Microchip Technology (MCHP, Financial) projects revenue for the first quarter to range between $1.02 billion and $1.07 billion, exceeding previous market expectations of $984.58 million. In the March 2025 quarter, the company marked a significant milestone by achieving its first favorable book-to-bill ratio in almost three years, signaling a turning point. April bookings surpassed any month during the March quarter, indicating strong demand.

Despite challenges stemming from geopolitical tensions and tariff-related uncertainties, Microchip Technology remains optimistic about its growth trajectory in the June 2025 quarter. The company aims to leverage its current momentum to enhance shareholder value, while continuing its commitment to dividend payments as it progresses toward sustained growth.

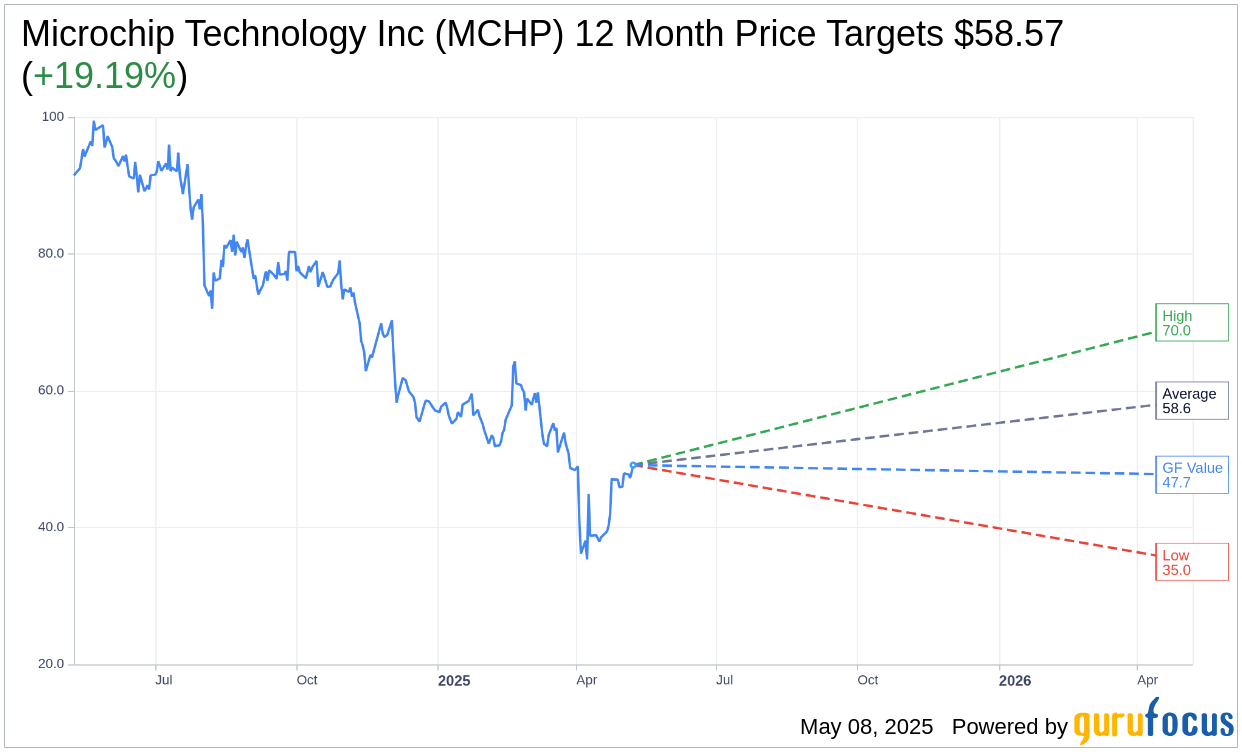

Wall Street Analysts Forecast

Based on the one-year price targets offered by 21 analysts, the average target price for Microchip Technology Inc (MCHP, Financial) is $58.57 with a high estimate of $70.00 and a low estimate of $35.00. The average target implies an upside of 19.19% from the current price of $49.14. More detailed estimate data can be found on the Microchip Technology Inc (MCHP) Forecast page.

Based on the consensus recommendation from 24 brokerage firms, Microchip Technology Inc's (MCHP, Financial) average brokerage recommendation is currently 2.1, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Microchip Technology Inc (MCHP, Financial) in one year is $47.73, suggesting a downside of 2.87% from the current price of $49.14. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Microchip Technology Inc (MCHP) Summary page.