Summary:

- Tapestry, Inc. (TPR, Financial) posts record financial performance in Q3 with significant growth in revenue and EPS.

- Analysts predict an 8.33% upside in Tapestry's stock price with strong consensus ratings.

- GuruFocus estimates suggest a potential downside based on historical stock performance and valuations.

Tapestry, Inc. (TPR) reports impressive growth for the third quarter, as evidenced by a stellar 8% increase in revenue at constant currency and a remarkable 27% rise in earnings per share (EPS). The resilience of the brand is underscored by substantial sales growth from Coach, particularly in Europe and North America. Consequently, the company has revised its fiscal year 2025 EPS guidance to $5 and forecasts $6.95 billion in revenue.

Wall Street Analysts Forecast

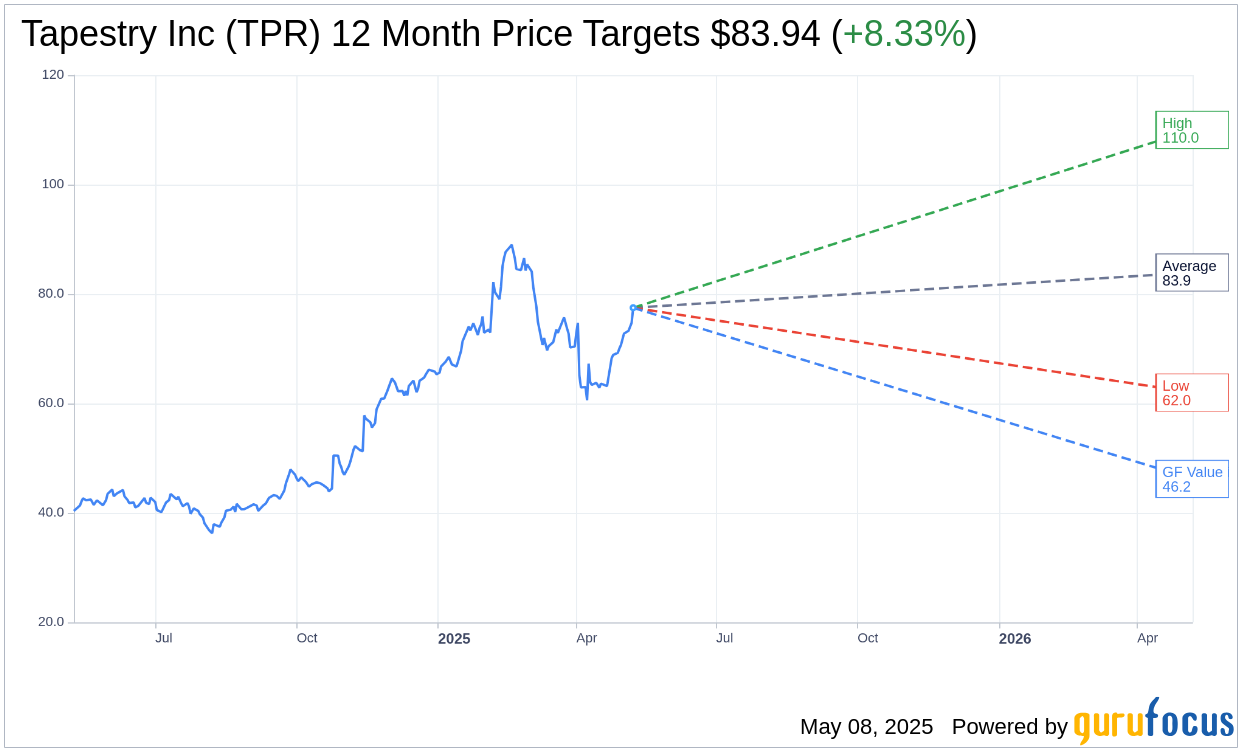

Current insights from 18 analysts place the average price target for Tapestry Inc (TPR, Financial) at $83.94. Estimates range from a high of $110.00 to a low of $62.00, indicating an implied upside of 8.33% from the present stock price of $77.49. Investors looking for elaborate projections can explore more on the Tapestry Inc (TPR) Forecast page.

The brokerage consensus from 22 firms rates Tapestry Inc's (TPR, Financial) average recommendation at 2.1, translating to an "Outperform" status. This rating scale runs from 1 (Strong Buy) to 5 (Sell), providing a favorable outlook for potential investors.

However, according to GuruFocus estimates, the GF Value for Tapestry Inc (TPR, Financial) over the next year is predicted to be $46.22, indicating a possible downside of 40.35% from the current price of $77.49. The GF Value is GuruFocus' calculation of the stock's fair market value, derived from historical trading multiples, past growth rates, and future business performance projections. For a deeper dive into Tapestry's prospects, visit the Tapestry Inc (TPR) Summary page.