Summary Points:

- Nomad Foods (NOMD, Financial) reports a Q1 Non-GAAP EPS of €0.35 amid a 3% revenue decline.

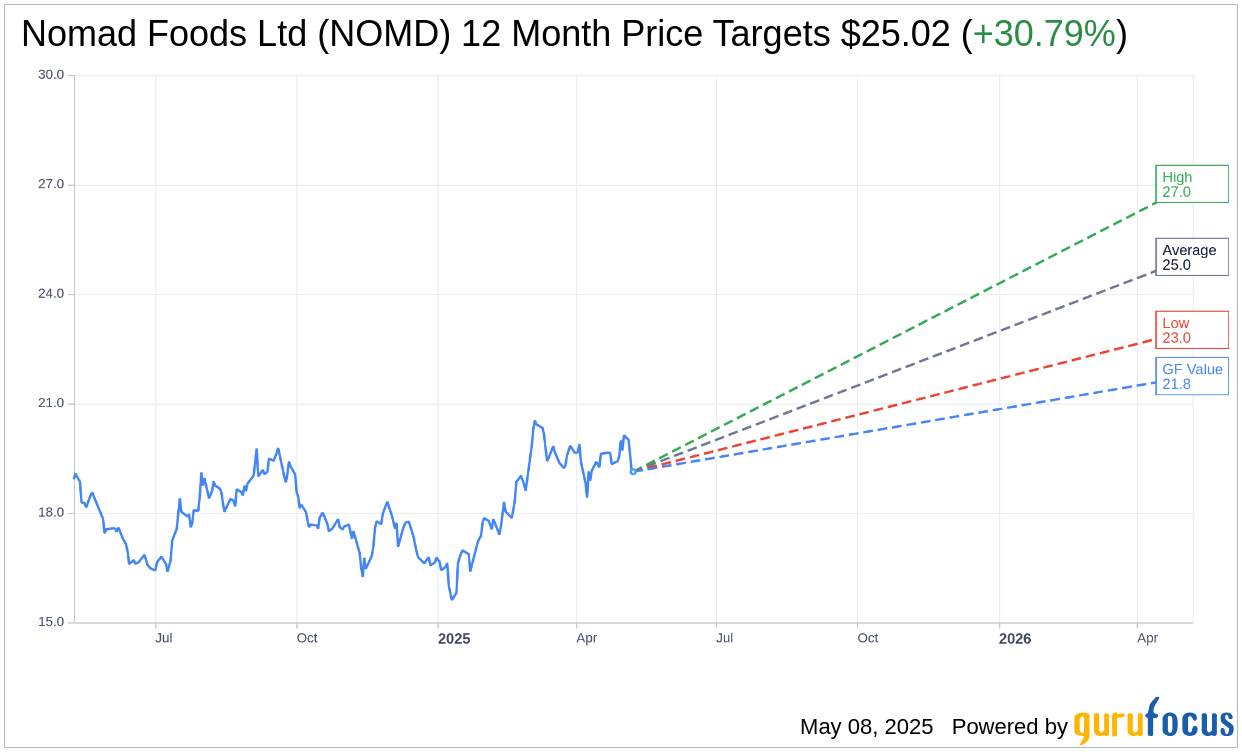

- Analysts provide an average price target of $25.02, suggesting a 30.79% upside potential.

- Nomad Foods holds an "Outperform" brokerage recommendation with a GF Value upside of 13.7%.

Nomad Foods' Financial Performance and Outlook

Nomad Foods (NOMD) has reported its first-quarter financial results, revealing a Non-GAAP earnings per share of €0.35. The company faced a 3% year-over-year decrease in revenue, amounting to €760.1 million. Despite this slight decline, Nomad Foods remains optimistic about its potential for sustained growth, aiming for increased revenue and EBITDA for the tenth consecutive year by 2025.

Wall Street Analysts' Price Targets

According to six analysts, the average one-year price target for Nomad Foods Ltd (NOMD, Financial) stands at $25.02. The projections range from a high of $27.02 to a low of $23.02. This average target suggests a potential upside of 30.79% from the current trading price of $19.13. Investors seeking more detailed estimates can visit the Nomad Foods Ltd (NOMD) Forecast page.

Brokerage Firms' Recommendations

The consensus recommendation from six brokerage firms places Nomad Foods Ltd (NOMD, Financial) at an average rating of 1.7, indicating an "Outperform" status. The rating system uses a scale from 1 to 5, where a rating of 1 signifies a Strong Buy and 5 denotes a Sell.

GuruFocus' Fair Value Assessment

Based on GuruFocus estimates, the GF Value for Nomad Foods Ltd (NOMD, Financial) is projected to be $21.75 in one year. This estimation suggests a potential upside of 13.7% from the current stock price of $19.13. GF Value represents GuruFocus' perspective on the fair trading value of the stock, derived from historical trading multiples, past business growth, and future performance predictions. For more comprehensive data, visit the Nomad Foods Ltd (NOMD) Summary page.