- Core Natural Resources achieves $123.5 million in adjusted EBITDA in Q1 2025.

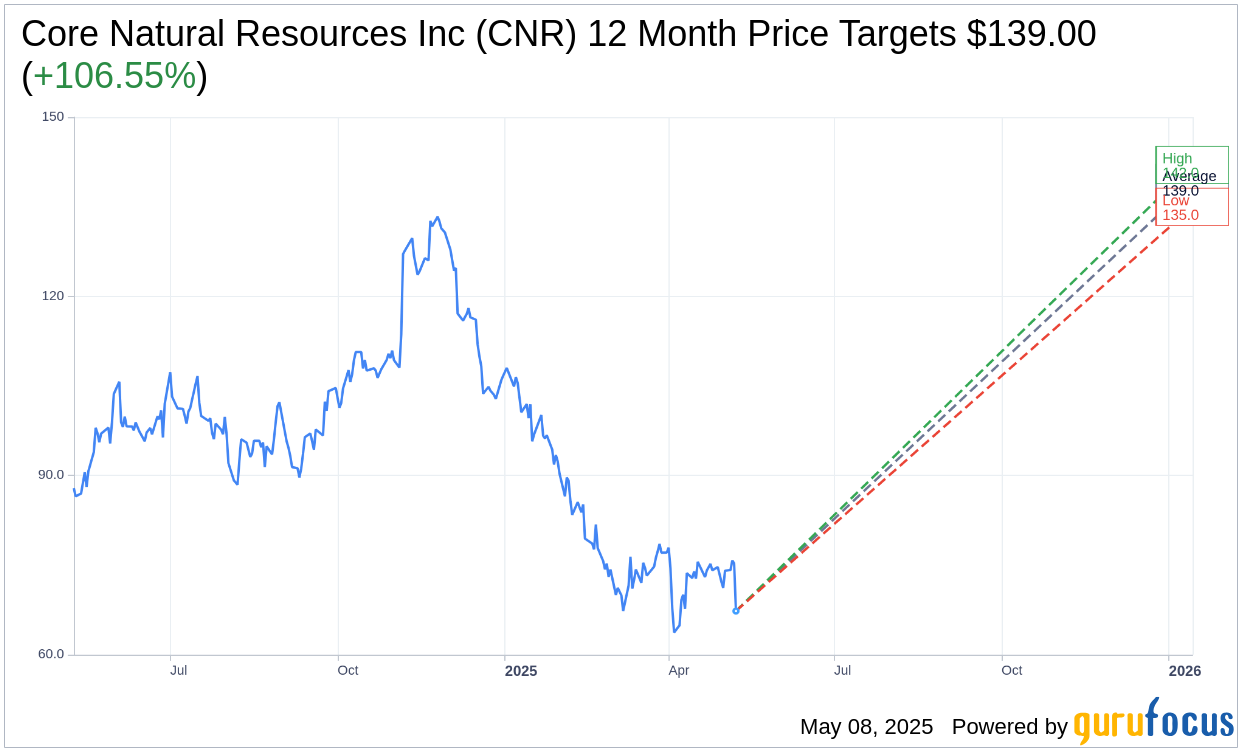

- Analysts project significant stock upside with an average target price of $139.00.

- Company demonstrates commitment to shareholders with $106.6 million in returns.

Core Natural Resources Inc. (CNR, Financial) reported a robust $123.5 million in adjusted EBITDA for the first quarter of 2025, proving resilient despite challenging market conditions. Demonstrating a strong commitment to shareholder value, the company returned $106.6 million through stock buybacks and dividends. Furthermore, CNR has ambitiously increased its synergy target to $125-$150 million annually while optimizing efficiency by reducing cash costs in the Metallurgical segment to $94-$98 per ton.

Wall Street Analysts Forecast

Analyst projections for Core Natural Resources paint a promising picture. Based on 3 expert analysts, the average one-year price target for CNR stands at $139.00, with estimates ranging from a high of $142.00 to a low of $135.00. This translates to a potential upside of 106.55% from the current share price of $67.30. For a more comprehensive view of these estimates, visit the Core Natural Resources Inc (CNR, Financial) Forecast page.

Consensus from three brokerage firms positions Core Natural Resources with an average brokerage recommendation of 2.0, categorizing the stock as "Outperform." This rating scale ranges from 1 (Strong Buy) to 5 (Sell), underscoring the positive sentiment surrounding the company's market performance.

According to GuruFocus estimates, the one-year projected GF Value for Core Natural Resources is pegged at $136.01. This indicates a promising upside of 102.11% from the current price of $67.295. The GF Value represents GuruFocus' calculated fair market value based on historical stock performance, business growth, and anticipated future outcomes. Explore more detailed metrics on the Core Natural Resources Inc (CNR, Financial) Summary page.