Guggenheim has increased its price target for NiSource (NI, Financial) to $43, up from $42, while maintaining a Buy rating. This decision comes in response to the company's recent performance, which exceeded expectations, and its confirmation of full-year guidance. Analysts highlight NiSource's strong regulatory execution, impressive earnings per share growth projected at 6% to 8%, effective cost management strategies, and robust balance sheet as reasons for the stock's premium valuation.

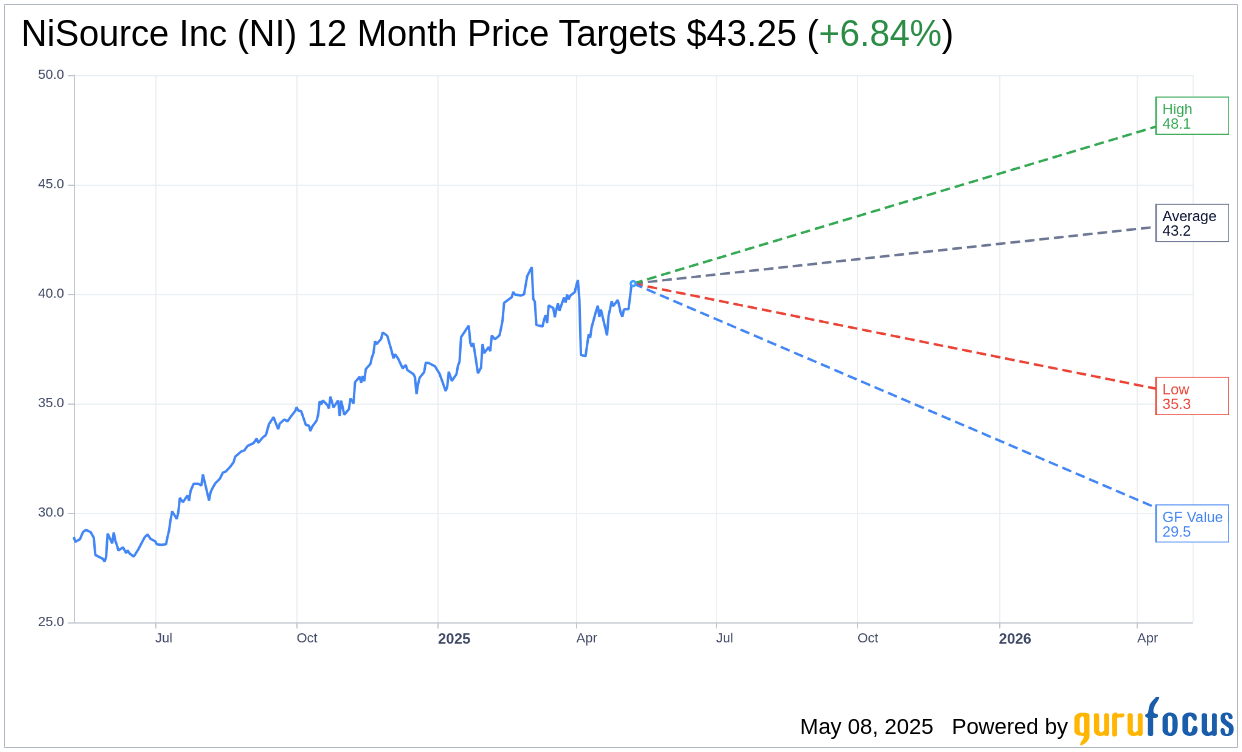

Wall Street Analysts Forecast

Based on the one-year price targets offered by 14 analysts, the average target price for NiSource Inc (NI, Financial) is $43.25 with a high estimate of $48.15 and a low estimate of $35.34. The average target implies an upside of 6.84% from the current price of $40.48. More detailed estimate data can be found on the NiSource Inc (NI) Forecast page.

Based on the consensus recommendation from 17 brokerage firms, NiSource Inc's (NI, Financial) average brokerage recommendation is currently 1.8, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for NiSource Inc (NI, Financial) in one year is $29.52, suggesting a downside of 27.08% from the current price of $40.48. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the NiSource Inc (NI) Summary page.

NI Key Business Developments

Release Date: May 07, 2025

- Adjusted EPS: $0.98, a 15% increase from $0.85 in the same quarter last year.

- 2025 Adjusted EPS Guidance: Reaffirmed at $1.85 to $1.89.

- Annual 2025-2029 Guidance: Adjusted EPS growth of 6% to 8%, rate base growth of 8% to 10%, and targeting 14% to 16% FFO/debt.

- Capital Expenditures: Over $19 billion projected over the next five years.

- Renewable Nameplate Capacity: 2,100 megawatts installed to support baseload generation.

- Regulated Revenue Growth: Driven by recovering capital investments from 2024's regulatory activity.

- Long-term Debt Issuance: $750 million issued.

- Equity Issuances: Secured at least half of forecasted 2025 equity issuances.

- Productivity Gains: Over 60,000 hours of productivity improvement through AI and work management programs.

- Capital Plan: Includes diversified investments across electric generation, gas and electric customer growth, and system modernization.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- NiSource Inc (NI, Financial) reported a 15% increase in adjusted EPS for Q1 2025, reaching $0.98 compared to $0.85 in the same quarter last year.

- The company reaffirmed its 2025 adjusted EPS guidance of $1.85 to $1.89 and long-term growth targets, indicating confidence in its financial outlook.

- NiSource Inc (NI) is leveraging AI to enhance operational efficiency, resulting in significant productivity improvements across multiple regions.

- The company is actively pursuing regulatory approvals and settlements, with a strong track record of achieving constructive outcomes in rate cases.

- NiSource Inc (NI) has a robust capital investment plan, with over $19 billion projected over the next five years, focusing on safety, reliability, and customer service enhancements.

Negative Points

- The GENCO strategy and related regulatory processes add complexity and uncertainty, with ongoing settlement discussions and no definitive outcomes yet.

- Potential changes in federal policies, such as tariffs and renewable tax credits, could impact NiSource Inc (NI)'s financial plans and cost structures.

- The company's reliance on regulatory approvals for capital recovery introduces risks of delays or unfavorable outcomes.

- There is minimal current impact from the electric vehicle supply chain on NiSource Inc (NI)'s load growth, limiting potential revenue from this sector.

- Ongoing negotiations and the complexity of large load customer agreements, such as those related to data centers, may require significant management attention and time.