Cronos Group (CRON, Financial) posted robust financial results for the first quarter, with revenue climbing to $32.3 million, up from $25.3 million in the previous year. The company is focusing on strategic initiatives to enhance revenue, improve profit margins, and maintain stringent cost control.

The demand for Cronos' flower products has exceeded current supply levels, but the company anticipates that the expansion of its Cronos GrowCo facility, scheduled for completion in the second quarter, will significantly boost capacity. This expansion is expected to propel growth, with initial sales anticipated in the latter half of the year.

Cronos’ Spinach brand continues to dominate the Canadian market, ranking number one in edibles, third in flower, fourth in vapes, and among the top ten in pre-rolls. Additionally, the PEACE NATURALS brand achieved record revenue in Israel while maintaining its top market share, reflecting Cronos' commitment to international markets and successful innovation in product development. The brand is also gaining prominence in Germany and the UK.

With a strong financial position and a global expansion strategy, Cronos is well-positioned to seize opportunities in the international cannabis market and deliver ongoing value to its shareholders.

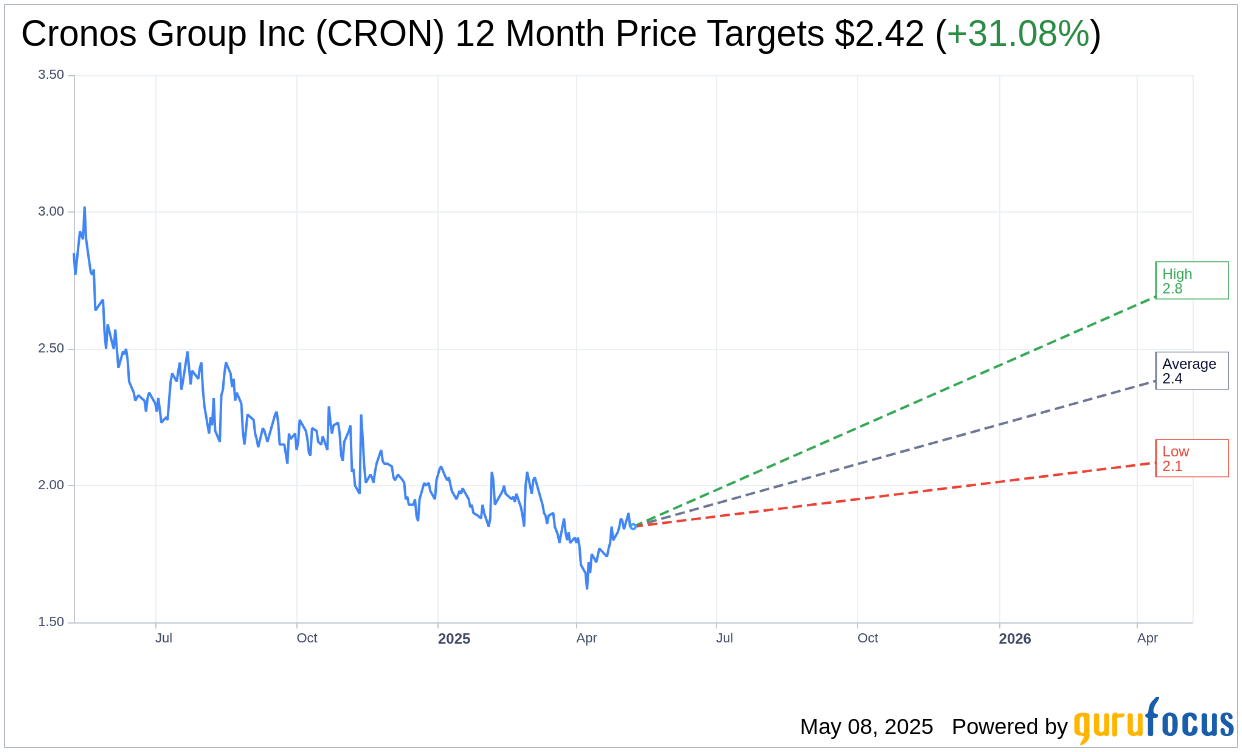

Wall Street Analysts Forecast

Based on the one-year price targets offered by 2 analysts, the average target price for Cronos Group Inc (CRON, Financial) is $2.43 with a high estimate of $2.75 and a low estimate of $2.10. The average target implies an upside of 31.08% from the current price of $1.85. More detailed estimate data can be found on the Cronos Group Inc (CRON) Forecast page.

Based on the consensus recommendation from 2 brokerage firms, Cronos Group Inc's (CRON, Financial) average brokerage recommendation is currently 2.5, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Cronos Group Inc (CRON, Financial) in one year is $3.84, suggesting a upside of 107.57% from the current price of $1.85. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Cronos Group Inc (CRON) Summary page.

CRON Key Business Developments

Release Date: February 27, 2025

- Annual Net Revenue Growth: 35% year-over-year increase to $117.6 million.

- Q4 Net Revenue: $30.3 million, a 27% increase from the prior year period.

- Adjusted Gross Margin: Improved by 12 percentage points to 26% for the full year 2024.

- Q4 Gross Profit: $10.8 million, equating to a 36% gross margin.

- Adjusted EBITDA: Negative $7.2 million in Q4, a $7.6 million improvement from the prior year period.

- Operating Cash Flow: Improved by $61.7 million to positive $18.8 million for 2024.

- Cash and Cash Equivalents: $859 million at the end of the quarter.

- Free Cash Flow: Positive $5.7 million for the full year 2024, a $51.9 million improvement from 2023.

- Operating Expenses: Declined by $5 million versus the prior year.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Cronos Group Inc (CRON, Financial) achieved a 35% year-over-year increase in annual net revenue, showcasing robust top-line growth.

- The company nearly doubled its adjusted gross margins, indicating improved operational efficiency.

- Spinach, a brand under Cronos Group Inc (CRON), ended the year as the number one cannabis brand in Canada by market share.

- Cronos Group Inc (CRON) maintains a strong balance sheet with $859 million in cash and cash equivalents, reinforcing its ability to invest in growth and innovation.

- The company reported a significant improvement in operating cash flow, with a $61.7 million increase to positive $18.8 million for 2024.

Negative Points

- Despite strong growth in the flower category, Cronos Group Inc (CRON) does not expect this growth to continue until the second half of 2025 due to supply constraints.

- The company faces increased competition and evolving market dynamics in Israel, including tariff threats and declining patient growth.

- Cronos Group Inc (CRON) reported a negative adjusted EBITDA of $7.2 million for the fourth quarter, although this was an improvement from the prior year.

- The expansion of GrowCo's facilities is still underway, with completion expected in Q2 2025, delaying the full realization of its benefits.

- Free cash flow for the fourth quarter of 2024 was positive $4 million, a decrease from the positive $15 million in the prior year period.