Key Takeaways:

- PubMatic (PUBM, Financial) beats Q1 earnings expectations despite a small loss.

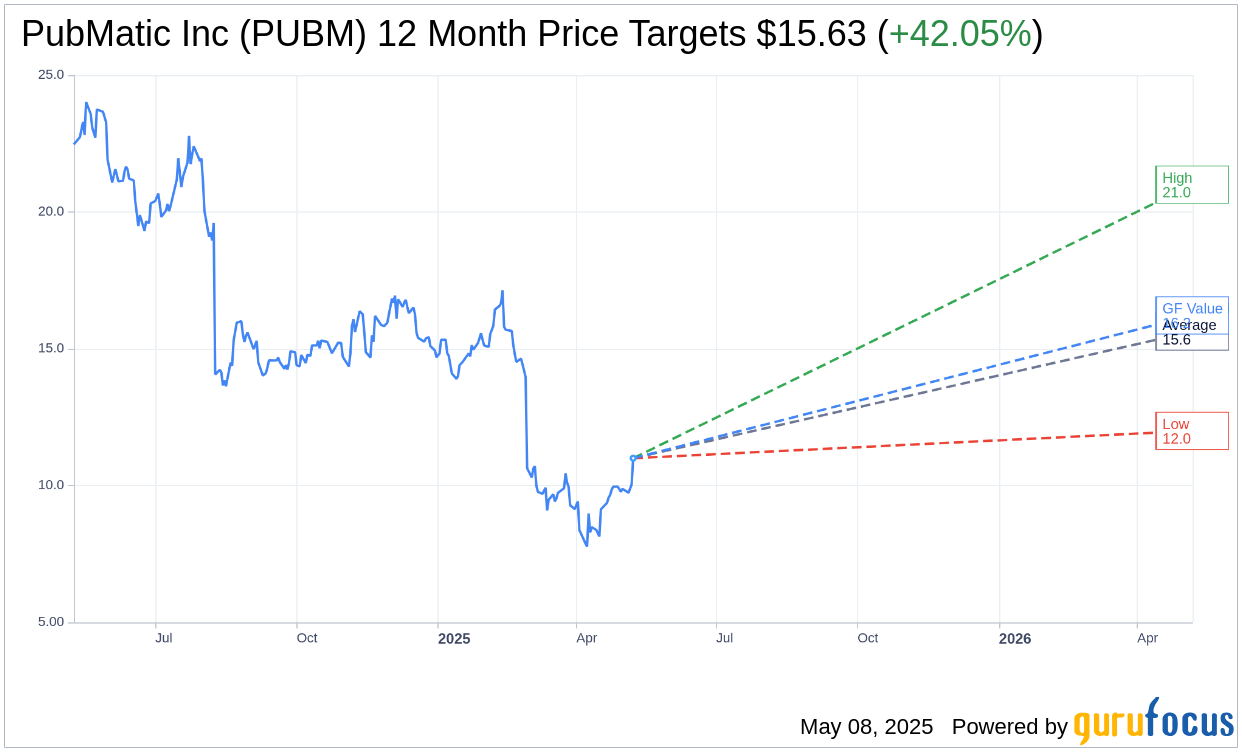

- Analysts project a significant upside potential for PUBM stock, with an average price target suggesting a 42.05% increase.

- The GF Value implies a 47.45% upside, underlining investor confidence in future growth.

PubMatic (PUBM) announced its Q1 results, reporting a non-GAAP EPS loss of $0.04 per share, outperforming analyst expectations by $0.03. The company generated $63.83 million in revenue, exceeding forecasted figures by $1.77 million. Looking ahead to Q2 2025, PubMatic anticipates revenue between $66 million and $70 million, alongside an adjusted EBITDA ranging from $9 million to $12 million.

Wall Street Analysts' Predictions

According to price targets from eight analysts, the average target price for PubMatic Inc (PUBM, Financial) is set at $15.63, with a high of $21.00 and a low of $12.00. This average target suggests a prospective 42.05% upside from the current trading price of $11.00. For more elaborate estimate data, visit the PubMatic Inc (PUBM) Forecast page.

Consensus amongst 11 brokerage firms places PubMatic Inc's (PUBM, Financial) average recommendation at 2.4, denoting an "Outperform" status. This rating scale ranges from 1, indicating a Strong Buy, to 5, indicating a Sell.

Assessing GF Value for PubMatic

GuruFocus estimates indicate that the projected GF Value for PubMatic Inc (PUBM, Financial) in one year stands at $16.22, translating to a 47.45% upside from the present price level of $11. This GF Value represents GuruFocus' fair value estimate, calculated using historical trading multiples, past business growth, and future performance forecasts. For further data and insights, please refer to the PubMatic Inc (PUBM) Summary page.