- Occidental Petroleum delivers robust Q1 2025 performance with enhanced cash flow and reduced capital expenditure.

- Wall Street analysts project a potential upside of over 16% for OXY shares with a consensus "Hold" rating.

- GuruFocus estimates a significant potential upside, suggesting OXY is currently undervalued.

Occidental Petroleum (OXY, Financial) has reported commendable financial results for the first quarter of 2025, showcasing strong operational and fiscal health. The company generated an impressive $3 billion in operating cash flow while maintaining an average daily production of 1.39 million barrels of oil equivalent (BOE). Strategic cost-efficiency measures have successfully reduced operating costs to $9.05 per BOE. Additionally, Occidental revised its capital expenditure guidance, decreasing it by $200 million for the year 2025.

Wall Street Analysts Forecast

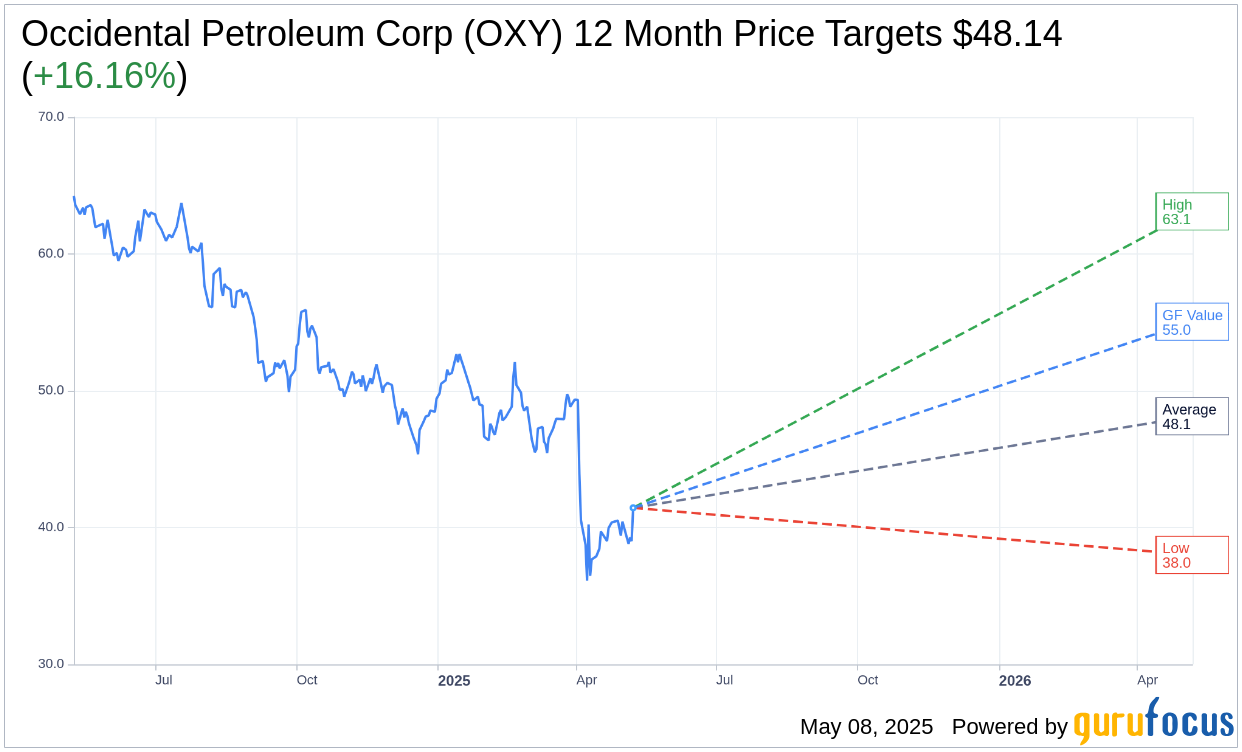

According to projections by 23 analysts, Occidental Petroleum Corp (OXY, Financial) is expected to reach an average price target of $48.14 over the next year, with price estimates ranging from a high of $63.11 to a low of $38.00. If these predictions hold true, the stock could experience an upside of 16.16% from its current trading price of $41.44. For more detailed information, visit the Occidental Petroleum Corp (OXY) Forecast page.

The consensus among 26 brokerage firms currently offers Occidental Petroleum Corp (OXY, Financial) an average recommendation rating of 2.8, indicating a "Hold" status. This rating falls on a scale where 1 represents a "Strong Buy" and 5 signifies "Sell."

According to GuruFocus estimates, the GF Value for Occidental Petroleum Corp (OXY, Financial) is projected to be $55.05 one year from now. This estimate suggests a notable potential upside of 32.84% from the present price of $41.44. The GF Value is a proprietary metric from GuruFocus, reflecting the stock's fair value, historically based multiples, and projected business performance. Dive deeper into the details by visiting the Occidental Petroleum Corp (OXY) Summary page.