EverCommerce (EVCM, Financial) announced its first-quarter revenue of $142.27 million, falling short of the anticipated $146.28 million. Despite this, the company surpassed the upper limit of its projected range for both revenue and Adjusted EBITDA, attributed to effective execution and proactive cost management strategies.

The CEO, Eric Remer, highlighted the company's ongoing success in implementing transformation and optimization initiatives. These include targeted investments in sectors with higher margins, such as payments monetization and artificial intelligence, which are contributing to the company’s growth momentum.

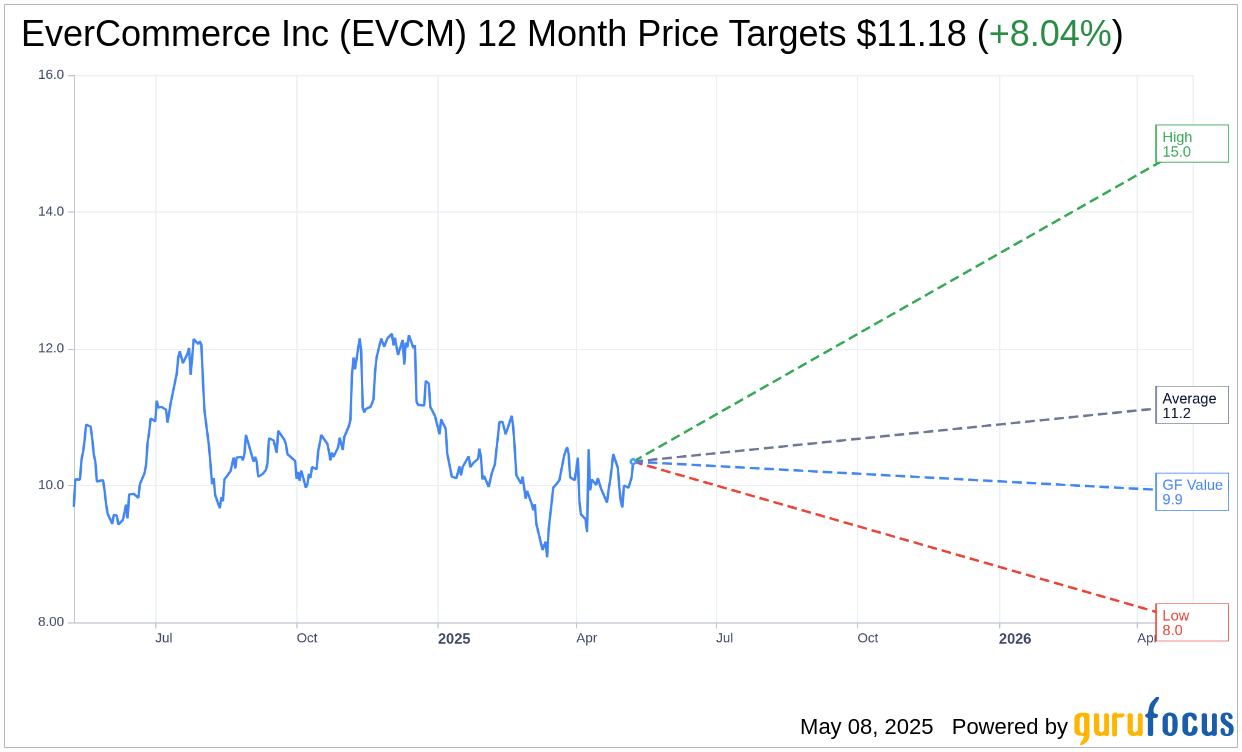

Wall Street Analysts Forecast

Based on the one-year price targets offered by 11 analysts, the average target price for EverCommerce Inc (EVCM, Financial) is $11.18 with a high estimate of $15.00 and a low estimate of $8.00. The average target implies an upside of 8.04% from the current price of $10.35. More detailed estimate data can be found on the EverCommerce Inc (EVCM) Forecast page.

Based on the consensus recommendation from 11 brokerage firms, EverCommerce Inc's (EVCM, Financial) average brokerage recommendation is currently 2.4, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for EverCommerce Inc (EVCM, Financial) in one year is $9.91, suggesting a downside of 4.25% from the current price of $10.35. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the EverCommerce Inc (EVCM) Summary page.

EVCM Key Business Developments

Release Date: March 13, 2025

- Fourth Quarter Revenue: $175 million, up 3.3% year over year.

- Pro Forma Revenue Growth: 7% year over year.

- Adjusted EBITDA: $50.4 million, representing a 28.8% margin.

- Adjusted EBITDA Margin Expansion: 340 basis points year over year.

- Payments Revenue Growth: 8.9% year over year.

- Annual Total Payment Volume (TPV): $12.6 billion, 9% year-over-year growth.

- Subscription and Transaction Revenue: $139 million, up 4.2% year over year.

- Marketing Technology Solutions Revenue: $29.6 million, down 1.6% year over year.

- Adjusted Gross Margin: 70.9%, up from 67.3% in Q4 2023.

- Cash Flow from Operations: $48.4 million, compared to $36 million in Q4 2023.

- Levered Free Cash Flow: $43.8 million for the quarter.

- Cash and Cash Equivalents: $136 million at the end of the quarter.

- Total Debt: $532 million, maturing in July 2028.

- Net Leverage Ratio: Approximately 2.2 times.

- Share Repurchase: 623,000 shares for $7 million at an average price of $10.88 per share.

- First Quarter 2025 Revenue Guidance: $138 million to $141 million.

- First Quarter 2025 Adjusted EBITDA Guidance: $39 million to $41 million.

- Full Year 2025 Revenue Guidance: $581 million to $601 million.

- Full Year 2025 Adjusted EBITDA Guidance: $167.5 million to $175.5 million.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- EverCommerce Inc (EVCM, Financial) ended 2024 on a strong note, with fourth-quarter reported revenue exceeding the top end of their guidance range.

- GAAP revenue increased by 3.3% year over year, and on a pro forma basis, revenue increased by 7% year over year.

- Adjusted EBITDA of $50.4 million beat the top end of guidance, representing a 28.8% margin, with a margin expansion of nearly 340 basis points year over year.

- The company grew its customer count by more than 7% over the past year, serving over 740,000 customers across its major verticals.

- Payments revenue, excluding fitness solutions, grew 8.9% year over year, driven by 9% growth in total payment volume (TPV).

Negative Points

- Marketing Technology Solutions revenue decreased by 1.6% from the prior year period.

- The company is actively seeking strategic alternatives for its marketing technology solutions, indicating potential instability or lack of focus in this area.

- Despite the growth in customer count, the annualized net revenue retention (NRR) for core software and payment solutions remained at 96%, consistent with the prior quarter, suggesting limited improvement in customer retention.

- The company faces challenges in increasing payments adoption due to inertia of change among SMBs.

- Adjusted operating expenses modestly increased as a percentage of revenue, indicating potential cost management issues.