On May 8, 2025, Granite Ridge Resources Inc (GRNT, Financial) released its 8-K filing detailing the financial and operational results for the first quarter of 2025. Granite Ridge Resources Inc is a scaled, non-operated oil and gas exploration and production company, investing in a diversified portfolio across the Permian and other prolific U.S. basins. The company primarily generates revenue from oil.

Performance Overview

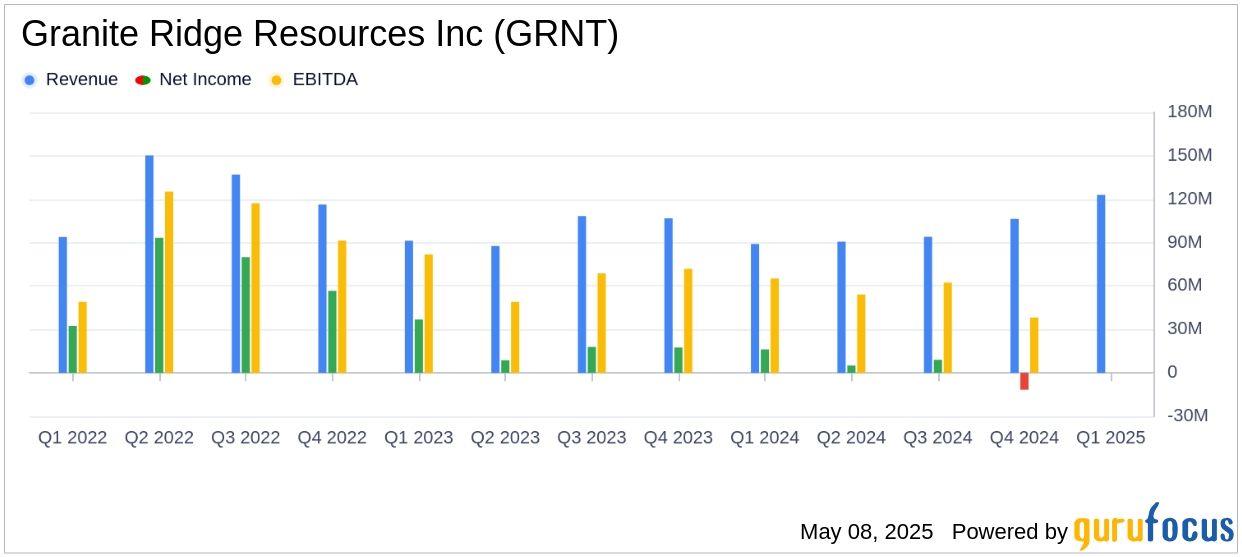

Granite Ridge Resources Inc reported a net income of $9.8 million, or $0.07 per diluted share, which fell short of the analyst estimate of $0.20 per share. However, the company achieved an adjusted net income of $28.9 million, or $0.22 per diluted share, surpassing the analyst estimate. The company's revenue for the quarter was $122.9 million, exceeding the estimated $115.79 million.

Financial Achievements and Challenges

The company reported a 23% increase in daily production to 29,245 barrels of oil equivalent (Boe) per day, with oil accounting for 50% of the production. This growth is significant for Granite Ridge Resources Inc as it underscores the effectiveness of its diversified, capital-efficient model. However, the decline in net income compared to the previous year, where it was $16.2 million, indicates challenges in maintaining profitability amidst fluctuating market conditions.

Key Financial Metrics

Granite Ridge Resources Inc generated $91.4 million in Adjusted EBITDAX, a notable increase from $64.5 million in the first quarter of 2024. This metric is crucial for assessing the company's operational efficiency and cash flow generation capabilities. The company invested $71.4 million in development capital expenditures and $34.4 million in acquisition capital, reflecting its strategic focus on capturing high-quality drilling opportunities.

Operational Highlights

The company placed 13.7 net wells online during the quarter, compared to 5.1 net wells in the same period last year. This operational activity, particularly in the Permian Basin, is expected to drive future production growth. The company's average realized price for oil was $69.18 per barrel, a decrease from $78.17 per barrel in the first quarter of 2024, highlighting the impact of market volatility on revenue.

Liquidity and Capital Resources

As of March 31, 2025, Granite Ridge Resources Inc had $250 million of debt outstanding and $90.8 million in liquidity. The company and its lenders agreed to increase the borrowing base to $375 million, enhancing its financial flexibility. This strategic move positions the company to capitalize on future opportunities while maintaining a low leverage profile.

Commentary and Strategic Outlook

Luke Brandenberg, President and CEO of Granite Ridge, commented, “Our first quarter results highlight the quality of our asset base, the consistency of our execution, and the advantages of our diversified, capital-efficient model. We achieved 23% year-over-year daily production growth and generated $91 million in Adjusted EBITDAX, exceeding our internal forecasts.”

Granite Ridge Resources Inc's strategic focus on controlled investments in high-value drilling opportunities and maintaining a robust hedge book covering approximately 75% of current production through 2026 positions the company to navigate market volatility effectively.

Conclusion

Granite Ridge Resources Inc's first-quarter results reflect strong operational performance and strategic investments, despite challenges in net income. The company's focus on production growth and financial flexibility is crucial for sustaining long-term shareholder value in the volatile oil and gas industry.

Explore the complete 8-K earnings release (here) from Granite Ridge Resources Inc for further details.