Investment Highlights:

- Fidus Investment (FDUS, Financial) reports a robust 5.3% increase in Q1 total investment income.

- Analysts forecast an average price target of $21.67, suggesting growth potential.

- GuruFocus estimates a GF Value of $26.56, indicating significant upside.

Fidus Investment Corp (FDUS) has released its first-quarter financial results, showcasing a commendable performance with a 5.3% year-over-year increase in total investment income, which now stands at $36.5 million. As of March 31, 2025, the company's net asset value (NAV) was reported at $677.9 million, or $19.39 per share. Additionally, Fidus disclosed an estimated spillover income of $47.4 million, equivalent to $1.36 per share, highlighting the company's potential for future earnings distribution.

Analyst Price Targets and Recommendations

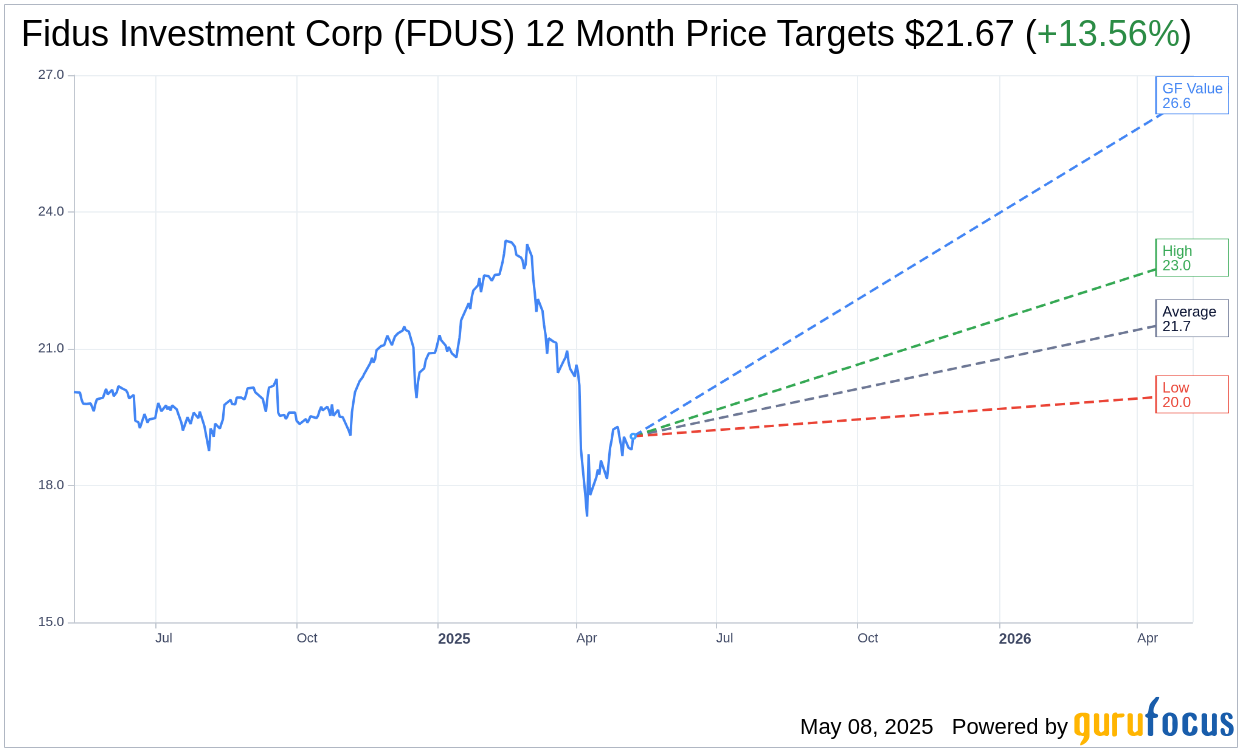

According to the forecasts from three analysts, the average price target for Fidus Investment Corp (FDUS, Financial) is set at $21.67. This estimate includes a high of $23.00 and a low of $20.00. These targets suggest a potential upside of 13.56% from the current share price of $19.08. For more detailed insights and updates, visit the Fidus Investment Corp (FDUS) Forecast page.

The consensus recommendation from five brokerage firms categorizes Fidus Investment Corp's (FDUS, Financial) average brokerage recommendation at 2.4, indicating an "Outperform" status. On the rating scale, 1 denotes a Strong Buy, while 5 indicates a Sell, placing Fidus in a favorable position among analysts.

GuruFocus Value Estimation

According to GuruFocus estimates, the projected GF Value for Fidus Investment Corp (FDUS, Financial) in one year is $26.56, implying a promising upside of 39.2% from the current price of $19.08. The GF Value metric is a GuruFocus proprietary calculation, estimating the stock's fair value based on historical multiples, past business growth, and future performance projections. For more comprehensive data, please refer to the Fidus Investment Corp (FDUS) Summary page.