Core Molding Technologies Inc (CMT, Financial) released its 8-K filing on May 8, 2025, reporting financial results for the first quarter ended March 31, 2025. The company, a leader in engineered materials specializing in molded structural products, operates across various sectors including medium and heavy-duty trucks, automobiles, and construction. Despite a challenging quarter, the company demonstrated strong operational execution, resulting in margin improvements and profitability.

Performance Overview

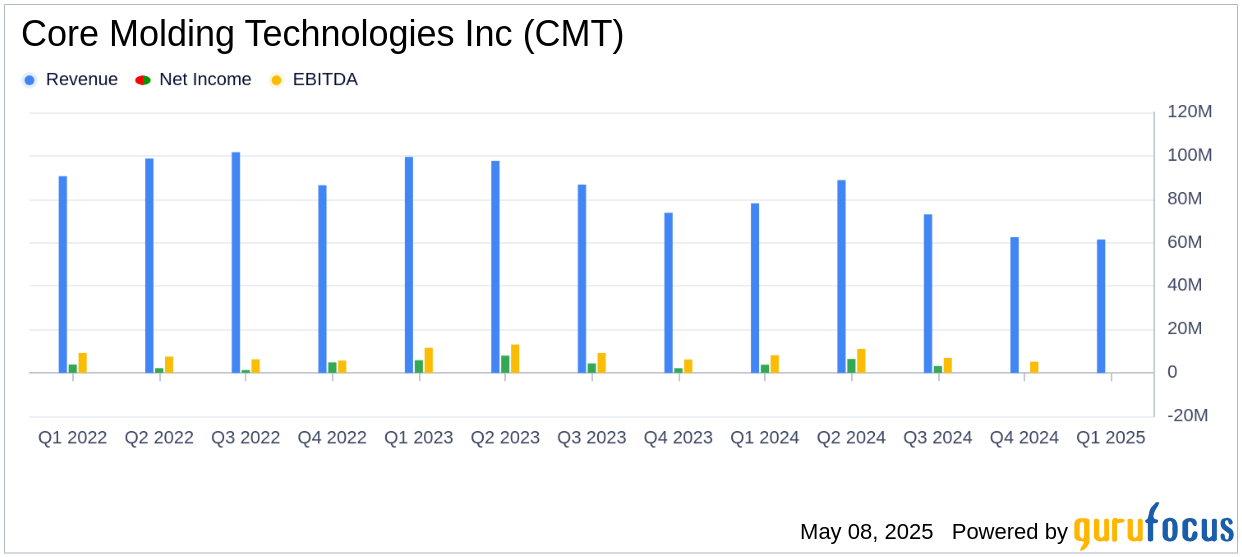

Core Molding Technologies Inc (CMT, Financial) reported total net sales of $61.4 million for the first quarter of 2025, a 21.4% decrease compared to the same period last year. This figure fell short of the analyst estimate of $68.46 million. The company's earnings per share (EPS) was $0.25, which also missed the analyst estimate of $0.33. The decline in sales was primarily attributed to the phase-out of a truck program and weakened consumer demand for powersports products.

Financial Achievements and Challenges

Despite the revenue decline, Core Molding Technologies Inc (CMT, Financial) achieved a gross margin of $11.8 million, or 19.2% of net sales, up from 17.0% in the prior year. This improvement highlights the company's effective cost management and operational efficiency. The adjusted EBITDA was $7.2 million, representing 11.7% of net sales, an increase from 9.2% in the previous quarter.

However, the company faced challenges with a decrease in operating income to $2.8 million from $4.7 million in the prior year, and net income dropped to $2.2 million from $3.8 million. These declines underscore the impact of reduced sales volume on profitability.

Key Financial Metrics

| Metric | Q1 2025 | Q1 2024 | % Change |

|---|---|---|---|

| Net Sales | $61.4 million | $78.1 million | -21.4% |

| Gross Margin | $11.8 million | $13.3 million | -11.4% |

| Operating Income | $2.8 million | $4.7 million | -40.0% |

| Net Income | $2.2 million | $3.8 million | -41.9% |

| Adjusted EBITDA | $7.2 million | $8.7 million | -18.1% |

Strategic Insights and Future Outlook

David Duvall, the company's President and CEO, emphasized the strategic wins in new business, particularly in formulated sheet molding compound (SMC) materials, which offer faster quote-to-cash cycles. He noted,

We delivered strong gross margin expansion, solid profitability, and positive free cash flow this quarter, despite the anticipated revenue decline previously communicated."The company is actively assessing macroeconomic and political uncertainties that may impact its end markets, particularly the trucking sector.

Alex Panda, VP and incoming CFO, highlighted the impact of the sales mix shift due to new revenue wins in 2024, which will affect the gross margin. He stated,

Our almost $45 million of cash reserves at the end of the quarter continue to provide flexibility for the Company to fund capital allocation priorities."

Financial Position and Liquidity

Core Molding Technologies Inc (CMT, Financial) reported a strong liquidity position with $94.5 million, including $44.5 million in cash. The company maintained a term debt of $21.1 million, with a term debt-to-trailing twelve months Adjusted EBITDA ratio of less than one. This financial stability supports the company's strategic growth initiatives and stock repurchase program.

Conclusion

Core Molding Technologies Inc (CMT, Financial) navigated a challenging first quarter with a focus on operational efficiency and strategic growth. While revenue and EPS fell short of expectations, the company's margin improvements and strong liquidity position provide a solid foundation for future growth. Investors will be keen to see how the company leverages its strategic wins and navigates the evolving market conditions in the coming quarters.

Explore the complete 8-K earnings release (here) from Core Molding Technologies Inc for further details.