Rackspace Technology (RXT, Financial) announced its financial results for the first quarter of 2025, reporting revenue of $690.8 million, surpassing market estimates of $657.98 million. The company's performance exceeded expectations in all major areas, with revenue reaching the higher end of their forecast. Additionally, both profit and earnings per share were above the projected range. This quarter marks the eleventh consecutive period in which RXT has achieved or surpassed its financial targets.

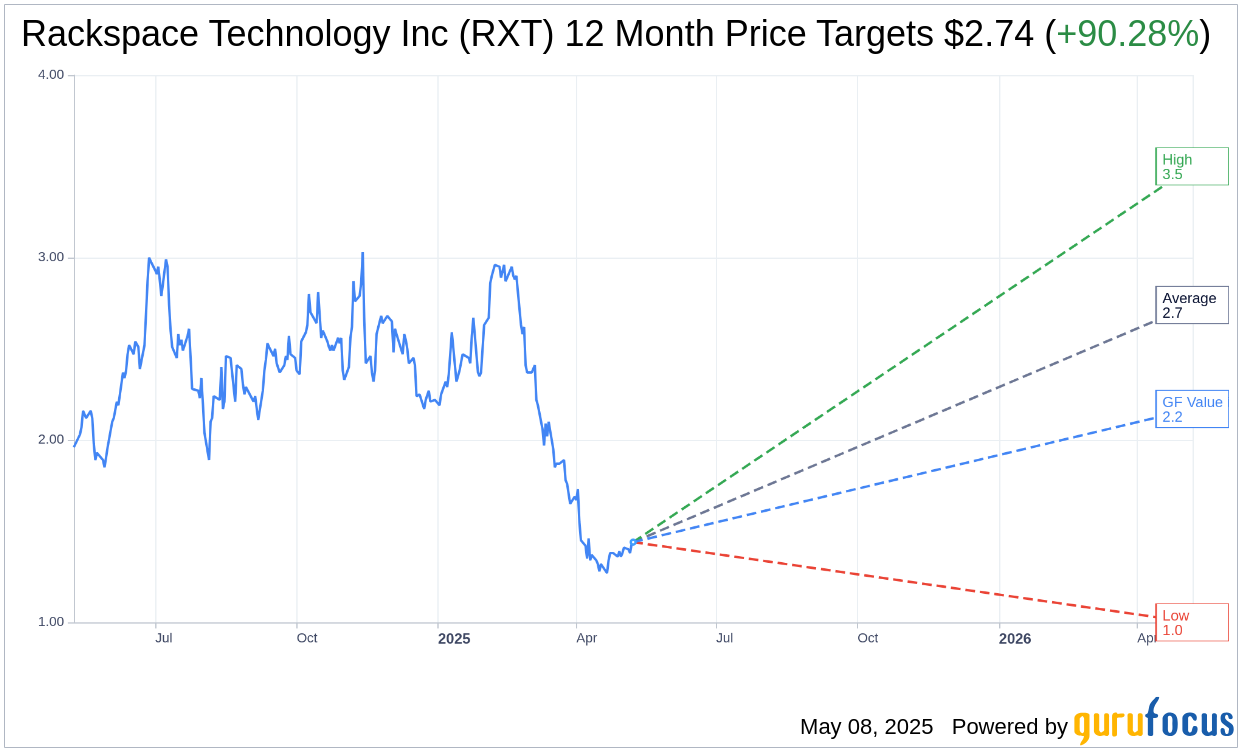

Wall Street Analysts Forecast

Based on the one-year price targets offered by 5 analysts, the average target price for Rackspace Technology Inc (RXT, Financial) is $2.74 with a high estimate of $3.50 and a low estimate of $1.00. The average target implies an upside of 90.28% from the current price of $1.44. More detailed estimate data can be found on the Rackspace Technology Inc (RXT) Forecast page.

Based on the consensus recommendation from 6 brokerage firms, Rackspace Technology Inc's (RXT, Financial) average brokerage recommendation is currently 3.0, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Rackspace Technology Inc (RXT, Financial) in one year is $2.17, suggesting a upside of 50.69% from the current price of $1.44. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Rackspace Technology Inc (RXT) Summary page.

RXT Key Business Developments

Release Date: February 20, 2025

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Rackspace Technology Inc (RXT, Financial) exceeded guidance for revenue, profit, and EPS for the 10th consecutive quarter.

- Record-breaking quarterly sales bookings, with high double-digit growth in annual contract value both sequentially and year over year.

- Strong performance in the Americas and increasing adoption of hybrid cloud solutions contributed to a 14% growth in sales bookings for fiscal 2024.

- Significant acceleration in private cloud bookings, with a 42% growth in the second half of 2024 compared to the first half.

- Public cloud bookings grew 22% year over year, driven by robust performance in services and infrastructure resale, with data services bookings more than doubling.

Negative Points

- Non-GAAP gross profit margin for the full year 2024 was down 172 basis points year over year.

- Non-GAAP operating margin for the full year 2024 was down 146 basis points versus the prior year.

- Free cash flow usage was $71 million for the full year, indicating cash flow challenges.

- Private cloud revenues are expected to show modest declines in fiscal 2025, despite recent momentum.

- Infrastructure resale volumes are difficult to predict and may face declines depending on contract renewals.