Key Highlights:

- XPLR Infrastructure reports a Q1 EPS loss, missing expectations, alongside a notable revenue increase.

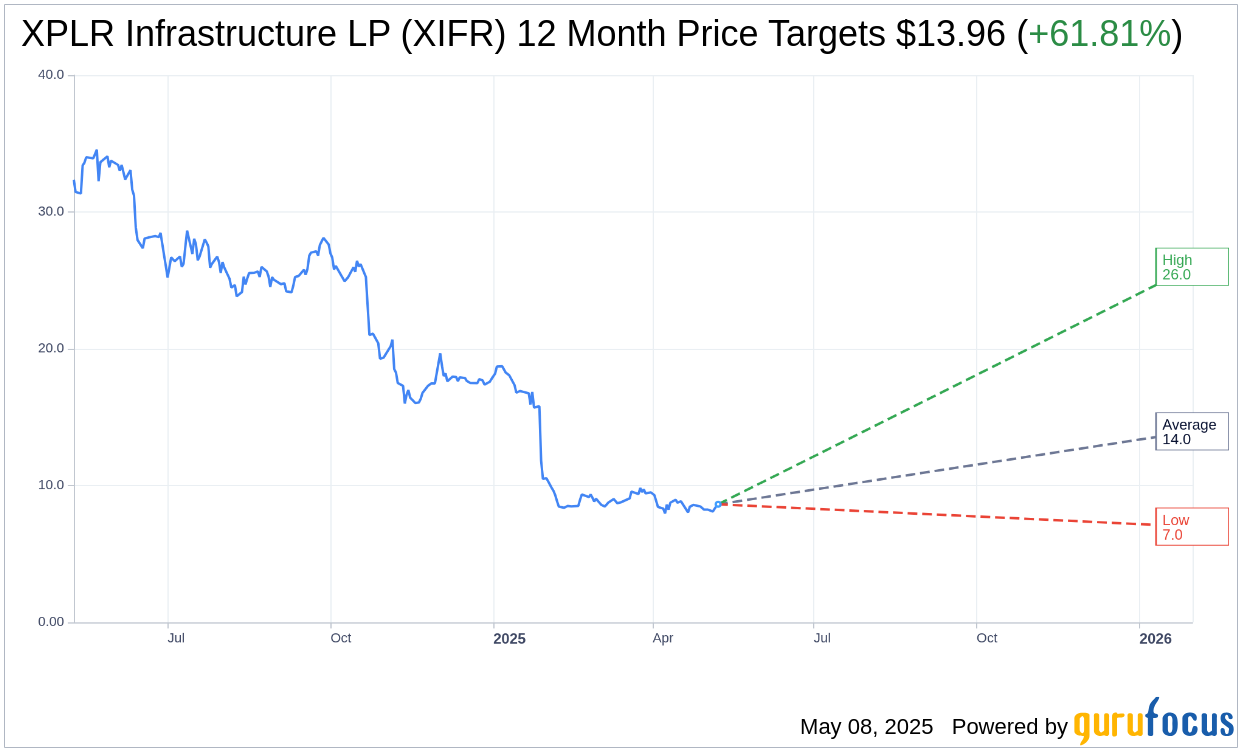

- Analysts project significant price targets, suggesting potential upside.

- Current ratings position the stock at a "Hold" status, with potential future gains based on GF Value estimates.

XPLR Infrastructure's Q1 Financial Performance

XPLR Infrastructure (XIFR, Financial) recently announced a first-quarter EPS loss of $1.05, falling short of the consensus estimate of $0.25. Despite this, the company's revenue climbed to $282 million, reflecting a year-over-year increase of 9.7%. However, this revenue still lagged behind expectations by $25.04 million. The company remains steadfast in its adjusted EBITDA forecast for 2025, maintaining a range between $1.85 billion and $2.05 billion.

Analyst Price Targets and Recommendations

Analyzing the insights from 14 analysts, XPLR Infrastructure LP (XIFR, Financial) holds an average price target of $13.96. The range varies with a high projection of $26.00 and a low of $7.00. This average target suggests a potential upside of 61.81% from its current trading price of $8.63. For more comprehensive data, readers can explore the XPLR Infrastructure LP (XIFR) Forecast page.

Analyst Ratings and GF Value Insights

Seventeen brokerage firms currently offer a consensus recommendation of "Hold" for XPLR Infrastructure LP (XIFR, Financial), translating to an average rating of 3.1 on a 1 to 5 scale. This scale ranges from 1 (Strong Buy) to 5 (Sell).

Moreover, GuruFocus estimates suggest that the GF Value for XPLR Infrastructure LP (XIFR, Financial) in the upcoming year is projected at $71.75. This projection indicates a remarkable upside of 731.4% from its current price of $8.63. The GF Value metric represents what GuruFocus considers to be the fair trading value of the stock, derived from historical trading multiples, past growth, and future performance forecasts. Additional insights are available on the XPLR Infrastructure LP (XIFR) Summary page.