Runway Growth Finance (RWAY, Financial) has declared a regular cash dividend of $0.33 per share for the second quarter of 2025. Alongside this, the company's Board of Directors approved an additional supplemental dividend of $0.02 per share for the same period.

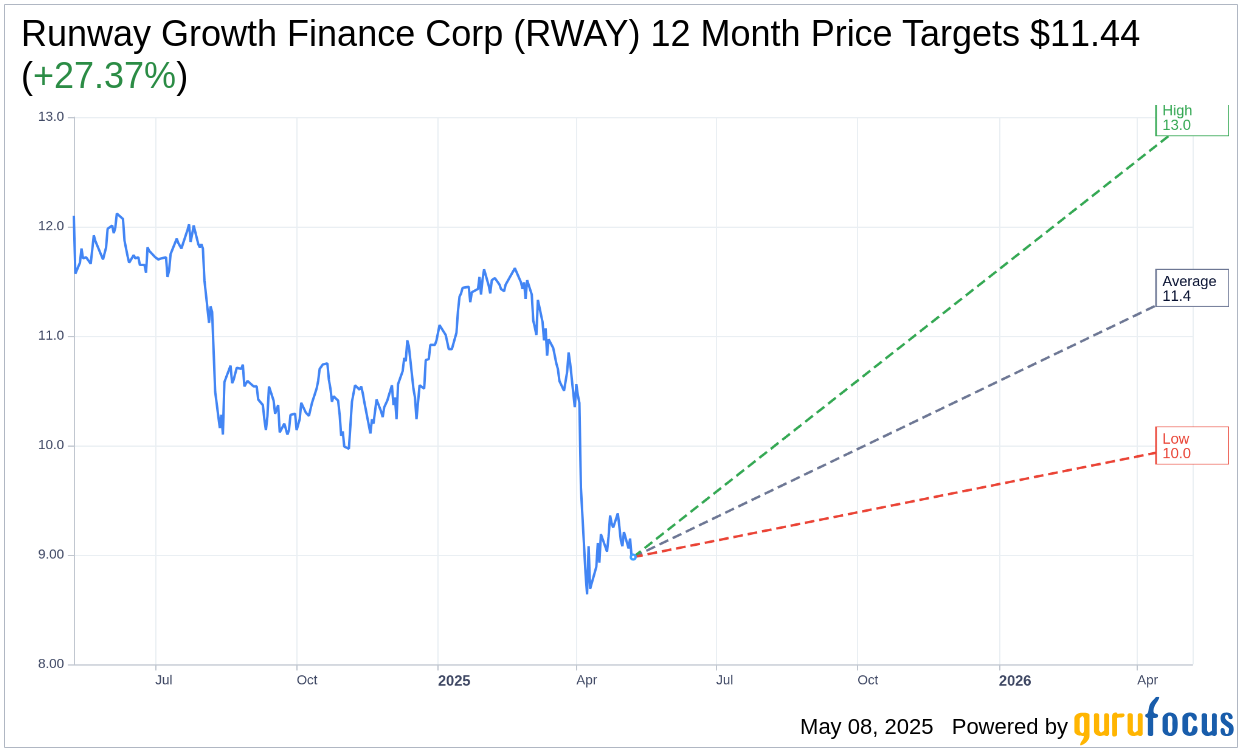

Wall Street Analysts Forecast

Based on the one-year price targets offered by 8 analysts, the average target price for Runway Growth Finance Corp (RWAY, Financial) is $11.44 with a high estimate of $13.00 and a low estimate of $10.00. The average target implies an upside of 27.37% from the current price of $8.98. More detailed estimate data can be found on the Runway Growth Finance Corp (RWAY) Forecast page.

Based on the consensus recommendation from 10 brokerage firms, Runway Growth Finance Corp's (RWAY, Financial) average brokerage recommendation is currently 2.5, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Runway Growth Finance Corp (RWAY, Financial) in one year is $35.74, suggesting a upside of 298% from the current price of $8.98. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Runway Growth Finance Corp (RWAY) Summary page.

RWAY Key Business Developments

Release Date: March 20, 2025

- Total Investment Income: $33.8 million for Q4 2024.

- Net Investment Income: $14.6 million for Q4 2024.

- Funded Loans: $154 million in Q4 2024.

- Net Assets: $514.9 million as of December 31, 2024.

- NAV per Share: $13.79 at the end of Q4 2024.

- Principal Prepayments: $152.6 million in Q4 2024.

- Operating Expenses: $19.2 million for Q4 2024.

- Net Realized Loss on Investments: $2.9 million in Q4 2024.

- Debt Portfolio Yield: 14.7% annualized for Q4 2024.

- Leverage Ratio: 1.08x as of December 31, 2024.

- Total Available Liquidity: $244.8 million as of December 31, 2024.

- Unfunded Commitments: $176.7 million as of December 31, 2024.

- Base Dividend Declared: $0.33 per share for Q1 2025.

- Supplemental Dividend Declared: $0.03 per share for Q1 2025.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Runway Growth Finance Corp (RWAY, Financial) delivered total investment income of $33.8 million and net investment income of $14.6 million for the fourth quarter of 2024.

- The acquisition of Runway Growth Capital by BC Partners Credit is expected to enhance origination channels and expand product offerings.

- RWAY completed $154 million in funded loans during the fourth quarter, including significant investments in high-growth sectors like technology and healthcare.

- The company's portfolio is primarily composed of first lien senior secured loans, providing a strong margin of safety.

- RWAY's NAV per share increased by 3% to $13.79 at the end of the fourth quarter, reflecting strong portfolio management.

Negative Points

- RWAY's debt portfolio yield decreased from 15.9% in the third quarter to 14.7% in the fourth quarter of 2024.

- The company recorded a net realized loss on investments of $2.9 million in the fourth quarter.

- Two loans, Mingle Healthcare and Snagajob, remain on nonaccrual status, representing 0.5% of the total investment portfolio.

- The dividend was reduced, with a new base dividend of $0.33 per share, reflecting a more conservative capital allocation strategy.

- RWAY's leverage ratio remained at 1.08x, indicating limited room for increasing leverage to drive growth.