Dyne Therapeutics (DYN, Financial) is making significant strides with its flagship programs, which are displaying promising results, including functional improvements in DM1 and DMD treatments. The company is on track to pursue U.S. Accelerated Approval applications by 2026, aiming for potential commercial product launches the following year.

John Cox, the president and CEO of Dyne, expressed enthusiasm for recent leadership team additions. With Erick, Vik, and Ron joining the ranks, and Oxana stepping into the role of chief innovation officer, the team is well-equipped with the expertise needed to propel business operations. Dyne remains focused on delivering impactful therapies that enhance patient outcomes while also driving shareholder value.

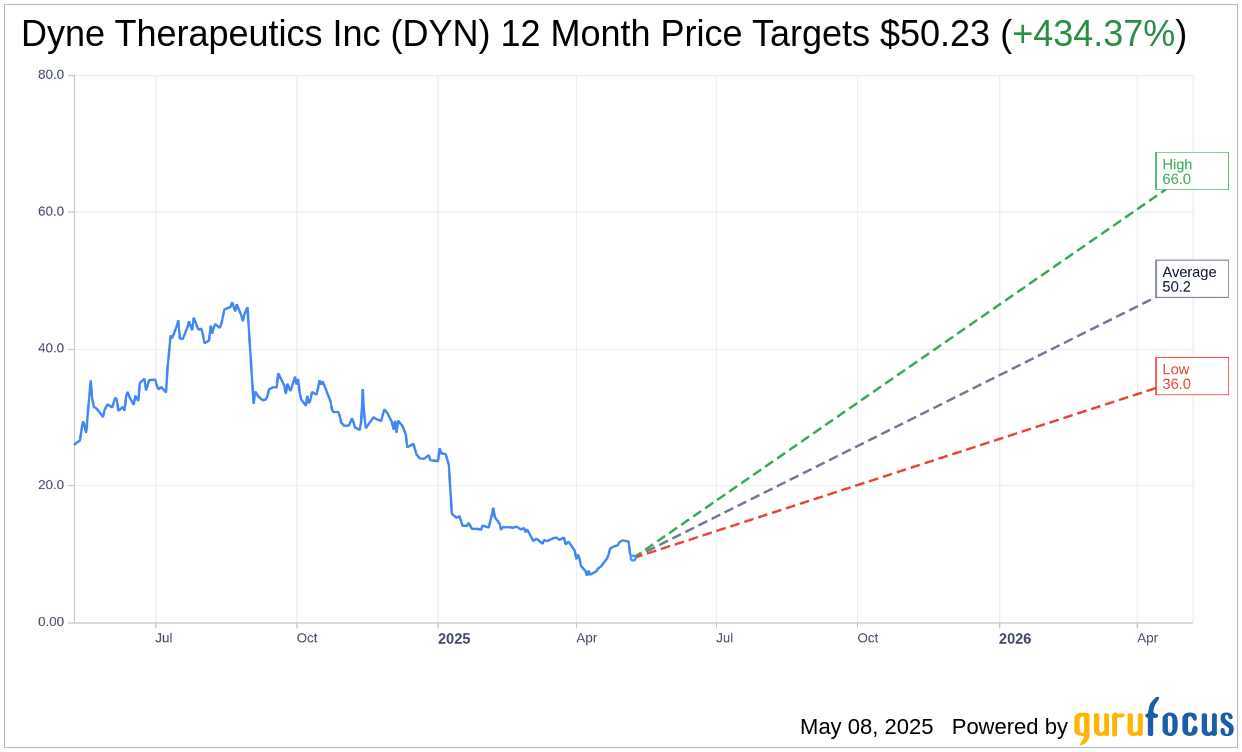

Wall Street Analysts Forecast

Based on the one-year price targets offered by 13 analysts, the average target price for Dyne Therapeutics Inc (DYN, Financial) is $50.23 with a high estimate of $66.00 and a low estimate of $36.00. The average target implies an upside of 434.37% from the current price of $9.40. More detailed estimate data can be found on the Dyne Therapeutics Inc (DYN) Forecast page.

Based on the consensus recommendation from 14 brokerage firms, Dyne Therapeutics Inc's (DYN, Financial) average brokerage recommendation is currently 1.6, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.