Key Highlights:

- Cenovus Energy (CVE, Financial) shares surged by 9.3% following the company's robust Q1 earnings and an 11% dividend increase.

- Analysts project a potential 42.72% upside for CVE shares, with a strong "Outperform" consensus rating.

- GuruFocus estimates a GF Value suggesting a 36.44% potential upside from current prices.

Cenovus Energy Inc. (CVE) has captured investor attention with a notable 9.3% rise in its share price. This leap comes on the heels of the company exceeding its Q1 earnings forecasts and announcing an 11% dividend hike, boosting it to C$0.80 annually. The first quarter saw Cenovus Energy report a net profit of C$859 million, fueled by revenues soaring to C$13.3 billion, driven by increased production and enhancements in refining operations.

Wall Street Analysts Forecast

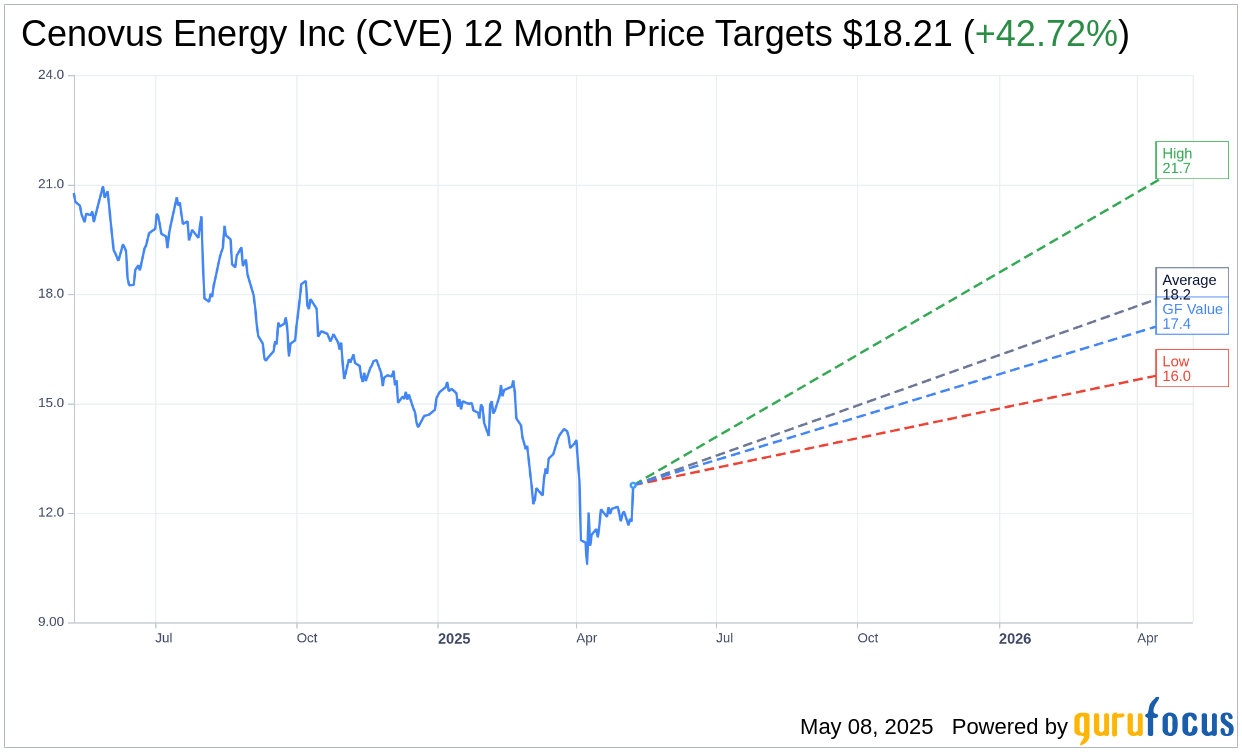

Analyst projections for Cenovus Energy Inc (CVE, Financial) present a promising outlook with an average one-year price target of $18.21. This analysis, which includes estimates from nine analysts, offers a high forecast of $21.67 and a low of $15.97. These figures translate to a potential 42.72% upside from the current trading price of $12.76. Investors seeking more detailed estimates can visit the Cenovus Energy Inc (CVE) Forecast page.

Cenovus Energy Inc.’s performance is further supported by the consensus recommendation of nine brokerage firms, resulting in an average rating of 2.1. This reflects an "Outperform" status on a scale where 1 indicates a Strong Buy and 5 signifies a Sell.

According to GuruFocus estimates, the projected GF Value of Cenovus Energy Inc (CVE, Financial) for the upcoming year is pegged at $17.41. This estimate suggests a 36.44% upside potential from its current price of $12.76. The GF Value is a crucial metric that represents GuruFocus' evaluation of the stock's fair trading value, crafted from historical trading multiples and projections of future business performance. Additional comprehensive insights are available on the Cenovus Energy Inc (CVE) Summary page.

Also check out: (Free Trial)