Key Highlights:

- Skyworks Solutions (SWKS, Financial) maintains its quarterly dividend at $0.70 per share, yielding 4.06%.

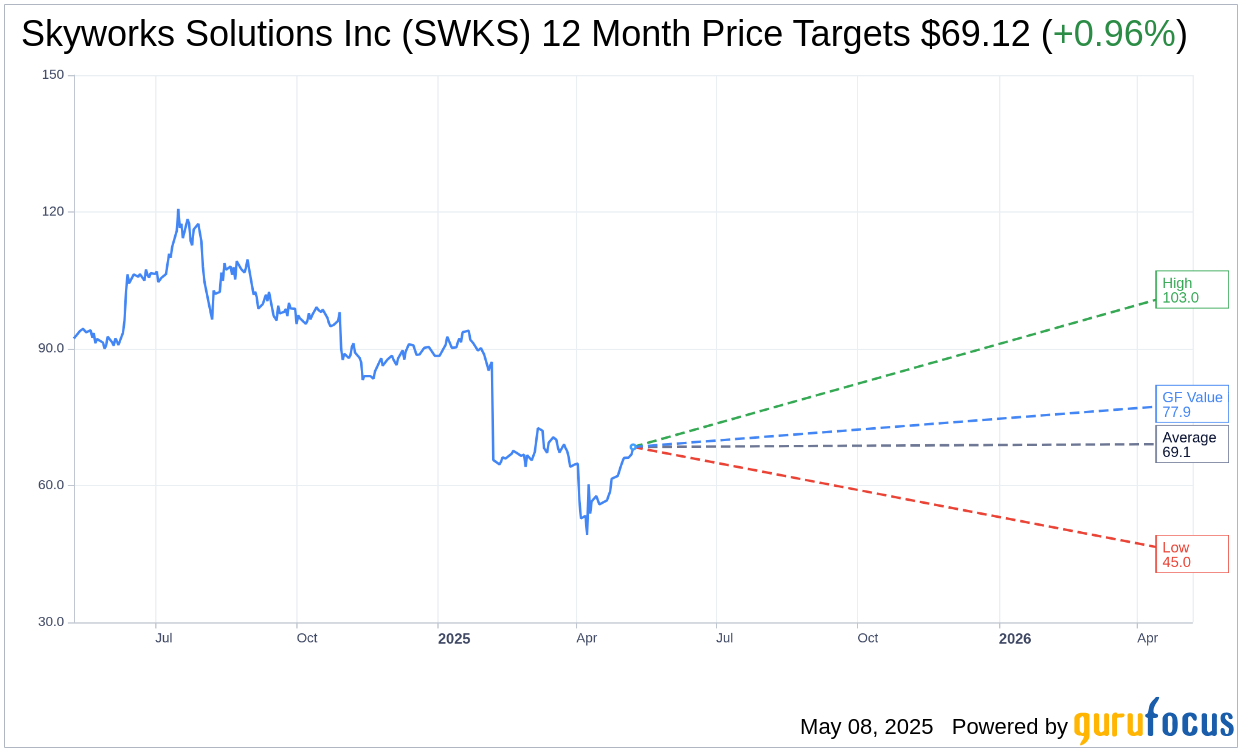

- Analysts predict a modest upside potential for SWKS with a one-year target price averaging $69.12.

- GuruFocus estimates suggest the stock may be undervalued, projecting a fair value increase to $77.93.

Skyworks Solutions (SWKS), a leading player in the semiconductor industry, has announced that it will maintain its quarterly dividend at $0.70 per share, offering a forward yield of 4.06%. This dividend will be disbursed on June 17 to shareholders noted on record by May 27, aligning the ex-dividend date accordingly.

Wall Street Analysts Forecast

According to insights from 18 prominent analysts, the average target price for Skyworks Solutions Inc (SWKS, Financial) is set at $69.12. This projection includes a high estimate of $103.00 and a low of $45.00. At its current trading price of $68.47, the average target price suggests a potential upside of 0.96%. For a deeper dive into these estimates, visit the Skyworks Solutions Inc (SWKS) Forecast page.

Analyzing recommendations from 28 brokerage firms, Skyworks Solutions Inc (SWKS, Financial) is positioned at an average brokerage recommendation of 3.1, placing it squarely in "Hold" territory on the usual 1 to 5 scale. On this scale, a score of 1 indicates a Strong Buy, while 5 suggests a Sell.

GuruFocus Valuation Insights

From a valuation perspective, GuruFocus provides an intriguing outlook with the estimated GF Value for Skyworks Solutions Inc (SWKS, Financial) projected at $77.93 in one year. This signifies a promising upside of 13.82% from its current price of $68.47. The GF Value represents GuruFocus' calculated estimate of the fair value at which the stock should be trading. This estimate is derived from historical trading multiples, past business growth metrics, and future performance forecasts. For more comprehensive information, explore the Skyworks Solutions Inc (SWKS) Summary page.