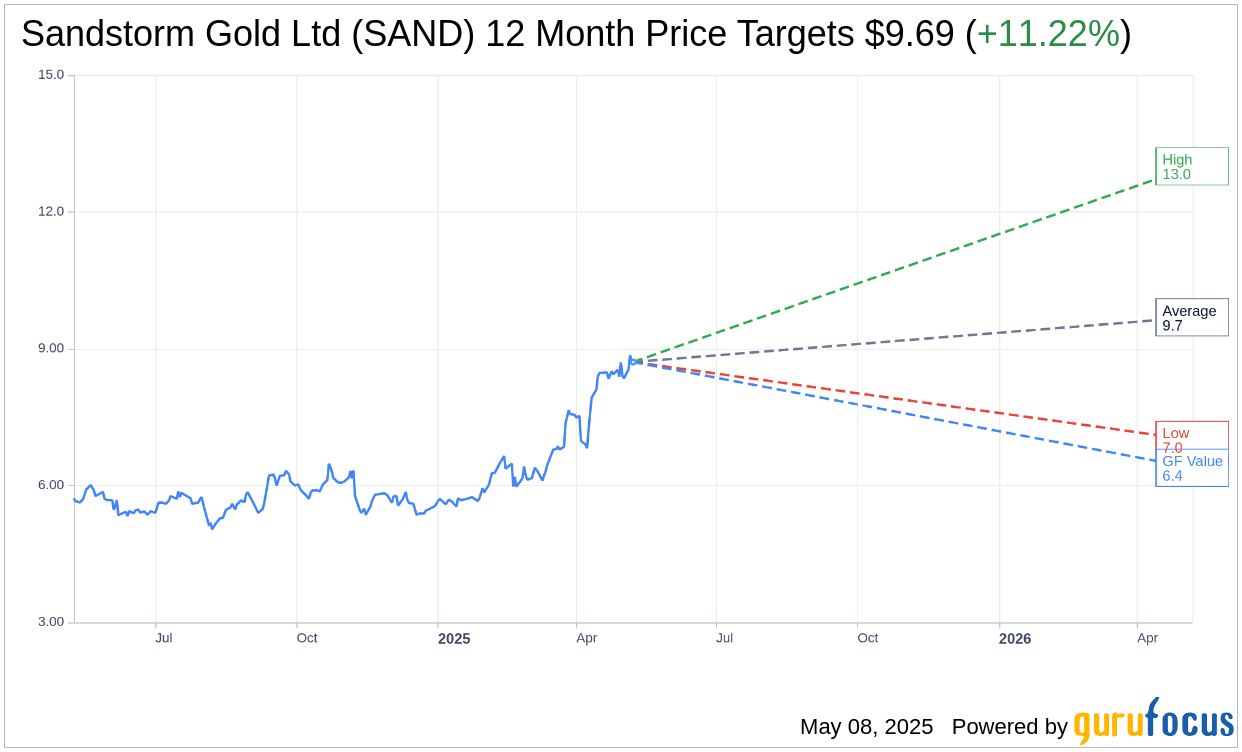

Based on the one-year price targets offered by 6 analysts, the average target price for Sandstorm Gold Ltd (SAND, Financial) is $9.69 with a high estimate of $13.00 and a low estimate of $7.00. The average target implies an upside of 11.22% from the current price of $8.71. More detailed estimate data can be found on the Sandstorm Gold Ltd (SAND) Forecast page.

Based on the consensus recommendation from 6 brokerage firms, Sandstorm Gold Ltd's (SAND, Financial) average brokerage recommendation is currently 2.2, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Sandstorm Gold Ltd (SAND, Financial) in one year is $6.39, suggesting a downside of 26.64% from the current price of $8.71. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Sandstorm Gold Ltd (SAND) Summary page.

SAND Key Business Developments

Release Date: May 07, 2025

- Revenue: Record quarterly revenue of $50.1 million.

- Operating Cash Flow: Over $40 million.

- Total Sales, Royalties, and Income: $54.1 million, including a $4 million payment from Vatukoula Gold Stream.

- Gold Equivalent Ounces (GEOs): 18,500 attributable GEOs, down from 20,300 in the previous year.

- Cash Margins: Over $2,500 per gold equivalent ounce, approximately 87% cash margins.

- Net Income: $11.3 million or $0.04 per share.

- Debt Repayment: $15 million repaid during the quarter, with an additional $12 million repaid subsequently, reducing debt to $328 million.

- Share Buybacks: Over 3 million shares repurchased at an average price of $6.21 per share.

- Production Guidance for 2025: Expected between 65,000 to 80,000 attributable gold equivalent ounces.

- Long-term Production Outlook: Anticipated to reach 150,000 ounces by 2030.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Sandstorm Gold Ltd (SAND, Financial) reported record quarterly revenue of USD50 million and operating cash flow of over USD40 million, indicating strong financial performance.

- The company anticipates its production to double by 2030, which is expected to significantly increase quarterly free cash flow in the coming years.

- Sandstorm Gold Ltd (SAND) successfully repurchased over 3 million shares during Q1 2025, which contributed to a rise in share price to approximately USD9 per share.

- The company made substantial progress in deleveraging its balance sheet, repaying $15 million of debt during the quarter and an additional $12 million subsequent to quarter end.

- Sandstorm Gold Ltd (SAND) maintained high cash margins of over $2,500 per gold equivalent ounce, resulting in strong cash flows and a return of over USD23 million to shareholders in the first quarter.

Negative Points

- Production from the stream and royalty portfolio was just shy of 18,500 attributable gold equivalent ounces, which was below the 20,300 ounces sold in the first quarter of the previous year.

- The year-over-year decrease in gold equivalent ounces was partly due to the timing of sales and the outperformance of gold relative to other commodities in the asset mix.

- Higher gold prices resulted in lower gold equivalent production as non-gold revenue from copper and silver streams converted to fewer gold equivalent ounces.

- Attributable gold sales at Bonikro were lower year over year due to atypical inventories at the end of 2023, which were sold in the first quarter of 2024.

- The company's production guidance is sensitive to changes in relative commodity prices, with a 10% change in copper and silver prices expected to impact attributable gold equivalent production by approximately 1,500 ounces.