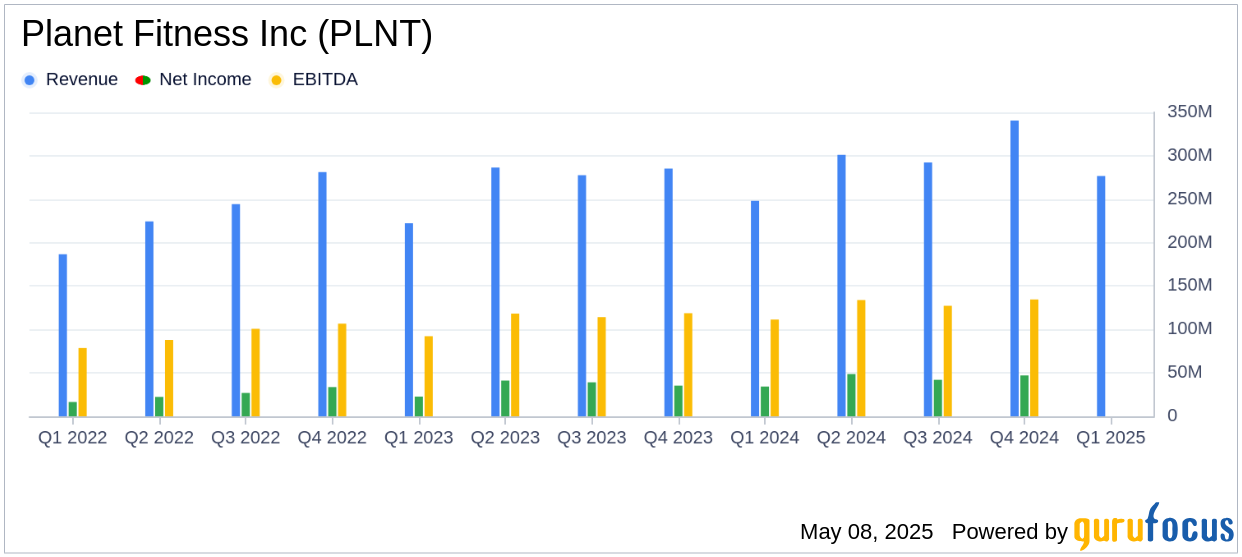

On May 8, 2025, Planet Fitness Inc (PLNT, Financial) released its 8-K filing detailing the financial results for the first quarter ended March 31, 2025. The company, a leading franchisor and operator of fitness centers, reported a total revenue of $276.7 million, which fell short of the analyst estimate of $279.16 million. However, the earnings per share (EPS) of $0.50 fell short of the estimated EPS of $0.54.

Company Overview

Planet Fitness Inc operates through three segments: Franchise, Corporate-owned stores, and Equipment. The Franchise segment includes operations in the United States, Puerto Rico, Canada, Panama, Mexico, and Australia. The Corporate-owned stores segment covers operations in the United States and Canada, while the Equipment segment involves the sale of equipment to franchisee-owned stores in the U.S. The majority of the company's revenue is generated from the Corporate-owned stores segment.

Performance Highlights and Challenges

Planet Fitness Inc reported a notable increase in system-wide same club sales by 6.1%, ending the quarter with approximately 20.6 million members. The company also repurchased $50.0 million in shares during the first quarter. Despite these achievements, the revenue of $276.7 million was slightly below the analyst estimate, indicating potential challenges in meeting market expectations.

Financial Achievements and Industry Context

The company's total revenue increased by 11.5% from the prior year period, reaching $276.7 million. This growth is significant in the Travel & Leisure industry, where maintaining a steady revenue stream is crucial amidst economic fluctuations. The net income attributable to Planet Fitness Inc rose to $41.9 million, or $0.50 per diluted share, compared to $34.3 million, or $0.39 per diluted share, in the previous year.

Detailed Financial Analysis

Planet Fitness Inc's Franchise segment revenue increased by 10.7% to $115.2 million, driven by higher royalty revenue and new club openings. The Corporate-owned clubs segment saw a 9.2% increase in revenue to $133.7 million, primarily due to same club sales growth and new club openings. The Equipment segment experienced a 28.7% rise in revenue to $27.8 million, attributed to higher equipment sales to existing franchisee-owned clubs.

| Segment | Revenue Increase | Adjusted EBITDA Increase |

|---|---|---|

| Franchise | 10.7% | 11.5% |

| Corporate-owned clubs | 9.2% | 8.1% |

| Equipment | 28.7% | 55.1% |

Commentary and Strategic Outlook

“We ended the first quarter with approximately 20.6 million members, an increase of approximately 900,000 from the end of 2024, and we grew system-wide same club sales by 6.1 percent,” said Colleen Keating, Chief Executive Officer. “Given the strength and durability of our model, we delivered this healthy growth against a backdrop of increasing volatility in the macro-economic environment.”

Conclusion

Planet Fitness Inc's first quarter results demonstrate resilience and strategic growth in a challenging economic landscape. While the revenue fell slightly short of expectations, the company's ability to expand its membership base underscores its strong market position. As the company continues to navigate economic uncertainties, its focus on expanding its club network and enhancing its value proposition remains pivotal for sustained growth.

Explore the complete 8-K earnings release (here) from Planet Fitness Inc for further details.