Barings BDC (BBDC, Financial) reported a consistent net asset value (NAV) per share of $11.29 as of March 31, 2025, and December 31, 2024. The company highlighted solid portfolio performance in the first quarter, maintaining stable NAV following increased repayments in the prior quarter. Credit quality remains strong, with non-accruals at just 0.6% of the portfolio based on fair value, outperforming industry norms.

After the quarter's conclusion, BBDC advanced its strategy of shifting towards income-generating assets by ending its MVC CSA agreement with Barings, receiving a $23 million payment. This sum will be used for lucrative new investments. The early full payment by Barings underscores their strong alignment with BBDC's objectives.

Currently, BBDC has over $420 million in available capital, backed by the expansive Barings platform, which offers the scale and global insights necessary to enhance future portfolio achievements. The company is well-prepared to manage diverse economic conditions, leveraging its global pipeline as the market landscape changes.

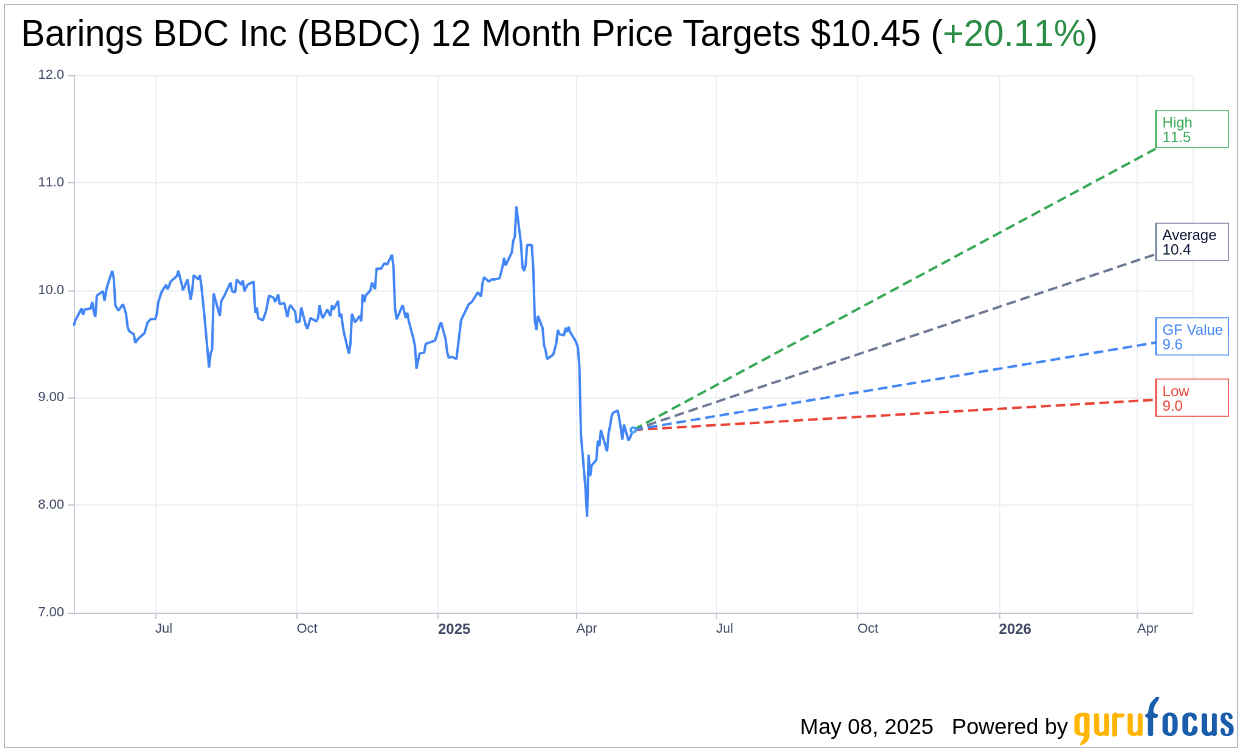

Wall Street Analysts Forecast

Based on the one-year price targets offered by 5 analysts, the average target price for Barings BDC Inc (BBDC, Financial) is $10.45 with a high estimate of $11.50 and a low estimate of $9.00. The average target implies an upside of 20.11% from the current price of $8.70. More detailed estimate data can be found on the Barings BDC Inc (BBDC) Forecast page.

Based on the consensus recommendation from 5 brokerage firms, Barings BDC Inc's (BBDC, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Barings BDC Inc (BBDC, Financial) in one year is $9.57, suggesting a upside of 10% from the current price of $8.7. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Barings BDC Inc (BBDC) Summary page.

BBDC Key Business Developments

Release Date: February 21, 2025

- Net Asset Value (NAV) per Share: $11.29, slightly up from $11.28 at the prior fiscal year end.

- Net Investment Income (NII) per Share: $0.28, exceeding the dividend of $0.26 per share.

- Total Shareholder Return for 2024: Exceeded 24%.

- Non-Accrual Rate: Declined to 0.3% on a fair-value basis and 1.6% on a cost basis.

- Weighted Average Yield at Fair Value: 10.4%.

- Fourth Quarter Dividend: $0.26 per share, with an additional $0.15 in supplemental dividends.

- Capital Deployment: $298 million deployed, offset by $222 million in sales and repayments.

- Net Leverage Ratio: 1.16 times, within the long-term range of 0.9 to 1.25 times.

- Unfunded Commitments: $323 million to portfolio companies and $65 million to joint venture investments.

- Available Capital: Over $464 million.

- Share Repurchase: 150,000 shares repurchased in Q4, totaling over 650,000 shares in 2024.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Barings BDC Inc (BBDC, Financial) delivered strong and consistent results in Q4 2024, driven by best-in-class credit performance and franchise stability.

- Total shareholder return for 2024 exceeded 24%, placing BBDC in the top quartile among publicly traded peers.

- The company experienced a meaningful uptick in deployment during Q4 2024, with strong originations from both existing portfolio add-ons and new buyouts.

- Net investment income for the quarter was $0.28 per share, out-earning the dividend of $0.26 per share.

- The non-accrual rate declined to 0.3% on a fair-value basis, one of the lowest levels across the industry, reflecting strong credit quality.

Negative Points

- Lending activity was muted during the first three quarters of 2024, consistent with broader industry trends.

- Regulatory and trade uncertainties have created caution in the market, impacting the pace of new buy opportunities.

- The portfolio's net asset value per share was largely unchanged, indicating limited growth in asset value.

- The company remains cautious about the economic outlook for 2025, despite positive economic indicators.

- There is uncertainty in the private equity market, with a slowdown in the expected sale of portfolio companies.