An analyst from Wells Fargo, Finian O’Shea, has adjusted the price target for Carlyle Secured Lending (CGBD, Financial), reducing it from $14 to $13. The analyst maintains an Equal Weight rating on the stock. Wells Fargo notes that while Carlyle Secured Lending's recent simplification initiatives are likely to enhance its valuation, they also introduce challenges in predicting its net operating income (NOI) in the short term.

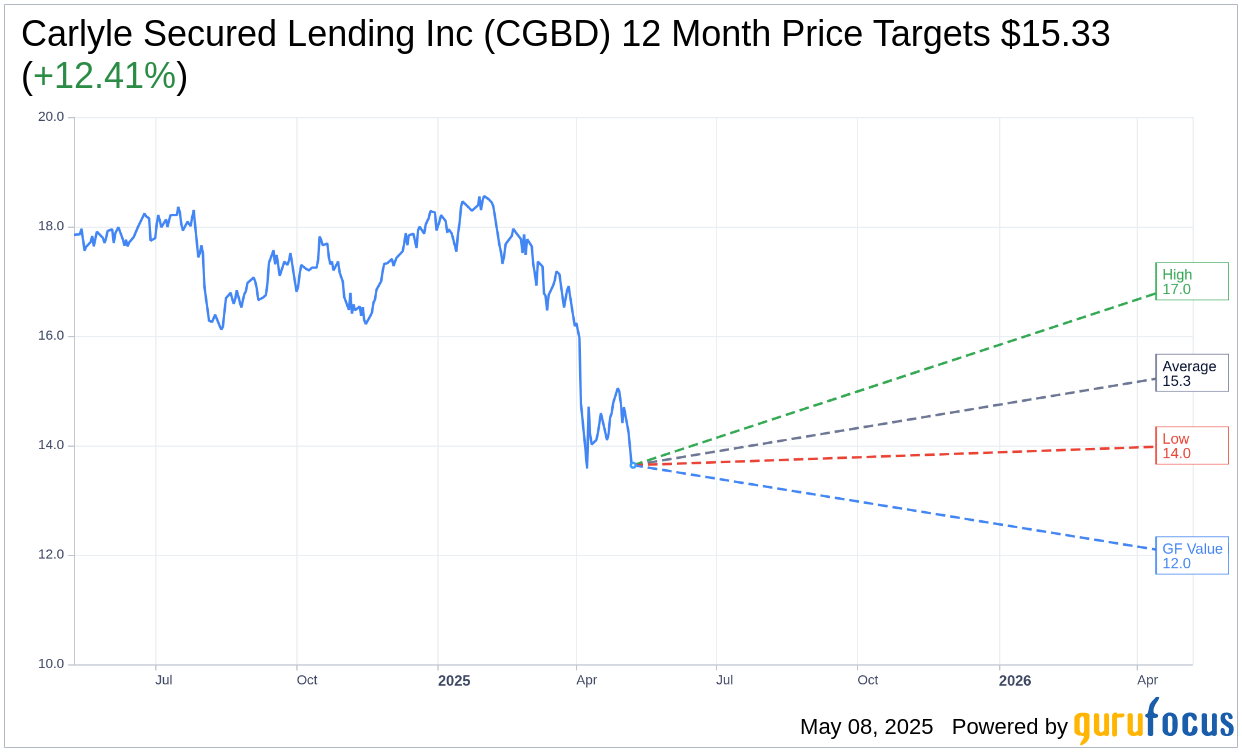

Wall Street Analysts Forecast

Based on the one-year price targets offered by 3 analysts, the average target price for Carlyle Secured Lending Inc (CGBD, Financial) is $15.33 with a high estimate of $17.00 and a low estimate of $14.00. The average target implies an upside of 12.41% from the current price of $13.64. More detailed estimate data can be found on the Carlyle Secured Lending Inc (CGBD) Forecast page.

Based on the consensus recommendation from 5 brokerage firms, Carlyle Secured Lending Inc's (CGBD, Financial) average brokerage recommendation is currently 3.4, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Carlyle Secured Lending Inc (CGBD, Financial) in one year is $11.99, suggesting a downside of 12.1% from the current price of $13.64. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Carlyle Secured Lending Inc (CGBD) Summary page.

CGBD Key Business Developments

Release Date: May 07, 2025

- GAAP Net Investment Income: $0.40 per share.

- Adjusted Net Investment Income: $0.41 per share.

- Annualized Yield: Approximately 10% on March 31 NAV.

- Net Asset Value (NAV): $16.63 per share as of March 31, down from $16.80 per share as of December 31.

- Organic Originations: Approximately $180 million added to the portfolio.

- Total Assets: Increased from $1.9 billion to $2.5 billion this quarter.

- Total Investment Income: $55 million for the first quarter.

- Total Expenses: $33 million, increased due to higher interest expense.

- Dividend Declared: $0.40 per share for the second quarter of 2025.

- Spillover Income: $0.85 per share.

- Nonaccruals: Increased to 1.6% of total investments at fair value.

- Revolving Credit Facility: Increased total commitments by $145 million to $935 million.

- Statutory Leverage: About one turn at quarter end.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Carlyle Secured Lending Inc (CGBD, Financial) reported a GAAP net investment income of $0.40 per share and adjusted net investment income of $0.41 per share, representing an annualized yield of approximately 10% on their NAV.

- The company declared a second quarter dividend of $0.40 per share, maintaining an attractive yield of about 11% based on the recent share price.

- CGBD successfully completed a merger with CSL 3, which increased their portfolio size and eliminated the preferred stock dilution overhang.

- The consolidation of Credit Fund 2 and the merger with CSL 3 increased total assets from $1.9 billion to $2.5 billion.

- CGBD's portfolio is diversified across 195 investments and 138 companies in more than 25 industries, with 94% of investments in senior secured loans.

Negative Points

- The company experienced a decline in net asset value from $16.80 per share as of December 31 to $16.63 per share as of March 31.

- There was a $0.04 per share decline in earnings from the prior quarter, attributed to tighter yields and a modest uptick in nonaccruals.

- CGBD faced headwinds from declining base rates and historically tight market spreads, which could impact near-term earnings.

- The company reported a total aggregate realized and unrealized net loss of about $8 million for the quarter.

- Nonaccruals increased to 1.6% of total investments at fair value, indicating some underperformance in a handful of portfolio names.