Clean Energy Fuels Corp. (CLNE, Financial) anticipates a GAAP net loss for 2025, expected to range between $225 million and $220 million. This forecast accounts for specific elements such as $55 million in accelerated depreciation due to the removal of LNG station assets at 55 Pilot Flying J locations, a $64.3 million one-time non-cash charge to Goodwill, and an estimated $53 million related to Amazon warrant expenses.

Potential fluctuations in diesel and natural gas markets, particularly affecting the company’s truck financing program, as well as variations in the vesting of the Amazon warrant, could significantly influence the expected net loss. For 2025, Clean Energy Fuels estimates an Adjusted EBITDA between $50 million and $55 million. These figures do not consider potential impacts from acquisitions, divestitures, new partnerships, or other extraordinary events, nor do they account for ongoing macroeconomic conditions and global supply chain issues. The Adjusted EBITDA projections also assume consistent calculation methods, including the aforementioned Amazon warrant charges, without further adjustments for unforeseen circumstances in 2025.

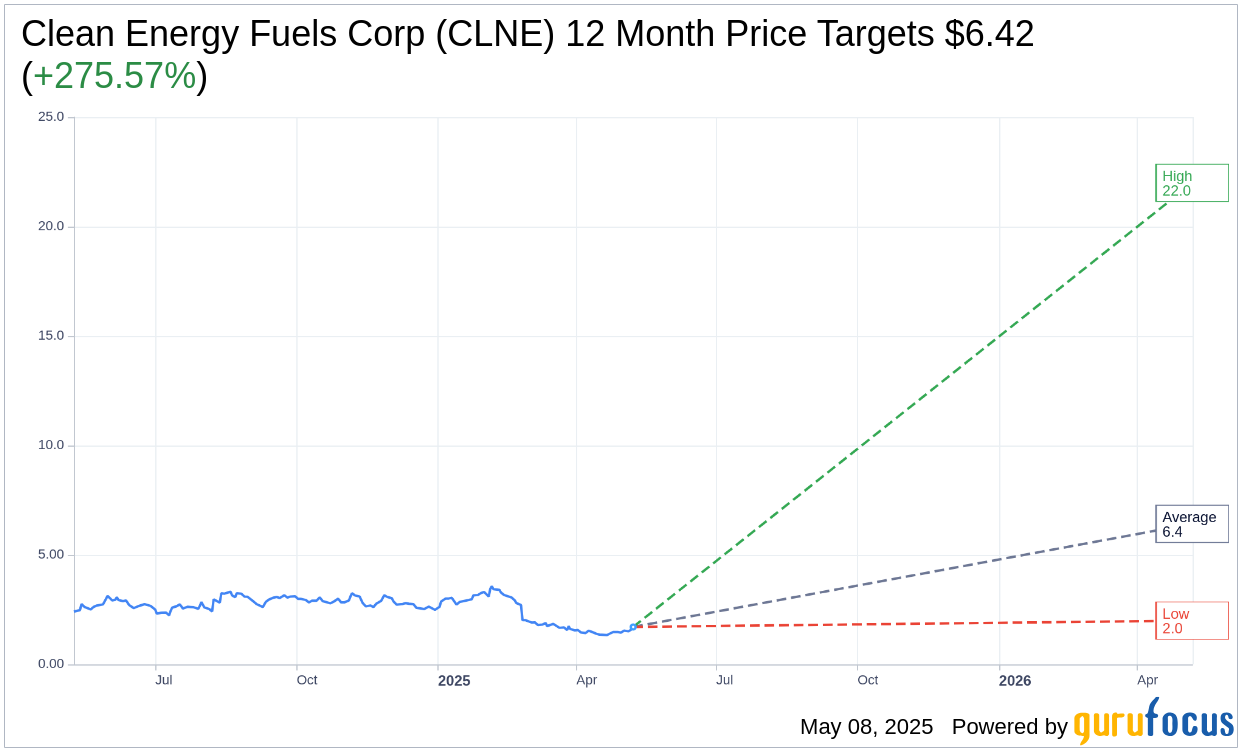

Wall Street Analysts Forecast

Based on the one-year price targets offered by 9 analysts, the average target price for Clean Energy Fuels Corp (CLNE, Financial) is $6.42 with a high estimate of $22.00 and a low estimate of $2.00. The average target implies an upside of 275.57% from the current price of $1.71. More detailed estimate data can be found on the Clean Energy Fuels Corp (CLNE) Forecast page.

Based on the consensus recommendation from 9 brokerage firms, Clean Energy Fuels Corp's (CLNE, Financial) average brokerage recommendation is currently 1.8, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Clean Energy Fuels Corp (CLNE, Financial) in one year is $3.82, suggesting a upside of 123.39% from the current price of $1.71. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Clean Energy Fuels Corp (CLNE) Summary page.

CLNE Key Business Developments

Release Date: February 24, 2025

- Revenue: $109.3 million for Q4 2024; $400 million projected for 2025.

- Net Loss: $29.8 million GAAP net loss for Q4 2024; $83.1 million GAAP net loss for full year 2024.

- Adjusted Net Income: $3.6 million for Q4 2024.

- Adjusted EBITDA: $24 million for Q4 2024; $77 million for full year 2024; $50 to $55 million projected for 2025.

- RNG Sales Volume: 62 million gallons in Q4 2024; 237 million gallons for full year 2024; 246 million gallons projected for 2025.

- Cash and Investments: $217 million in unrestricted cash and investments at end of 2024.

- Capital Expenditures: $57 million for 2024; $30 million projected for 2025.

- Long-term Debt: $303 million at end of 2024.

- RIN Prices: Estimated $2.40 for 2025, down from $3.10 in 2024.

- LCFS Prices: Estimated in the low $70s for 2025, up from $61 in 2024.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Clean Energy Fuels Corp (CLNE, Financial) reported a 9% increase in renewable natural gas (RNG) sales for the fourth quarter of 2024, reaching 62 million gallons.

- The company generated $109 million in revenue for the fourth quarter and $77 million in adjusted EBITDA for the full year 2024.

- CLNE's downstream RNG fueling business performed well, bringing in almost $89 million of EBITDA in 2024.

- The company has a strong balance sheet with $217 million in unrestricted cash and investments, plus $100 million available to draw on its debt facility.

- CLNE is optimistic about the adoption of the Cummins X15 engine, which is expected to drive significant growth in the heavy-duty trucking sector.

Negative Points

- Clean Energy Fuels Corp (CLNE) reported a GAAP net loss of $29.8 million for the fourth quarter of 2024.

- The company's 2025 outlook does not include the alternative fuel tax credit (AFTC), which contributed nearly $24 million to 2024 results.

- RIN prices are projected to be 30% lower in 2025 compared to 2024, impacting revenue.

- The company anticipates a decrease in adjusted EBITDA for 2025, with a guidance range of $50 to $55 million, down from $77 million in 2024.

- CLNE faces uncertainty regarding the finalization of the Section 45 clean fuel production credit, which could impact future revenue.