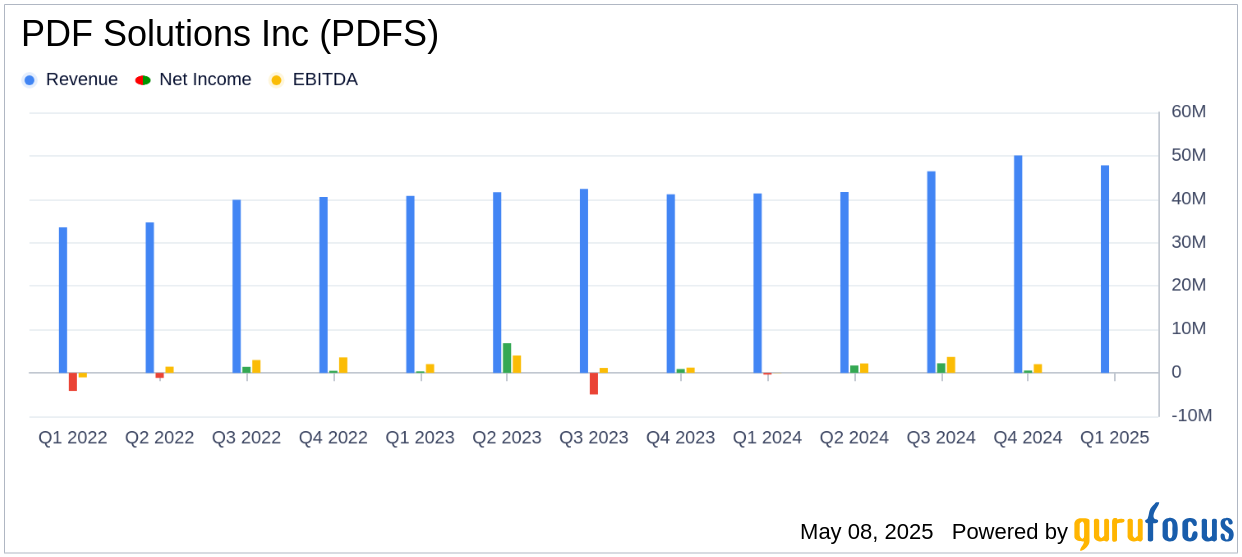

PDF Solutions Inc (PDFS, Financial) released its 8-K filing on May 8, 2025, detailing its financial performance for the first quarter ended March 31, 2025. The company, a leader in providing data solutions for the semiconductor and electronics ecosystem, reported total revenues of $47.8 million, surpassing the analyst estimate of $47.74 million. However, the company reported a GAAP diluted loss per share of ($0.08), which fell short of the estimated earnings per share of $0.01.

Company Overview

PDF Solutions Inc offers a suite of products and services aimed at enhancing the yield, quality, and profitability of semiconductor products. Its offerings include proprietary software, physical intellectual property for integrated circuit designs, electrical measurement hardware tools, and professional services. The company's clientele includes integrated device manufacturers, fabless semiconductor companies, foundries, outsourced semiconductor assembly and test companies, and system houses.

Performance and Challenges

The first quarter of 2025 saw PDF Solutions Inc achieve a 16% increase in total revenues compared to the same quarter last year, driven by strong customer activity and platform development. However, the company faced challenges as it reported a GAAP net loss of $3.0 million, or ($0.08) per diluted share, compared to a net income of $0.5 million in the previous quarter. This performance highlights the volatility in the semiconductor industry and the challenges companies face in maintaining profitability amidst fluctuating market conditions.

Financial Achievements

Despite the GAAP loss, PDF Solutions Inc reported a non-GAAP net income of $8.1 million, or $0.21 per diluted share, which exceeded the analyst estimate of $0.01. The company's non-GAAP gross margin improved to 77%, up from 72% in the previous quarter, indicating effective cost management and operational efficiency. These achievements are crucial for a software company operating in the competitive semiconductor industry, as they reflect the company's ability to leverage its technological capabilities to drive profitability.

Key Financial Metrics

PDF Solutions Inc's quarterly analytics revenue reached $42.5 million, a 10% increase from the previous year, while the Integrated Yield Ramp revenue rose to $5.3 million. The company's backlog stood at $226.7 million as of March 31, 2025, providing a strong foundation for future revenue generation. The GAAP gross margin improved to 73%, up from 67% in the same quarter last year, showcasing the company's ability to enhance its cost structure and maintain competitive pricing.

| Metric | Q1 2025 | Q4 2024 | Q1 2024 |

|---|---|---|---|

| Total Revenue | $47.8 million | $50.1 million | $41.3 million |

| Analytics Revenue | $42.5 million | $47.9 million | $38.5 million |

| Integrated Yield Ramp Revenue | $5.3 million | $2.2 million | $2.8 million |

| GAAP Gross Margin | 73% | 68% | 67% |

| Non-GAAP Gross Margin | 77% | 72% | 72% |

Analysis and Commentary

PDF Solutions Inc's performance in the first quarter of 2025 underscores the company's resilience and adaptability in a challenging market environment. The increase in analytics revenue and the substantial backlog indicate strong demand for the company's solutions. However, the GAAP net loss highlights the need for continued focus on cost management and strategic investments to sustain growth.

“The first quarter of 2025 saw strong customer activity and platform development, driven by AI-driven digitization. Sapience Manufacturing Hub saw record bookings, and we acquired secureWISE to enhance supply chain collaboration,” said John Kibarian, CEO and President.

Overall, PDF Solutions Inc's financial results reflect a company that is well-positioned to capitalize on opportunities in the semiconductor industry, despite the challenges posed by market volatility and competitive pressures. The reaffirmation of the 21-23% annual revenue growth guidance further emphasizes the company's confidence in its strategic direction and growth prospects.

Explore the complete 8-K earnings release (here) from PDF Solutions Inc for further details.