Baird has adjusted its price target for International Flavors & Fragrances (IFF, Financial), lowering it from $110 to $100. Despite the decrease, the firm maintains an Outperform rating on the stock. This update comes after evaluating the company's first-quarter performance, where uncertainty in demand has been a key factor affecting market sentiment.

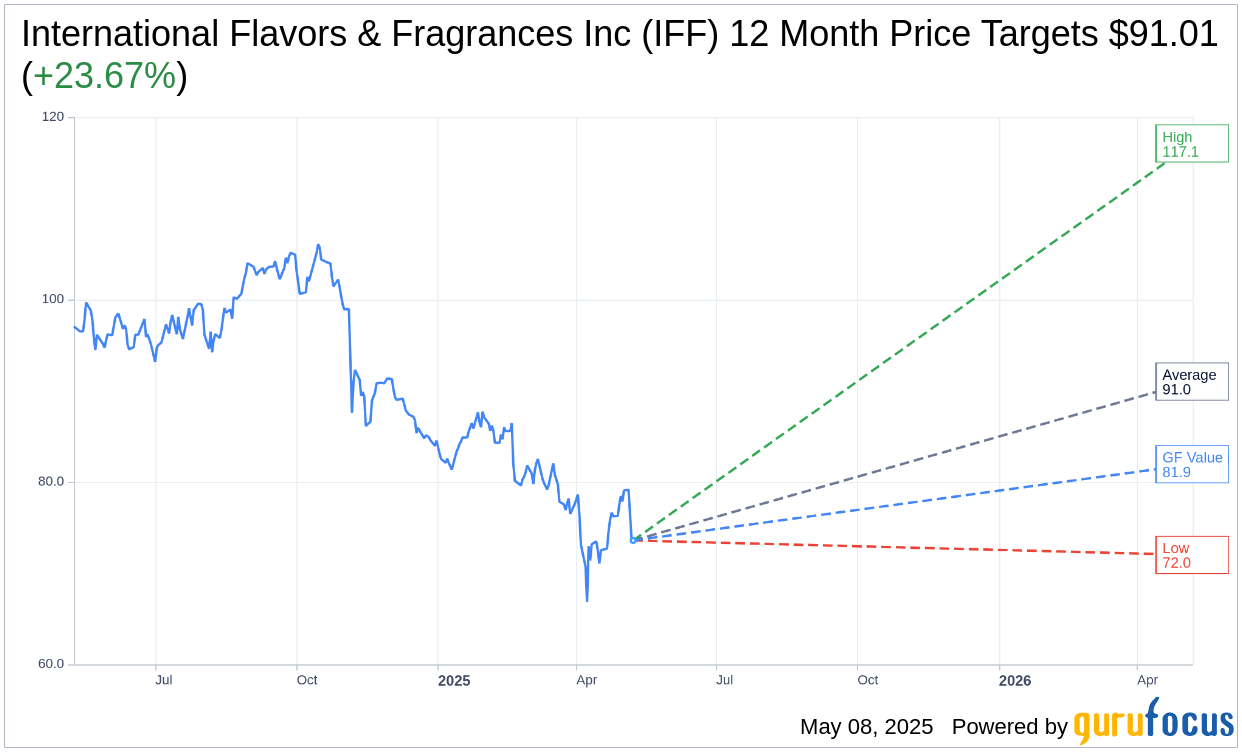

Wall Street Analysts Forecast

Based on the one-year price targets offered by 17 analysts, the average target price for International Flavors & Fragrances Inc (IFF, Financial) is $91.01 with a high estimate of $117.12 and a low estimate of $72.00. The average target implies an upside of 23.67% from the current price of $73.59. More detailed estimate data can be found on the International Flavors & Fragrances Inc (IFF) Forecast page.

Based on the consensus recommendation from 20 brokerage firms, International Flavors & Fragrances Inc's (IFF, Financial) average brokerage recommendation is currently 2.1, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for International Flavors & Fragrances Inc (IFF, Financial) in one year is $81.94, suggesting a upside of 11.35% from the current price of $73.59. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the International Flavors & Fragrances Inc (IFF) Summary page.

IFF Key Business Developments

Release Date: May 07, 2025

- Revenue: $2.8 billion in sales, representing 3% comparable currency neutral growth.

- Adjusted Operating EBITDA: $578 million, a 9% increase on a comparable currency neutral basis.

- Adjusted Operating EBITDA Margin: Increased more than 120 basis points to 20.3%.

- Pharma Solutions Sales: $266 million, an 8% year-over-year increase on a comparable currency neutral basis.

- Pharma Solutions Adjusted Operating EBITDA: $54 million, a 19% increase versus last year.

- Taste Sales: $627 million, a 7% year-over-year increase on a comparable currency neutral basis.

- Taste Adjusted Operating EBITDA Growth: 22% on a comparable currency neutral basis.

- Food Ingredients Sales: $796 million, a 4% comparable currency neutral decrease from the prior year.

- Food Ingredients Adjusted Operating EBITDA Growth: 5% on a comparable basis.

- Health and Bioscience Sales: 5% increase in comparable currency neutral sales.

- Health and Bioscience Adjusted Operating EBITDA: $138 million, a 3% increase on a year-over-year comparable currency neutral basis.

- Scent Sales: $614 million, up 4% year over year on a comparable currency neutral basis.

- Scent Adjusted Operating EBITDA: $144 million, up 4% on a comparable currency neutral basis.

- Cash Flow from Operations: $127 million year-to-date.

- Capital Expenditures (CapEx): $179 million, roughly 6% of sales.

- Dividends Paid: $102 million in the quarter.

- Gross Debt: Approximately $9.3 billion, a decrease of more than $1 billion compared to the year-ago period.

- Net Debt to Credit Adjusted EBITDA: 3.9 times.

- Full-Year 2025 Sales Guidance: $10.6 billion to $10.9 billion, representing currency neutral growth of 1% to 4%.

- Full-Year 2025 Adjusted Operating EBITDA Guidance: $2 billion to $2.15 billion, representing currency neutral growth of 5% to 10%.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- International Flavors & Fragrances Inc (IFF, Financial) reported a solid start to 2025 with $2.8 billion in sales, representing 3% comparable currency neutral growth.

- The company achieved a 9% growth in comparable currency neutral adjusted operating EBITDA, with a margin increase of more than 120 basis points to 20.3%.

- IFF completed the divestiture of Pharma Solutions two months ahead of schedule, strengthening its capital structure and achieving a net debt to credit adjusted EBITDA ratio of below 3 times.

- The Taste segment recorded a 7% year-over-year increase in sales, driven by broad-based volume growth across all regions and strong profitability with a 22% growth in adjusted operating EBITDA.

- IFF's strategic focus on innovation and operational discipline has led to strong performances across multiple segments, including Taste, Pharma Solutions, Scent, and Health and Biosciences.

Negative Points

- Volume decline in the Food Ingredients segment was primarily driven by weaker performance in protein solutions and limitations in capacity.

- The company faced challenges from the broader macroeconomic environment, including potential impacts from global tariffs and trade policy changes.

- IFF's Food Ingredients segment experienced a 4% decrease in sales on a comparable currency neutral basis, primarily due to sales pressures in protein solutions.

- The company is concerned about potential economic slowdowns, particularly in the United States, which could impact future performance.

- IFF's exposure to tariffs, particularly related to China, presents a significant cost challenge, with an estimated $100 million exposure for 2025.