Crinetics Pharmaceuticals, under the ticker CRNX, significantly surpassed first-quarter revenue expectations by reporting $361,000 compared to the anticipated $100,000. The company's CEO, Scott Struthers, emphasized the firm's unprecedented strength as they prepare for crucial developments. A significant milestone is the progress in FDA evaluation and readiness for the anticipated launch of their acromegaly treatment, paltusotine. Moreover, Crinetics is advancing several late-stage studies.

The company is set to reveal a Phase 3 study targeting adult patients with congenital adrenal hyperplasia (CAH), focusing on the normalization of androstenedione levels. This study aims to set a new standard of care through physiological glucocorticoid replacement. Additionally, the clinical development for CRN09682, derived from their innovative nonpeptide drug conjugate platform, is underway. These developments, along with other promising programs, will be highlighted at their forthcoming R&D Day.

Crinetics maintains a solid financial position and continues to gain momentum across clinical, regulatory, and commercial areas. This positions the company well to advance their mission of delivering cutting-edge treatments for endocrine disorders globally.

Wall Street Analysts Forecast

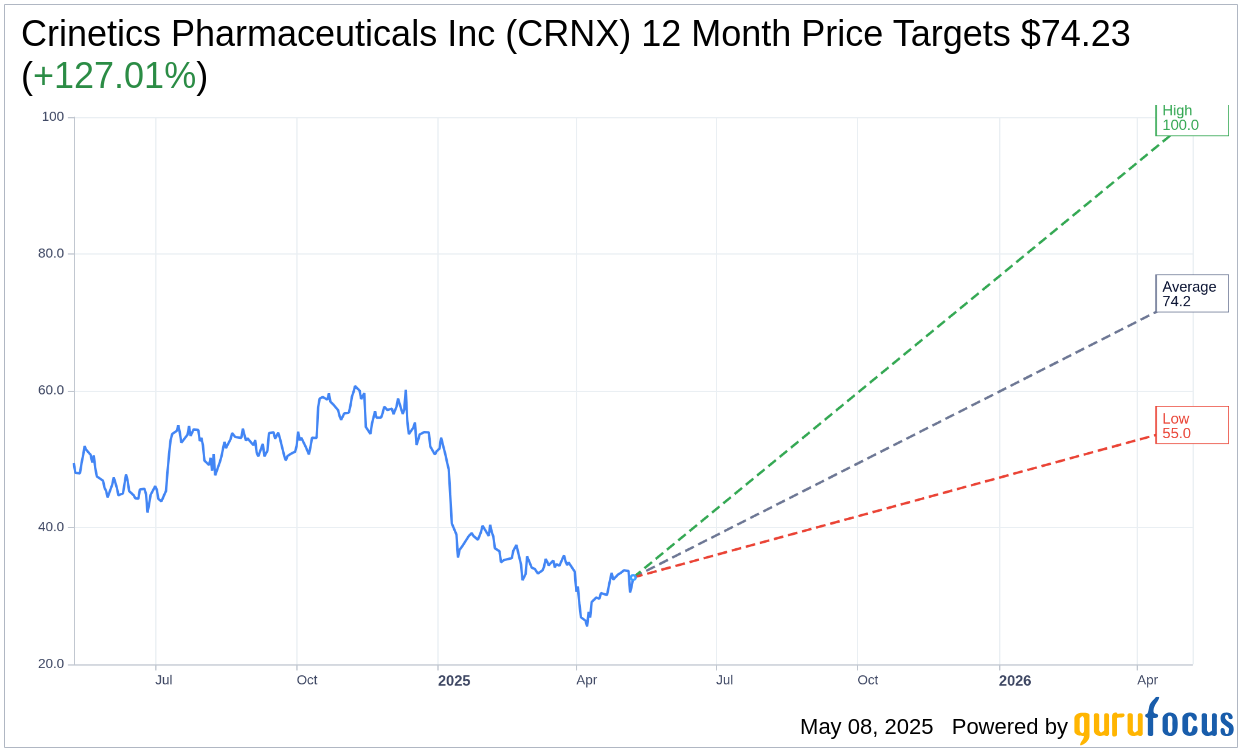

Based on the one-year price targets offered by 13 analysts, the average target price for Crinetics Pharmaceuticals Inc (CRNX, Financial) is $74.23 with a high estimate of $100.00 and a low estimate of $55.00. The average target implies an upside of 127.01% from the current price of $32.70. More detailed estimate data can be found on the Crinetics Pharmaceuticals Inc (CRNX) Forecast page.

Based on the consensus recommendation from 17 brokerage firms, Crinetics Pharmaceuticals Inc's (CRNX, Financial) average brokerage recommendation is currently 1.7, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Crinetics Pharmaceuticals Inc (CRNX, Financial) in one year is $3.71, suggesting a downside of 88.65% from the current price of $32.7. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Crinetics Pharmaceuticals Inc (CRNX) Summary page.