Summary:

- Morgan Stanley Direct Lending Fund (MSDL, Financial) reports Q2 earnings per share of $0.34.

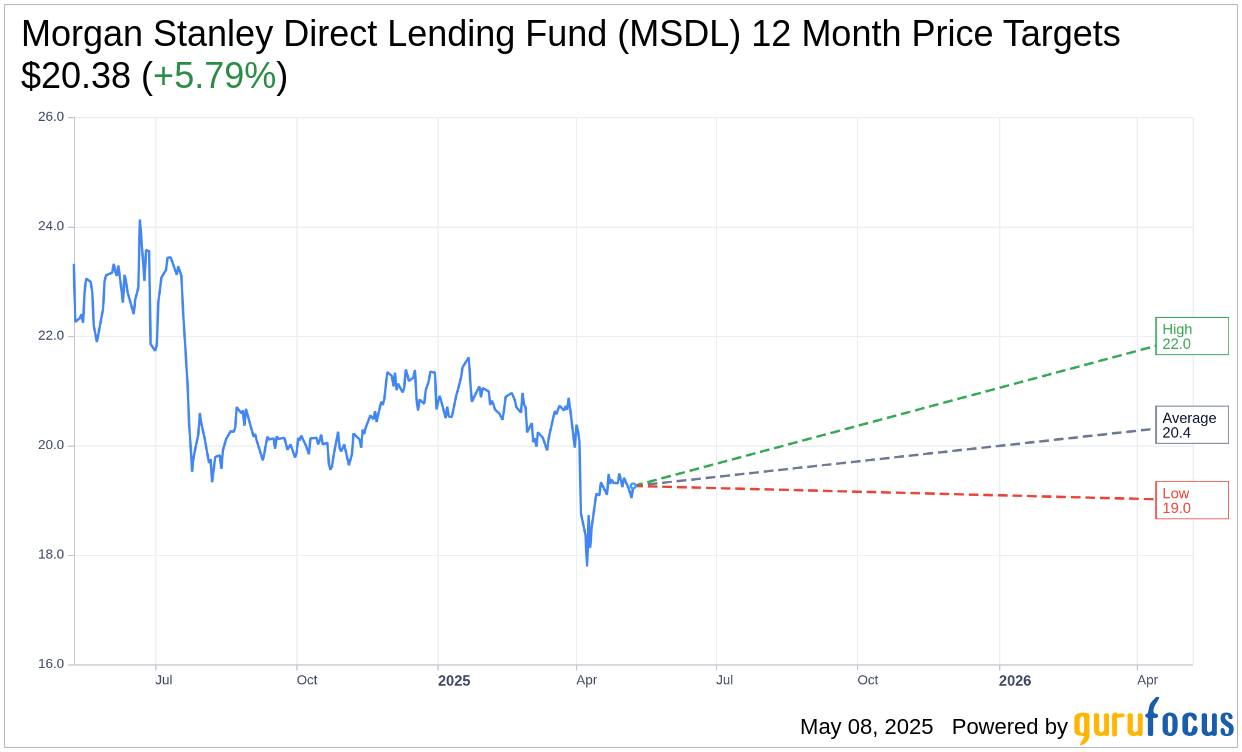

- Analysts provide an average price target of $20.38, suggesting a potential upside of 5.79%.

- The fund's current consensus rating is a "Hold" with a score of 2.8.

Q2 Financial Highlights for Morgan Stanley Direct Lending Fund (MSDL)

In its latest financial release, Morgan Stanley Direct Lending Fund (MSDL) reported a Q2 GAAP earnings per share of $0.34. This performance coincides with a slight decline in the net asset value, which has dipped to $20.65 from the previous $20.81. Meanwhile, the fund's debt-to-equity ratio has risen to 1.11x, reflecting increased leverage. Notably, the fund secured new investment commitments amounting to $233.4 million and declared a dividend of $0.50.

Analysts Offer Optimistic Price Targets

Looking ahead, Wall Street analysts have shared their insights, assigning an average one-year price target of $20.38 for Morgan Stanley Direct Lending Fund (MSDL, Financial). This estimate includes a high target of $22.00 and a low of $19.00. At its current trading price of $19.26, the average target suggests a potential upside of 5.79%. Investors can explore additional detailed estimate data on the Morgan Stanley Direct Lending Fund (MSDL) Forecast page.

Investment Recommendation: Hold

The consensus from six brokerage firms places Morgan Stanley Direct Lending Fund's (MSDL, Financial) average brokerage recommendation at 2.8, categorizing it under the "Hold" status. This rating scale ranges from 1, indicating a Strong Buy, to 5, which denotes a Sell. This suggests a moderate outlook from analysts, advising investors to maintain their current holdings while keeping an eye on potential market shifts.