Summary:

- TORM (TRMD, Financial) declares an attractive interim dividend of $0.40, yielding 9.78%.

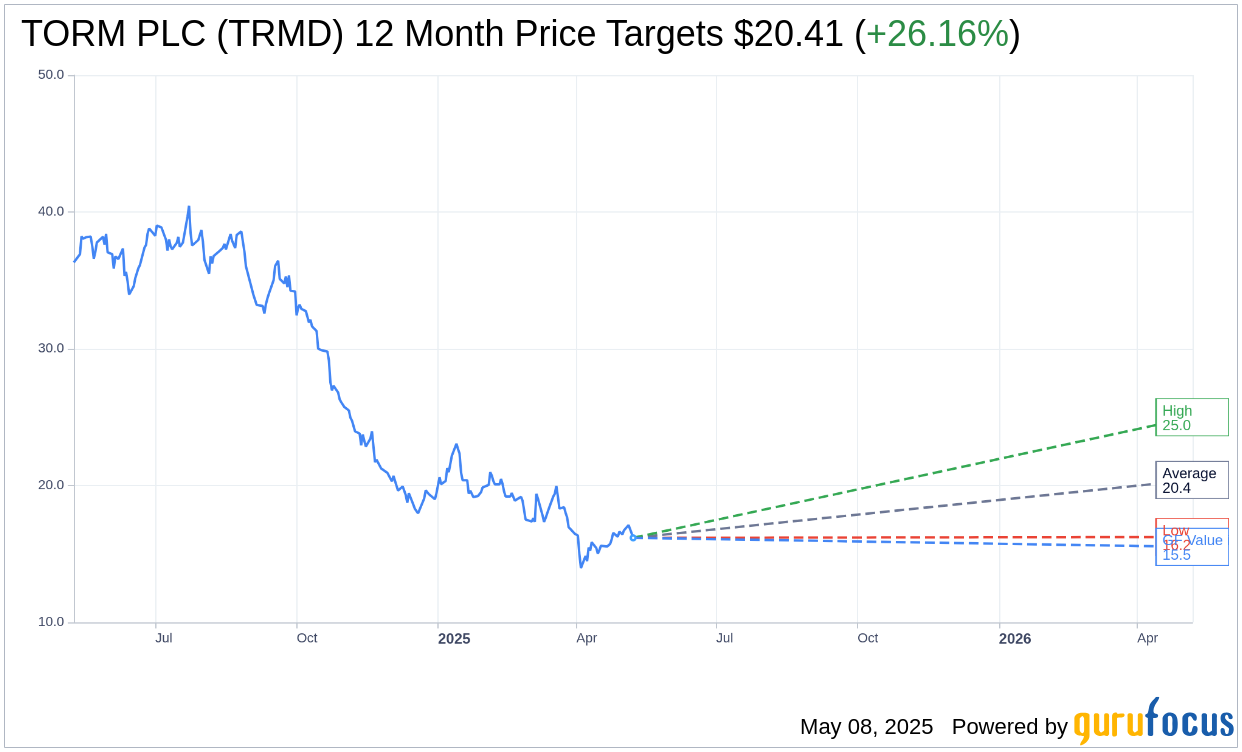

- Analysts foresee a potential upside of 26.16% with a target price of $20.41.

- Current recommendations suggest a "Hold" status, with GF Value indicating a slight downside.

TORM's (TRMD) Attractive Dividend Announcement

TORM PLC (TRMD) has delighted investors by announcing an interim dividend of $0.40 per share for the first quarter, offering a compelling forward yield of 9.78%. This dividend is scheduled for payment on June 4, and investors must ensure they are registered by May 22, which is also the ex-dividend date.

Wall Street Analysts' Projections

Industry experts have provided their forecasts for TORM PLC (TRMD, Financial), with three analysts setting an average target price at $20.41. Price estimates range from a high of $25.00 to a low of $16.24. This indicates a potential upside of 26.16% from the current trading price of $16.18. For further insights, visit the TORM PLC (TRMD) Forecast page.

Analyst Ratings and Recommendations

The consensus among three brokerage firms categorizes TORM PLC (TRMD, Financial) with a 2.7 average brokerage recommendation, suggesting a "Hold" status. This ranking is based on a five-point scale where 1 represents Strong Buy and 5 indicates Sell.

Evaluating the GF Value of TORM PLC

According to GuruFocus estimates, the projected GF Value for TORM PLC (TRMD, Financial) in the upcoming year stands at $15.52. This suggests a potential downside of 4.08% relative to the current price of $16.18. The GF Value is a proprietary metric by GuruFocus, which assesses the fair value of a stock by examining historical trading multiples, past growth trends, and future performance projections. For comprehensive data, refer to the TORM PLC (TRMD) Summary page.

Also check out: (Free Trial)