Key Highlights for Investors:

- Goldman Sachs BDC's non-GAAP net investment income fell short of expectations, at $0.41 per share.

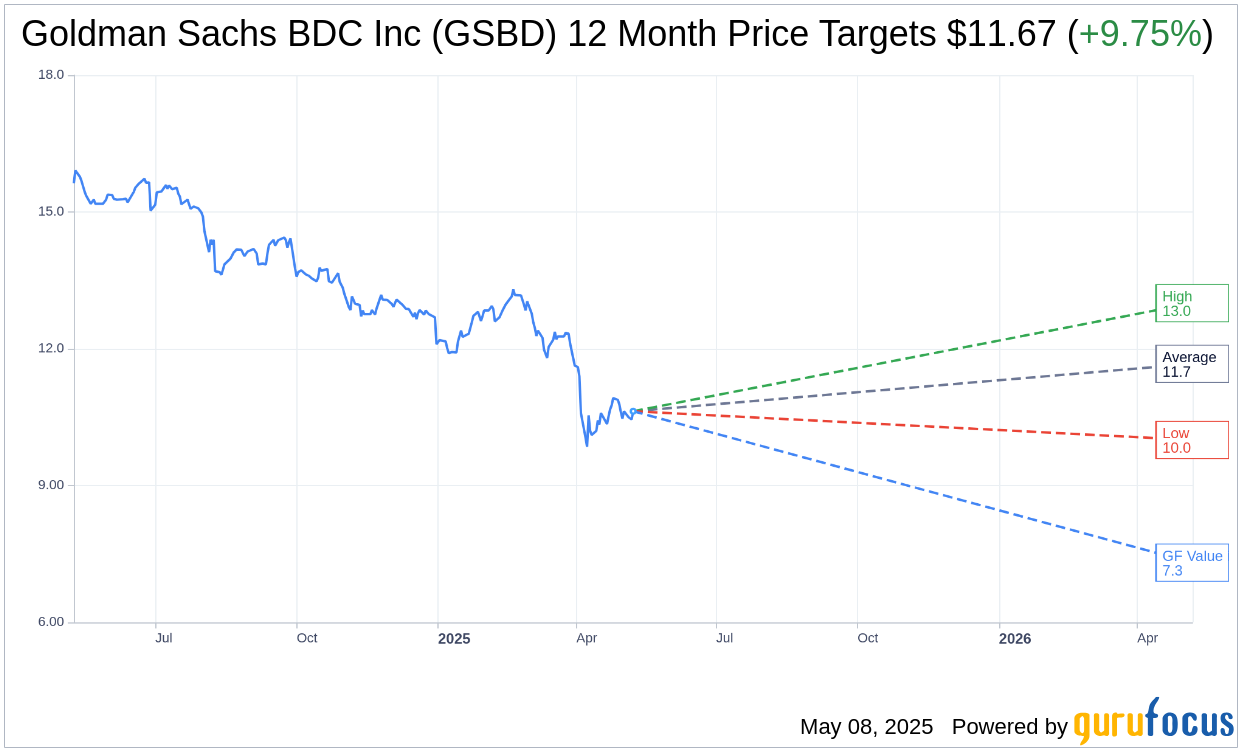

- The stock's current price level suggests a potential upside of 9.75% based on analyst forecasts.

- GuruFocus estimates hint at a significant downside, with a projected GF Value of $7.31.

Goldman Sachs BDC Inc. (GSBD, Financial) recently reported its financial figures for the first quarter, revealing some notable insights for investors. The company's non-GAAP net investment income reached $0.41 per share, missing consensus estimates by $0.05. Additionally, Goldman Sachs BDC's total investment income stood at $96.9 million, reflecting a year-over-year decline of 6.6% and falling short of expectations by $4.22 million.

Analyst Price Targets and Predictions

According to forecasts provided by three analysts, the average one-year price target for Goldman Sachs BDC Inc. (GSBD, Financial) is set at $11.67. Analysts have offered a high estimate of $13.00 and a low of $10.00, suggesting an upside potential of 9.75% from the prevailing stock price of $10.63. Further detailed estimates are accessible on the Goldman Sachs BDC Inc. (GSBD) Forecast page.

Analyst Recommendations and Market Sentiment

The consensus recommendation among four brokerage firms currently positions Goldman Sachs BDC Inc. (GSBD, Financial) at a 3.3 rating, indicative of a "Hold" status. The recommendation scale spans from 1, representing a Strong Buy, to 5, denoting a Sell.

GF Value and Investment Considerations

GuruFocus has calculated the estimated GF Value for Goldman Sachs BDC Inc. (GSBD, Financial) at $7.31 for the upcoming year. This suggests a potential downside of 31.23% relative to the current price of $10.63. The GF Value represents GuruFocus's fair value assessment, derived from historical trading multiples, past business growth, and future business performance forecasts. More comprehensive data is available on the Goldman Sachs BDC Inc. (GSBD) Summary page.