ZIMV announced its first-quarter revenue, reaching $112 million, slightly missing the consensus estimate of $113.41 million. The company is emphasizing execution and operational diligence as it continues to hold a strong position among dental clients through its focus on innovation and education. Chief Executive Officer Vafa Jamali expressed a commitment to enhancing operational efficiency and profitability, with an aim to achieve top-line growth in the future.

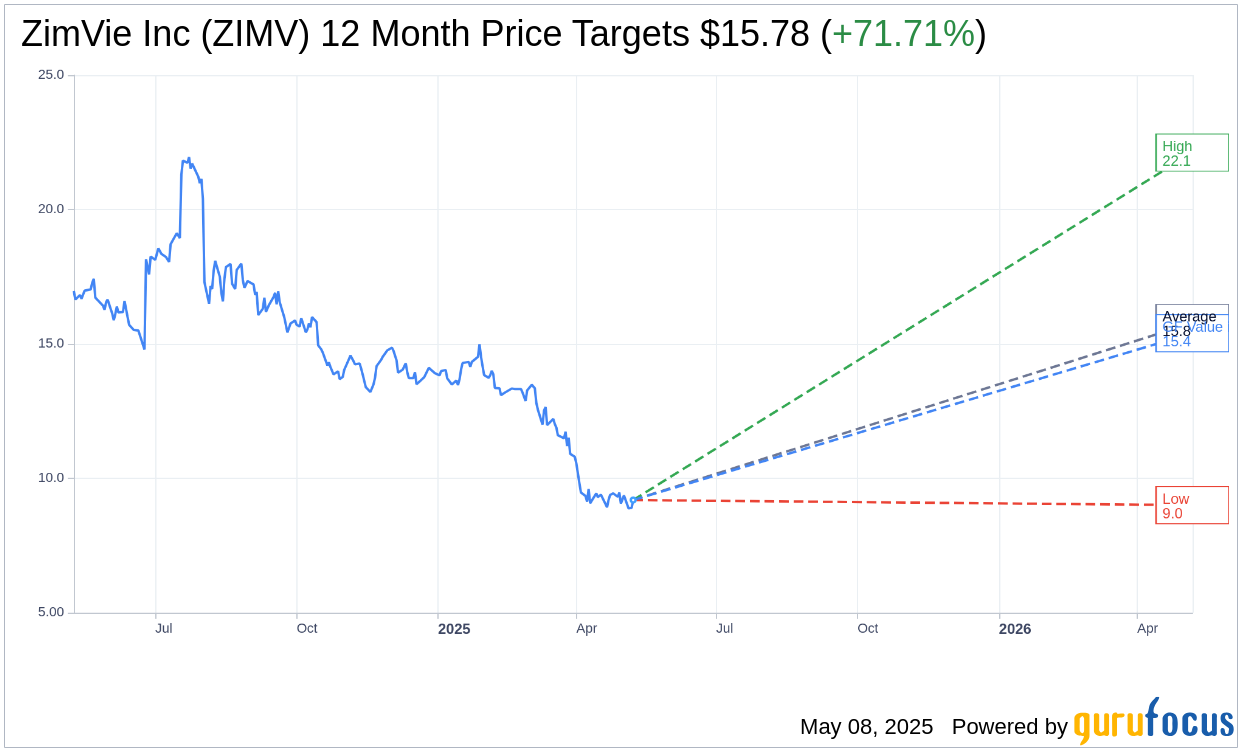

Wall Street Analysts Forecast

Based on the one-year price targets offered by 4 analysts, the average target price for ZimVie Inc (ZIMV, Financial) is $15.78 with a high estimate of $22.12 and a low estimate of $9.00. The average target implies an upside of 71.71% from the current price of $9.19. More detailed estimate data can be found on the ZimVie Inc (ZIMV) Forecast page.

Based on the consensus recommendation from 4 brokerage firms, ZimVie Inc's (ZIMV, Financial) average brokerage recommendation is currently 3.0, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for ZimVie Inc (ZIMV, Financial) in one year is $15.40, suggesting a upside of 67.57% from the current price of $9.19. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the ZimVie Inc (ZIMV) Summary page.

ZIMV Key Business Developments

Release Date: February 26, 2025

- Full Year Revenue: $450 million.

- Fourth Quarter Revenue: $111.5 million, a decrease of 1.4% reported and 0.9% in constant currency.

- Fourth Quarter Operating Cash Flow: Over $21 million.

- Fourth Quarter Adjusted EBITDA: $18.4 million, 16.5% margin, 420 basis points improvement.

- Full Year Adjusted EBITDA: $60.0 million, 13.3% margin, 220 basis points improvement.

- Fourth Quarter Adjusted Earnings Per Share: $0.27, 170% increase from prior year.

- Full Year Adjusted Earnings Per Share: $0.62, 182% increase from prior year.

- Fourth Quarter Adjusted Cost of Products Sold: 35.0% of sales, 240 basis points decrease.

- Full Year Adjusted Cost of Products Sold: 35.8%, 40 basis points decrease.

- Full Year R&D Expense: $25.0 million, 5.6% of sales.

- Full Year SG&A Expense: $237.7 million.

- Cash Balance: $75 million at end of fourth quarter.

- Gross Debt: Approximately $220 million.

- Net Debt: Approximately $145 million.

- 2025 Revenue Guidance: $445 million to $460 million.

- 2025 Adjusted EBITDA Guidance: $65 million to $70 million.

- 2025 Adjusted Earnings Per Share Guidance: $0.80 to $0.95.

- 2025 Operating Cash Flow Guidance: $30 million to $40 million.

- First Quarter 2025 Revenue Guidance: $112 million to $114 million.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- ZimVie Inc (ZIMV, Financial) successfully transitioned to a pure-play dental company by selling its Spine business, focusing on dental implants, biomaterials, and digital dentistry solutions.

- The company reported $450 million in full-year revenue for 2024, demonstrating strong financial performance.

- ZimVie Inc (ZIMV) improved adjusted EBITDA margins by over 2 percentage points for the year, showcasing operational efficiency.

- The company generated over $21 million in operating cash flow in the fourth quarter, indicating strong cash management.

- ZimVie Inc (ZIMV) significantly reduced its debt using proceeds from the sale of its Spine business, enhancing financial stability.

Negative Points

- Total third-party net sales for the fourth quarter decreased by 1.4% in reported rates, indicating a decline in sales performance.

- US third-party net sales for the fourth quarter declined by 1.5%, driven by weakness in implant sales and lower oral scanner sales.

- The company experienced softness in its end markets, impacting overall financial performance.

- ZimVie Inc (ZIMV) faced challenges in the implant market, with pressure on more expensive cases and specialist-level procedures.

- The company's guidance for 2025 reflects a potential 1% decline to 2% reported growth, indicating cautious market expectations.