Quick Summary:

- Pembina Pipeline (PBA, Financial) reported strong Q1 results, significantly outperforming earnings expectations.

- Wall Street analysts foresee an average price target suggesting a potential upside for investors.

- GuruFocus estimates indicate a potential valuation downside, presenting a mixed outlook for Pembina.

Pembina Pipeline (PBA) achieved remarkable financial performance in the first quarter. The company reported a Non-GAAP earnings per share of $0.80, which exceeded expectations by $0.24. Additionally, Pembina's revenue experienced a substantial increase of 48.1% year over year, reaching $2.28 billion, surpassing projections by $770 million.

Wall Street Analysts Forecast

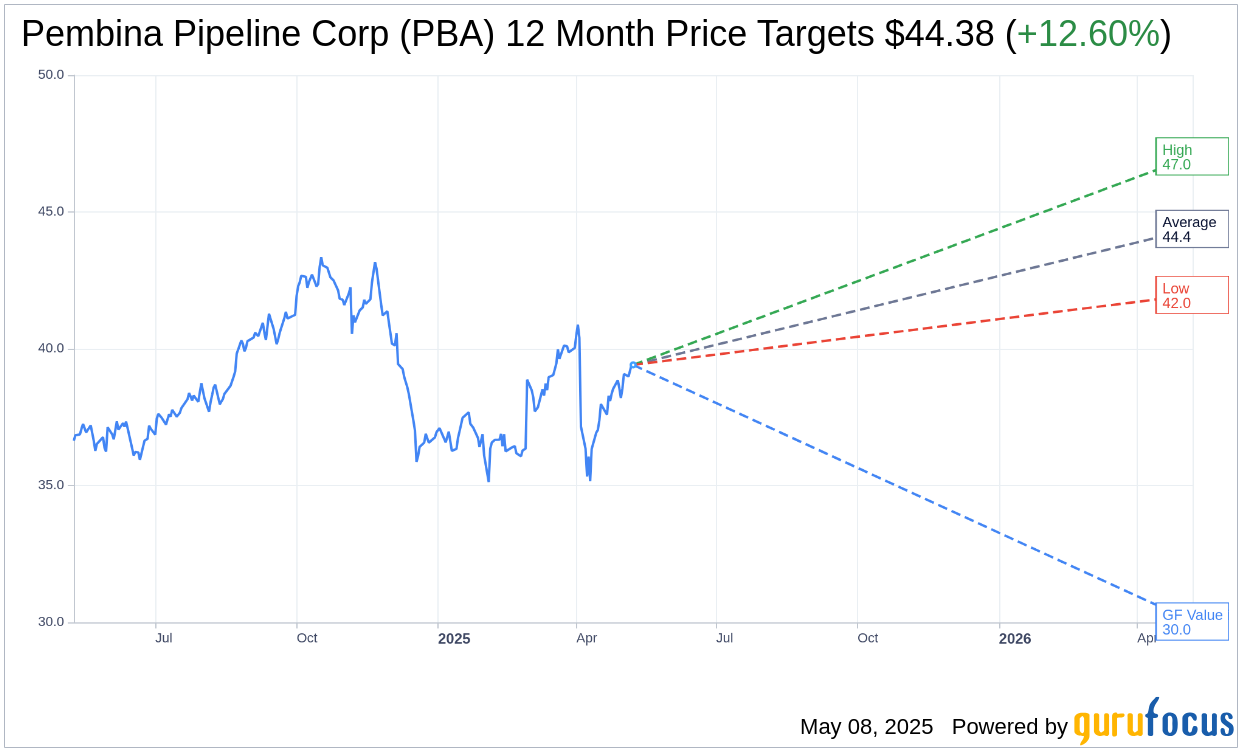

According to the one-year price targets given by three analysts, Pembina Pipeline Corp (PBA, Financial) has an average target price of $44.38, with estimates ranging from a high of $47.03 to a low of $41.97. This average target suggests a potential upside of 12.60% from the current price of $39.41. For a deeper dive into these projections, visit the Pembina Pipeline Corp (PBA) Forecast page.

The consensus recommendation from three brokerage firms indicates an average brokerage recommendation of 2.3 for Pembina Pipeline Corp (PBA, Financial), implying an "Outperform" status. The rating scale ranges from 1, signifying a Strong Buy, to 5, indicating a Sell.

GuruFocus GF Value Estimate

According to GuruFocus estimates, the projected GF Value for Pembina Pipeline Corp (PBA, Financial) in one year is $30.03, which suggests a downside of 23.8% from the current price of $39.41. The GF Value is GuruFocus' assessment of the stock's fair trading value, calculated based on historical trading multiples, past business growth, and future performance projections. Investors can explore more comprehensive details on the Pembina Pipeline Corp (PBA) Summary page.

These contrasting analyses present a nuanced picture for potential investors, balancing the recent strong performance with differing future valuation forecasts. As always, investors should conduct thorough research and consider these insights as part of their broader investment strategy.