Astrana Health (ASTH, Financial) announced its first-quarter earnings with revenue falling slightly short of projections. The company reported $620.4 million in revenue, compared to the anticipated $630.68 million. Despite this, Astrana maintains a strong position, showcasing momentum in its mission to establish a prominent patient-focused healthcare platform.

Under the leadership of CEO Brandon Sim, Astrana continues to leverage its unique clinical abilities and technology-driven delegated model, promoting profitable growth while enhancing outcomes for patients and providers. Even amidst regulatory and economic challenges, the company remains committed to proving the effectiveness and sustainability of value-based care on a large scale.

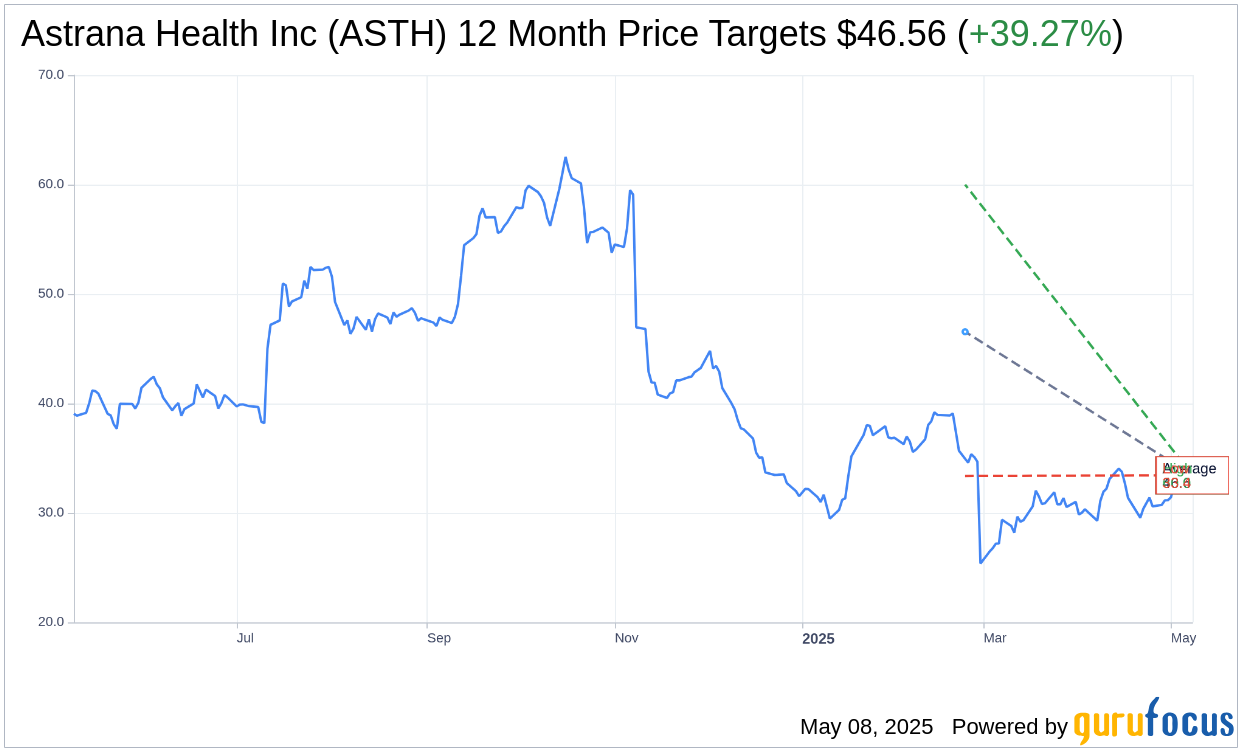

Wall Street Analysts Forecast

Based on the one-year price targets offered by 6 analysts, the average target price for Astrana Health Inc (ASTH, Financial) is $46.56 with a high estimate of $60.00 and a low estimate of $33.38. The average target implies an upside of 39.27% from the current price of $33.44. More detailed estimate data can be found on the Astrana Health Inc (ASTH) Forecast page.

Based on the consensus recommendation from 6 brokerage firms, Astrana Health Inc's (ASTH, Financial) average brokerage recommendation is currently 1.5, indicating "Buy" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Astrana Health Inc (ASTH, Financial) in one year is $77.40, suggesting a upside of 131.49% from the current price of $33.435. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Astrana Health Inc (ASTH) Summary page.

ASTH Key Business Developments

Release Date: February 27, 2025

- Q4 Revenue: $665.2 million, an 88.4% increase year-over-year.

- Full Year 2024 Revenue: $2.03 billion, a 47% increase from the prior year.

- Q4 Adjusted EBITDA: $35 million, reflecting 20.8% growth year-over-year.

- Full Year 2024 Adjusted EBITDA: $170.4 million, up 16.2% year-over-year.

- Care Partners Segment Growth: 52% year-over-year to $1.95 billion.

- Membership Growth in Care Partner Segment: 55% in 2024.

- Full Risk Arrangements Revenue: 73% of total capitation revenue by end of 2024.

- Cash and Cash Equivalents: $288.5 million at year-end 2024.

- Total Debt: $471.8 million, including lease liabilities.

- Prospect Health Systems Revenue: $1.2 billion in 2024.

- 2025 Revenue Guidance: $2.5 billion to $2.7 billion.

- 2025 Adjusted EBITDA Guidance: $170 million to $190 million.

- Q1 2025 Revenue Guidance: $600 million to $650 million.

- Q1 2025 Adjusted EBITDA Guidance: $32 million to $37 million.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Astrana Health Inc (ASTH, Financial) reported a significant revenue increase of 88.4% year-over-year in Q4 2024, reaching $665.2 million.

- The company achieved a 47% increase in total revenue for the full year 2024, amounting to $2.03 billion.

- Astrana Health Inc (ASTH) experienced a 55% membership growth in its care partner segment, driven by acquisitions and organic growth.

- The company is making strategic investments in automation and AI-driven enhancements, expected to yield $10 million in operational efficiencies by early 2026.

- Astrana Health Inc (ASTH) successfully expanded its proprietary care enablement platform, enhancing operational excellence and supporting new partnerships.

Negative Points

- Astrana Health Inc (ASTH) faced a $13 million drag on earnings due to strategic investments in growth initiatives and integration capabilities.

- The company experienced utilization headwinds in 2024, with a 5.3% realization trend, which is approximately half the national blended average.

- Medicaid trends were higher than expected, impacting earnings from the Medicaid segment due to a mismatch between reimbursement rates and cost trends.

- The acquisition of CHS is expected to approach break-even late in 2025, indicating a potential short-term financial burden.

- Astrana Health Inc (ASTH) anticipates $15 million in costs associated with strategic investments in integration, automation, and AI in 2025, impacting short-term profitability.