Aemetis (AMTX, Financial) announced its first-quarter revenue for 2025, totaling $42.9 million, which fell short of the projected $58.99 million. The company's performance was notably supported by its California Ethanol and Dairy Renewable Natural Gas segments, demonstrating robust execution.

The India Biodiesel segment faced temporary production and supply challenges but has now been cleared to resume normal operations. Looking forward, Aemetis anticipates significant revenue growth with expected approvals for the Low Carbon Fuel Standard (LCFS) provisional pathway, which are projected to potentially double LCFS earnings. Additionally, the firm plans to benefit from the federal Inflation Reduction Act Section 45Z production tax credits.

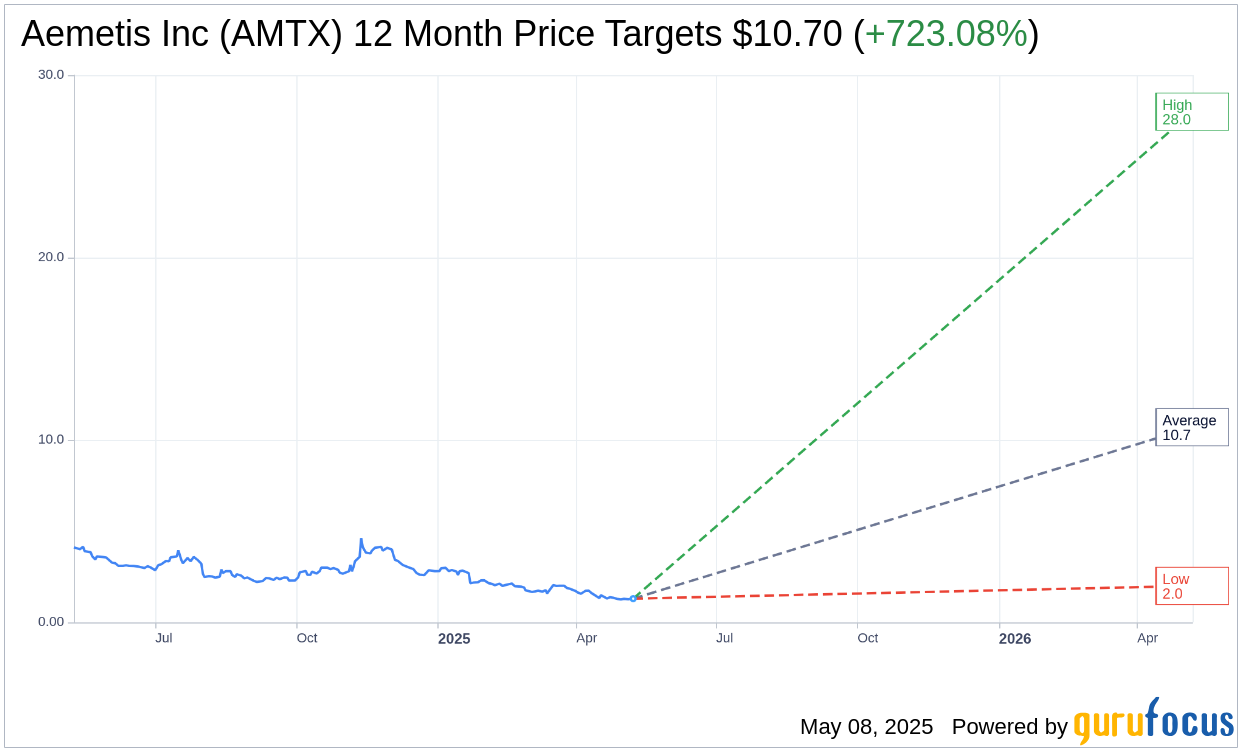

Wall Street Analysts Forecast

Based on the one-year price targets offered by 5 analysts, the average target price for Aemetis Inc (AMTX, Financial) is $10.70 with a high estimate of $28.00 and a low estimate of $2.00. The average target implies an upside of 723.08% from the current price of $1.30. More detailed estimate data can be found on the Aemetis Inc (AMTX) Forecast page.

Based on the consensus recommendation from 6 brokerage firms, Aemetis Inc's (AMTX, Financial) average brokerage recommendation is currently 2.5, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Aemetis Inc (AMTX, Financial) in one year is $7.29, suggesting a upside of 460.77% from the current price of $1.3. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Aemetis Inc (AMTX) Summary page.

AMTX Key Business Developments

Release Date: March 13, 2025

- Revenue: $268 million for the year ended December 31, 2024, up from $187 million in 2023.

- California Ethanol Revenue Increase: $57.7 million increase from operating during the full year.

- India Biodiesel Revenue Increase: $15.7 million increase from stronger oil marketing company tender delivery volumes.

- California Renewable Natural Gas Revenue Increase: $7.6 million increase from increased production and sales of RINs and LCFS credits.

- Cost of Goods Sold: Increased to $268.2 million in 2024 from $184.7 million in 2023.

- Gross Loss: $580,000 for 2024 compared to a gross profit of $2 million in 2023.

- Operating Loss: $40.4 million for 2024 compared to $37.4 million in 2023.

- Interest Expense: $59.3 million in 2024, a decrease from $64.8 million in 2023.

- Net Loss: $87.5 million for 2024 compared to $46.4 million in 2023.

- Cash at Year-End: $898,000 at the end of 2024 compared to $2.7 million at the end of 2023.

- Capital Expenditures: $20.3 million for carbon intensity reduction projects and biogas production capacity expansion in 2024.

- India Biofuels Revenue: $112 million for the period ending September 2024.

- LCFS Credit Price Increase: From $44 to $75 by February 2025, with a subsequent 30% decrease due to implementation delay.

- Investment Tax Credits Cash Proceeds: $17 million received in early 2025.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Aemetis Inc (AMTX, Financial) reported a significant increase in revenues for 2024, reaching $268 million compared to $187 million in 2023, with all three segments showing growth.

- The company benefited from public policies supporting domestic energy producers, which are expected to further support growth in biogas, ethanol, and biodiesel.

- Aemetis Biogas is expanding its production capacity, with plans to reach 1 million MMBtu per year by 2026, supported by USDA guaranteed funding.

- The company has successfully sold $17 million in investment tax credits in early 2025, with expectations for further sales.

- Aemetis is preparing for an IPO of its India Biodiesel business, which has shown positive EBITDA and self-funded operations and capacity growth.

Negative Points

- Aemetis Inc (AMTX) reported a net loss of $87.5 million for 2024, a significant increase from the $46.4 million loss in 2023.

- The company experienced a gross loss of $580,000 in 2024, compared to a gross profit of $2 million in 2023.

- There was an unexpected delay in the implementation of California's amended Low Carbon Fuel Standard (LCFS), causing a 30% decrease in LCFS credit prices.

- Interest expenses increased to $59.3 million in 2024, up from $64.8 million in 2023.

- Cash reserves decreased significantly, with only $898,000 at the end of 2024 compared to $2.7 million at the end of 2023.