Canaccord has revised its price target for Hudson Technologies (HDSN, Financial), increasing it from $6.25 to $6.75 while maintaining a Hold rating. The firm noted that the company's first-quarter results for 2025 were influenced by continued tough pricing conditions for refrigerants. This challenge was coupled with typically slower sales during the winter and spring months, attributed to the overall decline in refrigerant prices during these periods.

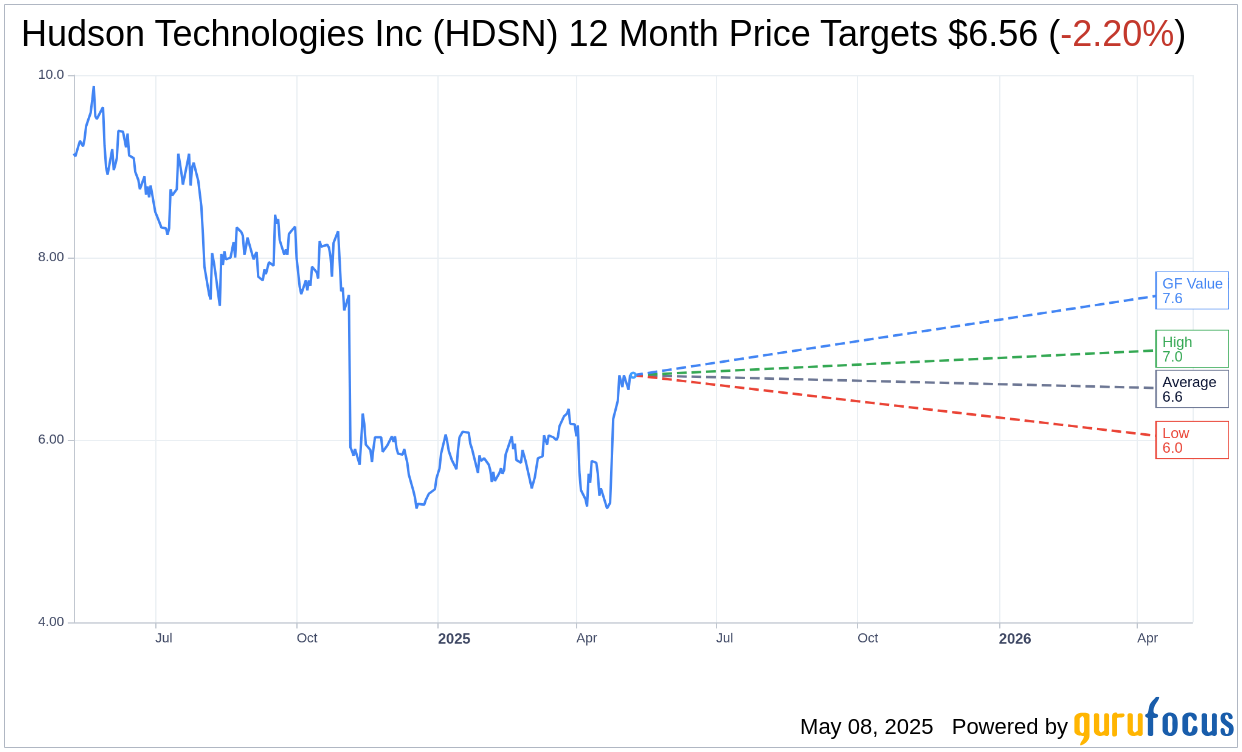

Wall Street Analysts Forecast

Based on the one-year price targets offered by 4 analysts, the average target price for Hudson Technologies Inc (HDSN, Financial) is $6.56 with a high estimate of $7.00 and a low estimate of $6.00. The average target implies an downside of 2.20% from the current price of $6.71. More detailed estimate data can be found on the Hudson Technologies Inc (HDSN) Forecast page.

Based on the consensus recommendation from 4 brokerage firms, Hudson Technologies Inc's (HDSN, Financial) average brokerage recommendation is currently 3.0, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Hudson Technologies Inc (HDSN, Financial) in one year is $7.64, suggesting a upside of 13.86% from the current price of $6.71. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Hudson Technologies Inc (HDSN) Summary page.

HDSN Key Business Developments

Release Date: March 06, 2025

- Full Year Revenue: $237 million, slightly below the revised target of $240 million.

- Full Year Gross Margin: Achieved target of 28%.

- Cash Position: $70 million with no debt as of December 31, 2024.

- Stock Repurchase: $8.1 million of common stock repurchased in 2024.

- Fourth Quarter Revenue: $34.6 million, a 23% decrease compared to the 2023 quarter.

- Fourth Quarter Gross Margin: 17%, down from 31% in the 2023 quarter.

- Fourth Quarter Operating Loss: $3.2 million compared to operating income of $4.7 million in the 2023 quarter.

- Fourth Quarter Net Loss: $2.6 million or $0.06 per share, compared to net income of $3.9 million or $0.09 per share in the 2023 quarter.

- Full Year Net Income: $24.4 million or $0.54 per basic and $0.52 per diluted share, compared to $52.2 million or $1.15 per basic and $1.10 per diluted share in 2023.

- Refrigerant Sales Volume: Increased slightly over 2023, but offset by declining market prices.

- DLA Contract Revenue: $36 million in 2024, slightly ahead of expected normal purchasing levels.

- SG&A Expenses: $33 million in 2024, up from $30.5 million in 2023, including costs from the acquisition of USA Refrigerants.

- Net Interest Income: $500,000 in 2024, a shift from $8.4 million of net interest expense in 2023.

- Reclaim Activity: Increased by 18% in 2024.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Hudson Technologies Inc (HDSN, Financial) achieved a full-year gross margin target of 28%, despite challenging market conditions.

- The company strengthened its balance sheet, ending 2024 with $70 million in cash and no debt.

- Hudson Technologies Inc (HDSN) repurchased $8.1 million of common stock in 2024, demonstrating confidence in its financial position.

- The company has a diverse customer base, allowing it to perform better than the market despite a decline in HFC pricing.

- Hudson Technologies Inc (HDSN) increased its overall reclaim activity by 18% in 2024, positioning itself well for future demand for reclaimed refrigerants.

Negative Points

- Full-year revenue of $237 million was slightly below the revised target of $240 million.

- HFC pricing in 2024 declined up to 45%, impacting the company's revenue and gross margins.

- The company recorded a net loss of $2.6 million in the fourth quarter of 2024, compared to a net income of $3.9 million in the same quarter of 2023.

- Fourth-quarter revenue decreased by 23% compared to the same period in 2023, primarily due to lower refrigerant market prices.

- Operating income for 2024 was significantly lower at $29.3 million compared to $78.2 million in 2023, reflecting the decline in refrigerant prices and tough comparisons with the previous year.