BioLife Solutions (BLFS, Financial) announced impressive first-quarter revenue of $23.9 million, exceeding the market consensus of $22.22 million. This marks a 33% year-over-year increase in revenue specifically from cell processing, attributed to the strong performance of its core biopreservation media product line. Notably, clients involved in commercial therapies now contribute about 40% of the total revenue from this segment, highlighting the model's robustness and sustainability.

The company also reported a significant enhancement in its adjusted EBITDA margin. This improvement reflects the benefits of a streamlined organization and a refined portfolio, unlocking greater operating leverage as a result of strategic initiatives implemented the previous year. With a solid balance sheet and a disciplined strategy for capital allocation, BioLife Solutions is poised to continue its growth trajectory in the cell and gene therapy (CGT) market. This includes potential expansions via acquisitions, such as the recent purchase of PanTHERA CryoSolutions.

Despite the challenges posed by a dynamic market environment, BioLife Solutions maintains a positive outlook for 2025, aiming to sustain growth, strengthen its leadership, and deliver long-term value to shareholders.

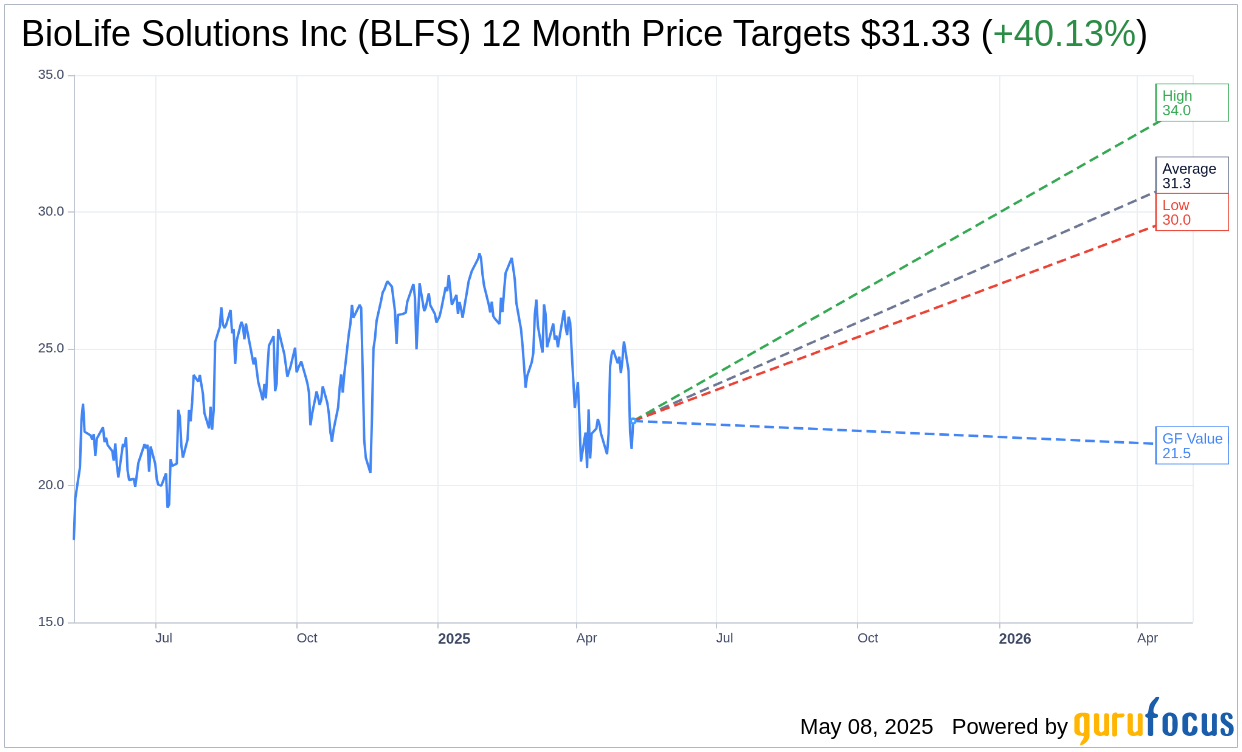

Wall Street Analysts Forecast

Based on the one-year price targets offered by 9 analysts, the average target price for BioLife Solutions Inc (BLFS, Financial) is $31.33 with a high estimate of $34.00 and a low estimate of $30.00. The average target implies an upside of 40.13% from the current price of $22.36. More detailed estimate data can be found on the BioLife Solutions Inc (BLFS) Forecast page.

Based on the consensus recommendation from 9 brokerage firms, BioLife Solutions Inc's (BLFS, Financial) average brokerage recommendation is currently 1.9, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for BioLife Solutions Inc (BLFS, Financial) in one year is $21.47, suggesting a downside of 3.98% from the current price of $22.36. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the BioLife Solutions Inc (BLFS) Summary page.

BLFS Key Business Developments

Release Date: March 03, 2025

- Total Revenue 2024: $82 million, down from $143 million in 2023 due to divestitures.

- GAAP Gross Margin 2024: 62%, up from 31% in 2023.

- Adjusted EBITDA 2024: Positive $16 million, compared to negative $5 million in 2023.

- Cash Balance 2024: $109 million, up from $45 million in 2023.

- Cell Processing Revenue Q4 2024: $20.3 million, up 7% over Q3 and 37% year-over-year.

- Total Q4 Revenue 2024: $22.7 million, a 31% increase year-over-year.

- GAAP Gross Margin Q4 2024: 60%, compared to 53% in Q4 2023.

- Adjusted EBITDA Q4 2024: $4 million, up from $3.7 million in Q4 2023.

- GAAP Net Loss Q4 2024: $2 million or $0.04 per share, compared to $7.2 million or $0.16 per share in Q4 2023.

- 2025 Revenue Guidance: $95.5 million to $99 million, representing 16% to 20% growth over 2024.

- Cell Processing Revenue 2025 Guidance: $86.5 million to $89 million, 18% to 21% growth over 2024.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- BioLife Solutions Inc (BLFS, Financial) achieved five consecutive quarters of growth in cell processing revenue, exceeding the high end of their full-year guidance.

- The company successfully divested non-core product lines, resulting in a stronger and cleaner balance sheet with a doubled cash balance of $109 million by the end of 2024.

- GAAP gross margin improved significantly from 31% in 2023 to 62% in 2024, generating $51 million in gross margin dollars.

- Adjusted EBITDA turned positive in 2024, reaching $16 million or 19% of revenue, compared to a negative $5 million in 2023.

- BioLife Solutions Inc (BLFS) anticipates 16% to 20% revenue growth in 2025, driven primarily by their cell processing platform, with expected growth in adjusted EBITDA margin.

Negative Points

- Total revenue in 2024 decreased to $82 million from $143 million in 2023 due to divestitures.

- EVO and SAW platform revenue for Q4 2024 decreased by 8% compared to the same period in 2023.

- GAAP operating expenses for Q4 2024 increased slightly to $24.8 million from $24.4 million in Q4 2023.

- The company faces competition from home-brew formulations in the media market and established products like cryobags in the CryoCase market.

- R&D expenses are expected to increase in 2025, which may offset some of the anticipated revenue growth.