In its first quarter, Cytek Biosciences (CTKB, Financial) reported revenue of $41.46 million, falling short of the anticipated $42.66 million. Despite the challenging economic conditions, the company's portfolio showed resilience, with significant revenue growth observed in its cell sorters and service segments. The Asia-Pacific region was highlighted as a strong performer.

CEO Wenbin Jiang emphasized the company's robust foundation, characterized by an expanding installed base that supports steady revenue growth in both service and reagent operations. Cytek's strategy includes diversifying sales, service, and manufacturing on a worldwide scale, coupled with a focus on new and fast-growing products. Jiang believes that these efforts will strengthen their position, enabling the company to emerge more robustly from current uncertainties. With a leading cell analysis portfolio and a solid financial position, Cytek is investing in enhancing its competitiveness as a market leader.

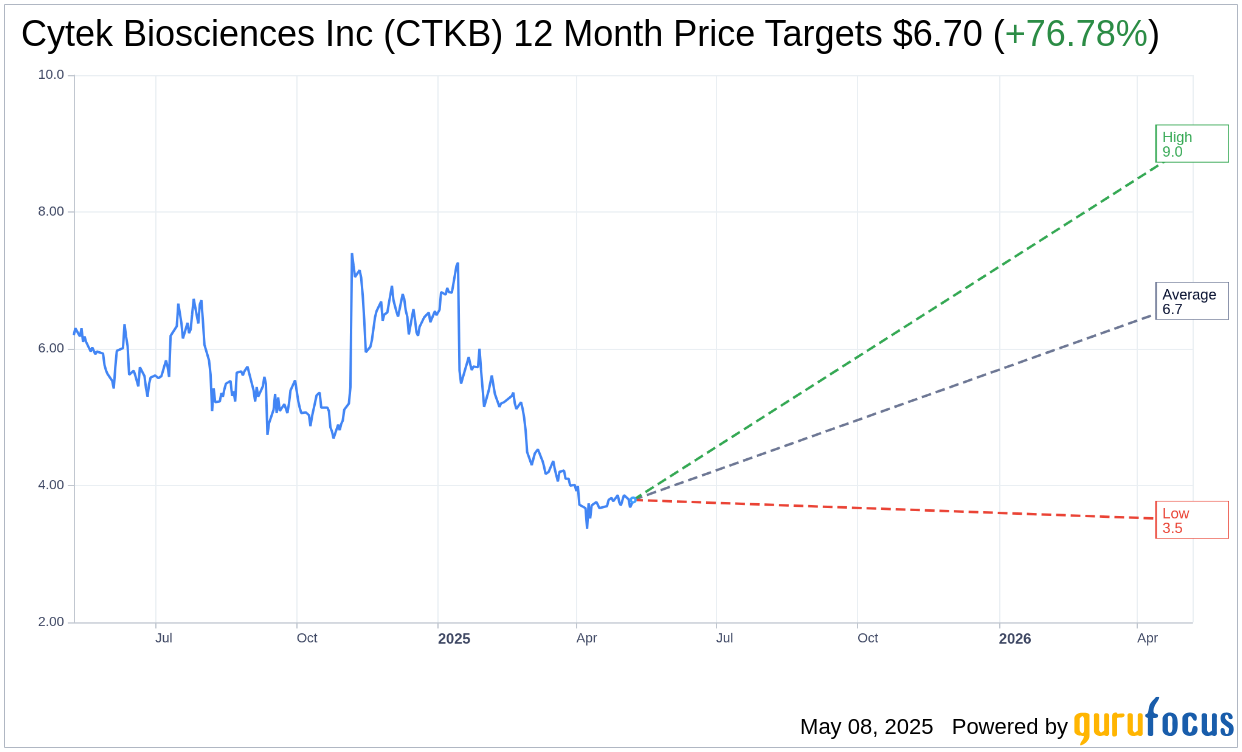

Wall Street Analysts Forecast

Based on the one-year price targets offered by 5 analysts, the average target price for Cytek Biosciences Inc (CTKB, Financial) is $6.70 with a high estimate of $9.00 and a low estimate of $3.50. The average target implies an upside of 76.78% from the current price of $3.79. More detailed estimate data can be found on the Cytek Biosciences Inc (CTKB) Forecast page.

Based on the consensus recommendation from 6 brokerage firms, Cytek Biosciences Inc's (CTKB, Financial) average brokerage recommendation is currently 2.5, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Cytek Biosciences Inc (CTKB, Financial) in one year is $10.47, suggesting a upside of 176.25% from the current price of $3.79. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Cytek Biosciences Inc (CTKB) Summary page.

CTKB Key Business Developments

Release Date: February 27, 2025

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Cytek Biosciences Inc (CTKB, Financial) achieved a 4% revenue growth in 2024, reaching $200.5 million, driven by strong service revenue and double-digit growth in international markets.

- The company reported an 8.5% increase in unit volume growth for its full special profiling and imaging instruments, outperforming the broader flow cytometry market.

- Cytek Biosciences Inc (CTKB) demonstrated a significant improvement in adjusted EBITDA, which increased by more than 77% from the previous year.

- The company successfully repurchased 4 million shares in 2024 and announced a new $50 million repurchase program for 2025, reflecting strong cash flow and shareholder returns.

- Cytek Biosciences Inc (CTKB) expanded its global footprint with a new manufacturing facility in Singapore, enhancing capacity and supply chain flexibility.

Negative Points

- Total revenue for the fourth quarter of 2024 was flat compared to the previous year, with a 1% decrease due to a decline in product revenue and a strong US dollar.

- US and EEA revenues declined by 10% and 18% respectively, driven by lower instrument sales and foreign exchange effects.

- The company faces potential headwinds from new export controls, tariffs, and NIH funding reductions, which could impact future revenues.

- Research and development expenses decreased by 11% in the fourth quarter, reflecting reduced compensation and engineering expenses, which may impact future innovation.

- The company reported a GAAP net loss of $6 million for the year, primarily due to foreign exchange losses and lower tax benefits.