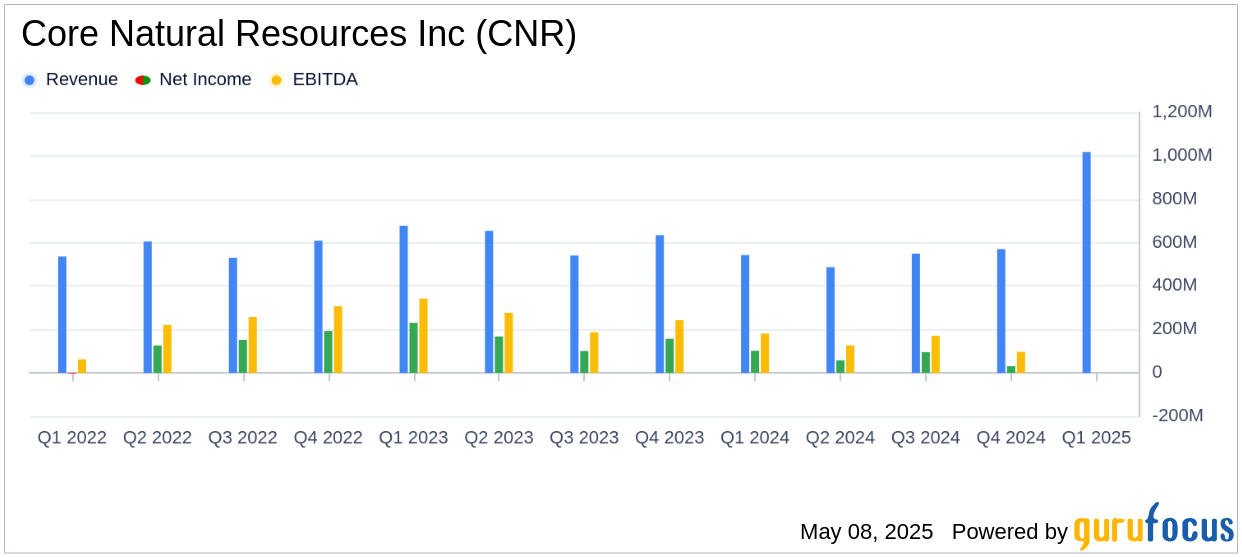

On May 8, 2025, Core Natural Resources Inc (CNR, Financial) released its 8-K filing detailing the financial results for the first quarter of 2025. The company, a prominent producer and exporter of coal, reported a net loss of $69.3 million, or $1.38 per diluted share, falling short of the analyst estimate of $3.61 per share. This loss was primarily attributed to merger-related expenses of $49.2 million and a $11.7 million loss associated with the extinguishment of debt.

Company Overview and Operational Highlights

Core Natural Resources Inc (CNR, Financial) is a key player in the coal industry, focusing on the mining, preparation, and marketing of thermal coal, primarily sold to power generators. The company operates longwall mining operations and export terminals on the Eastern seaboard.

Despite the challenges, CNR reported adjusted EBITDA of $123.5 million and revenues of $1,017.4 million for the quarter. The company made significant strides in integrating its operations post-merger, enhancing synergy targets by 10% to a range of $125 to $150 million annually. Additionally, CNR returned $106.6 million to investors through share buybacks and dividends, demonstrating a commitment to shareholder value.

Financial Achievements and Challenges

CNR's financial performance is crucial in the Other Energy Sources industry, where maintaining liquidity and operational efficiency is vital. The company executed capital market transactions to establish a target capital structure, boosting liquidity and extending maturities. These actions are expected to enhance financial flexibility and reduce interest rates.

However, the net loss highlights the challenges faced by CNR, including merger-related costs and debt extinguishment. The company's ability to navigate these challenges will be critical in maintaining its competitive edge in the coal market.

Income Statement and Key Metrics

For the first quarter of 2025, CNR's revenue reached $1,017.4 million, with the high calorific value thermal coal segment achieving sales volumes of 7.1 million tons. The realized coal revenue per ton sold was $63.18, while the cash cost of coal sold per ton was $42.78. The metallurgical segment reported sales volumes of 2.3 million tons, with a realized coal revenue per ton sold of $98.26 and a cash cost of coal sold per ton of $91.00.

| Segment | Sales Volume (Million Tons) | Realized Revenue per Ton ($) | Cash Cost per Ton ($) |

|---|---|---|---|

| High C.V. Thermal | 7.1 | 63.18 | 42.78 |

| Metallurgical | 2.3 | 98.26 | 91.00 |

Liquidity and Capital Return Program

As of March 31, 2025, CNR had total liquidity of $858.3 million, including $388.5 million in cash and cash equivalents. The company announced a capital return framework targeting the return of approximately 75% of free cash flow to stockholders, primarily through share repurchases and a quarterly dividend of $0.10 per share.

“During the quarter, we executed on several capital market transactions that not only helped establish our target capital structure but also bolstered our liquidity, extended maturities, and added significant financial flexibility to execute our capital return program,” said Mitesh Thakkar, Core’s president and chief financial officer.

Analysis and Outlook

CNR's performance in the first quarter of 2025 reflects both the opportunities and challenges in the coal industry. The company's strategic initiatives to enhance synergies and financial flexibility are commendable, yet the net loss underscores the need for continued focus on cost management and operational efficiency. As the company progresses towards resuming operations at Leer South and capitalizing on market dynamics, its ability to generate substantial free cash flow and return value to shareholders will be pivotal.

Explore the complete 8-K earnings release (here) from Core Natural Resources Inc for further details.