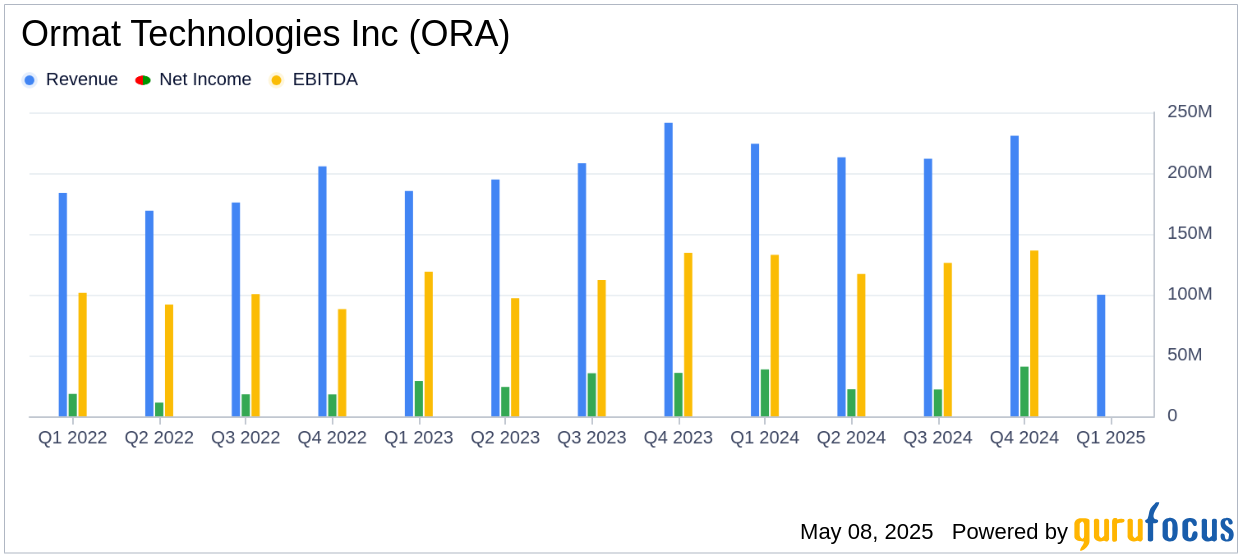

On May 8, 2025, Ormat Technologies Inc (ORA, Financial) released its 8-K filing detailing the financial results for the first quarter ended March 31, 2025. The company, a leader in geothermal and recovered energy power, reported a 2.5% increase in total revenues and a 4.6% rise in net income attributable to stockholders, surpassing analyst estimates. The company's adjusted EBITDA reached a record $150.3 million, marking a 6.4% increase from the previous year.

Company Overview

Ormat Technologies Inc is engaged in the geothermal and recovered energy power business, operating through three segments: Electricity, Product, and Energy Storage. The Electricity Segment focuses on developing, building, owning, and operating power plants, while the Product Segment designs and sells equipment for electricity generation. The Energy Storage Segment owns and operates grid-connected systems providing capacity and ancillary services.

Performance and Challenges

Ormat Technologies Inc's performance in Q1 2025 was driven by significant growth in its Energy Storage Segment, which saw revenues increase by 120%, contributing to a meaningful margin increase. However, the Electricity Segment faced challenges due to curtailments in California and Nevada, resulting in a slight year-over-year decline. Despite these challenges, the company remains optimistic about its growth trajectory, with several projects under development expected to enhance generation capacity by the end of 2025.

Financial Achievements

The company's financial achievements are crucial in the Utilities - Independent Power Producers industry, where consistent revenue growth and profitability are key indicators of success. The acquisition of the Blue Mountain geothermal power plant for $88 million further underscores Ormat's strategic expansion efforts. This acquisition is expected to enhance the company's capacity and efficiency, aligning with its commitment to innovation and maximizing renewable energy output.

Key Financial Metrics

Ormat Technologies Inc reported a 2.5% increase in total revenues and a 4.6% rise in net income attributable to stockholders. The company's adjusted EBITDA reached a record $150.3 million, a 6.4% increase from the previous year. These metrics are vital for evaluating the company's financial health and operational efficiency, providing insights into its ability to generate profits and sustain growth.

“Ormat had a strong start to 2025, achieving a 2.5% increase in revenue, a 4.6% rise in net income attributable to the Company’s stockholders, and a 6.4% increase in adjusted EBITDA. This growth was driven by improved performance in both our Product and Storage segments,” said Doron Blachar, Chief Executive Officer of Ormat Technologies.

Analysis and Outlook

Ormat Technologies Inc's Q1 2025 performance reflects its strategic focus on expanding its portfolio and enhancing operational efficiency. The company's ability to navigate challenges in the Electricity Segment while capitalizing on opportunities in the Energy Storage Segment demonstrates its resilience and adaptability. With ongoing projects and strategic acquisitions, Ormat is well-positioned to achieve its long-term growth targets and contribute to a sustainable energy future.

For more detailed insights and analysis, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Ormat Technologies Inc for further details.