On May 8, 2025, Mach Natural Resources LP (MNR, Financial) released its 8-K filing detailing its financial performance for the first quarter of 2025. Mach Natural Resources LP is an independent upstream oil and gas company focused on the acquisition, development, and production of oil, natural gas, and NGL reserves in the Anadarko Basin region of Western Oklahoma, Southern Kansas, and the panhandle of Texas.

Performance Overview

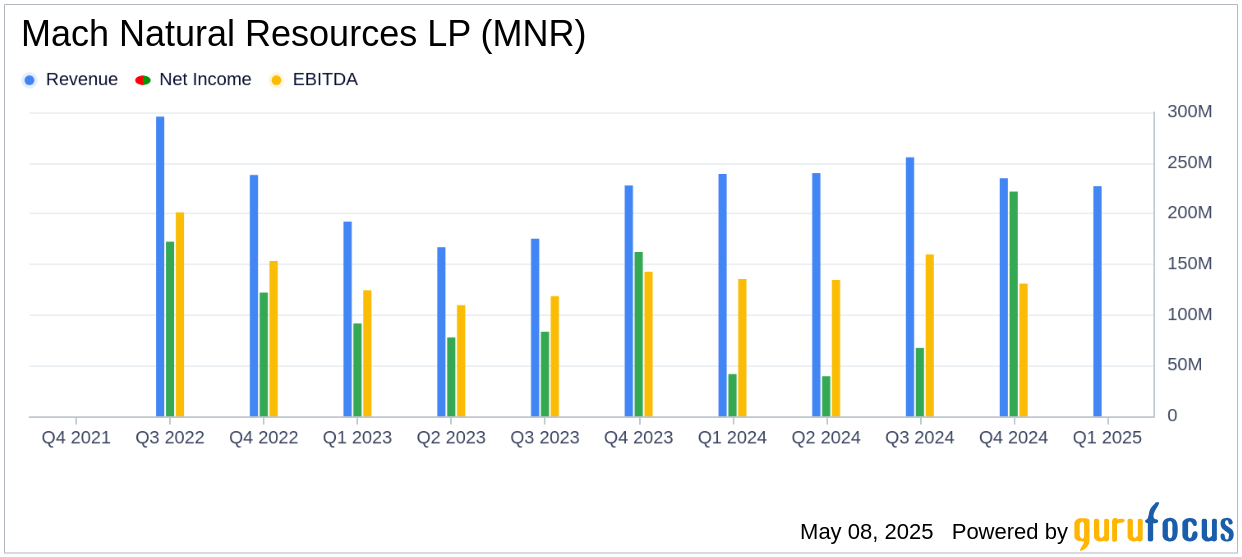

Mach Natural Resources LP reported total revenue of $227 million for the first quarter of 2025, falling short of the analyst estimate of $255.74 million. The company achieved a net income of $16 million, which translates to an earnings per share (EPS) that was not explicitly provided but can be inferred to be below the quarterly estimate of $0.62 per share. This performance highlights challenges in meeting market expectations, potentially due to volatile commodity prices and operational costs.

Financial Achievements and Industry Context

Despite missing revenue estimates, Mach Natural Resources LP declared a quarterly cash distribution of $0.79 per common unit, showcasing its commitment to returning value to shareholders. The company reported an Adjusted EBITDA of $160 million, a significant metric for evaluating operational performance in the oil and gas industry, as it excludes volatile items like interest and depreciation.

Key Financial Metrics

Mach Natural Resources LP's financial health is underscored by its successful closing of a senior secured reserve-based revolving credit facility with an initial borrowing base of $750 million. As of March 31, 2025, the company had a cash balance of $8 million and a pro forma net-debt-to-Adjusted-EBITDA ratio of 0.7x, indicating a strong balance sheet position.

Operational Highlights

The company achieved an average oil equivalent production of 80.9 thousand barrels of oil equivalent per day (Mboe/d), with production revenues totaling $253 million. Lease operating expenses were reported at $49 million, or $6.69 per Boe, while gathering and processing expenses amounted to $28 million, or $3.87 per Boe.

Commentary and Strategic Outlook

“Mach is off to a solid start for 2025,” commented Tom L. Ward, Chief Executive Officer. “Our strong distribution reflects our ongoing ability to generate industry-leading cash returns. Despite today’s volatile commodity backdrop, we are well positioned to transition our drilling program toward natural gas while maintaining our reinvestment rate of less than 50%.”

Conclusion

Mach Natural Resources LP's first quarter results reflect both achievements and challenges. While the company missed revenue estimates, its strategic financial management and commitment to shareholder returns remain strong. The reaffirmation of its 2025 outlook suggests confidence in navigating the volatile oil and gas market. Investors and stakeholders will be keenly observing how the company adapts its strategies to optimize value creation in the coming quarters.

Explore the complete 8-K earnings release (here) from Mach Natural Resources LP for further details.