Canaccord has revised its price target for Health Catalyst (HCAT, Financial), bringing it down to $9 from the previous $10, while maintaining a Buy recommendation on the stock. Although the firm reduced its projections for the second quarter, it made only slight adjustments to its 2025 outlook. Despite uncertainties linked to the broader economic environment, company management has expressed confidence in achieving its bookings target, supported by a robust pipeline of new business opportunities.

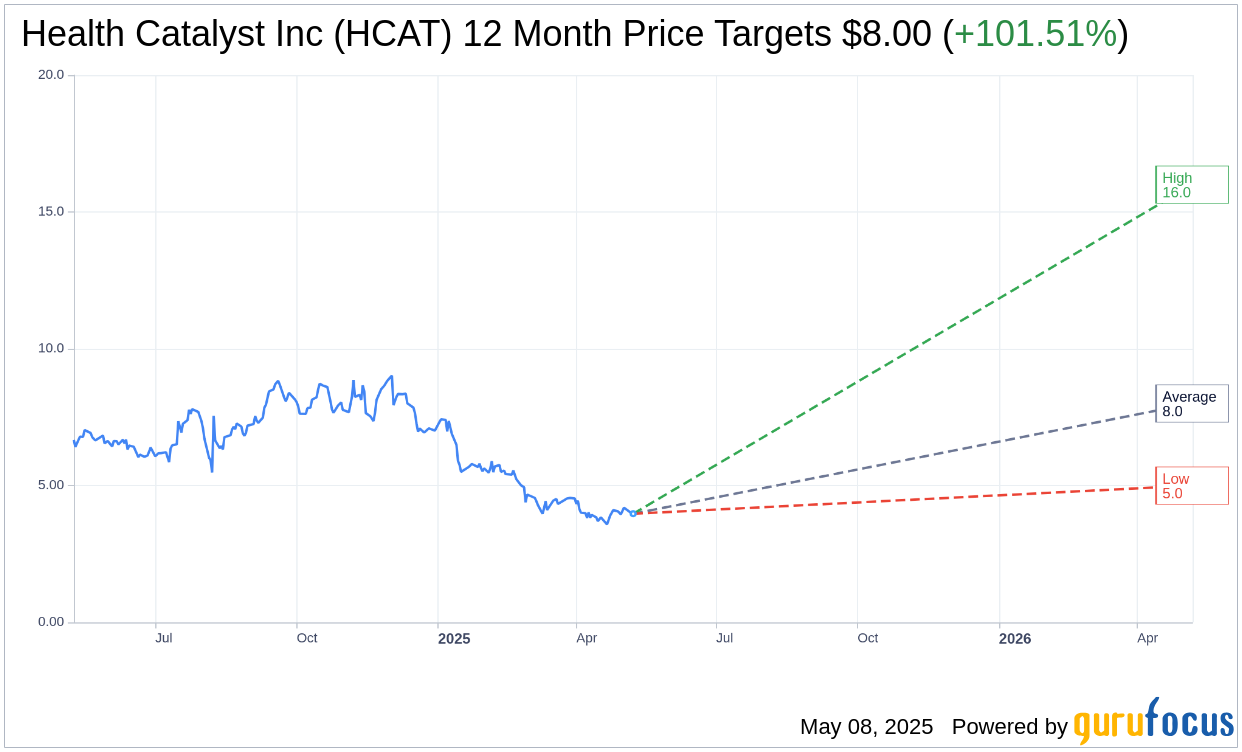

Wall Street Analysts Forecast

Based on the one-year price targets offered by 10 analysts, the average target price for Health Catalyst Inc (HCAT, Financial) is $8.00 with a high estimate of $16.00 and a low estimate of $5.00. The average target implies an upside of 101.51% from the current price of $3.97. More detailed estimate data can be found on the Health Catalyst Inc (HCAT) Forecast page.

Based on the consensus recommendation from 13 brokerage firms, Health Catalyst Inc's (HCAT, Financial) average brokerage recommendation is currently 2.1, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Health Catalyst Inc (HCAT, Financial) in one year is $10.70, suggesting a upside of 169.52% from the current price of $3.97. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Health Catalyst Inc (HCAT) Summary page.

HCAT Key Business Developments

Release Date: February 26, 2025

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Health Catalyst Inc (HCAT, Financial) reported total revenue of $307 million for 2024, with a 137% year-over-year growth in adjusted IA.

- The technology segment showed strong performance with $195 million in revenue for the full year 2024, representing a 10% growth year-over-year for Q4.

- The company successfully added 21 net new platform clients in 2024, with a significant portion coming from cross-selling to existing app clients.

- Health Catalyst Inc (HCAT) received external recognitions, including being named a leader in Frost and Sullivan's 2024 US Population Health Management Report.

- The company anticipates technology revenue to grow by 13% in 2025, driven by the momentum of the Ignite platform and cross-selling opportunities.

Negative Points

- The net new platform client additions in 2024 were at the lower end of the expected revenue range, indicating potential challenges in client acquisition.

- The transition to the Ignite platform may temporarily impact dollar-based retention rates, as increased app adoption does not always translate into proportional revenue increases.

- Adjusted technology gross margin decreased by approximately 200 basis points in Q4 2024 due to initial deployment costs and Ignite migration headwinds.

- Professional services revenue remained flat in Q4 2024, with lower than anticipated performance in certain segments.

- The company plans to exit certain unprofitable ambulatory operations, which may impact professional services revenue in the short term.