On December 31, 2024, Pacer Advisors, Inc. (Trades, Portfolio) executed a significant transaction involving Adient PLC, a leading supplier in the automotive seating industry. The firm reduced its holdings in Adient PLC by 346,777 shares, marking a 6.74% change in its position. This transaction reflects a strategic decision by Pacer Advisors, Inc. (Trades, Portfolio) to adjust its investment portfolio, impacting its overall holdings in Adient PLC.

About Pacer Advisors, Inc. (Trades, Portfolio)

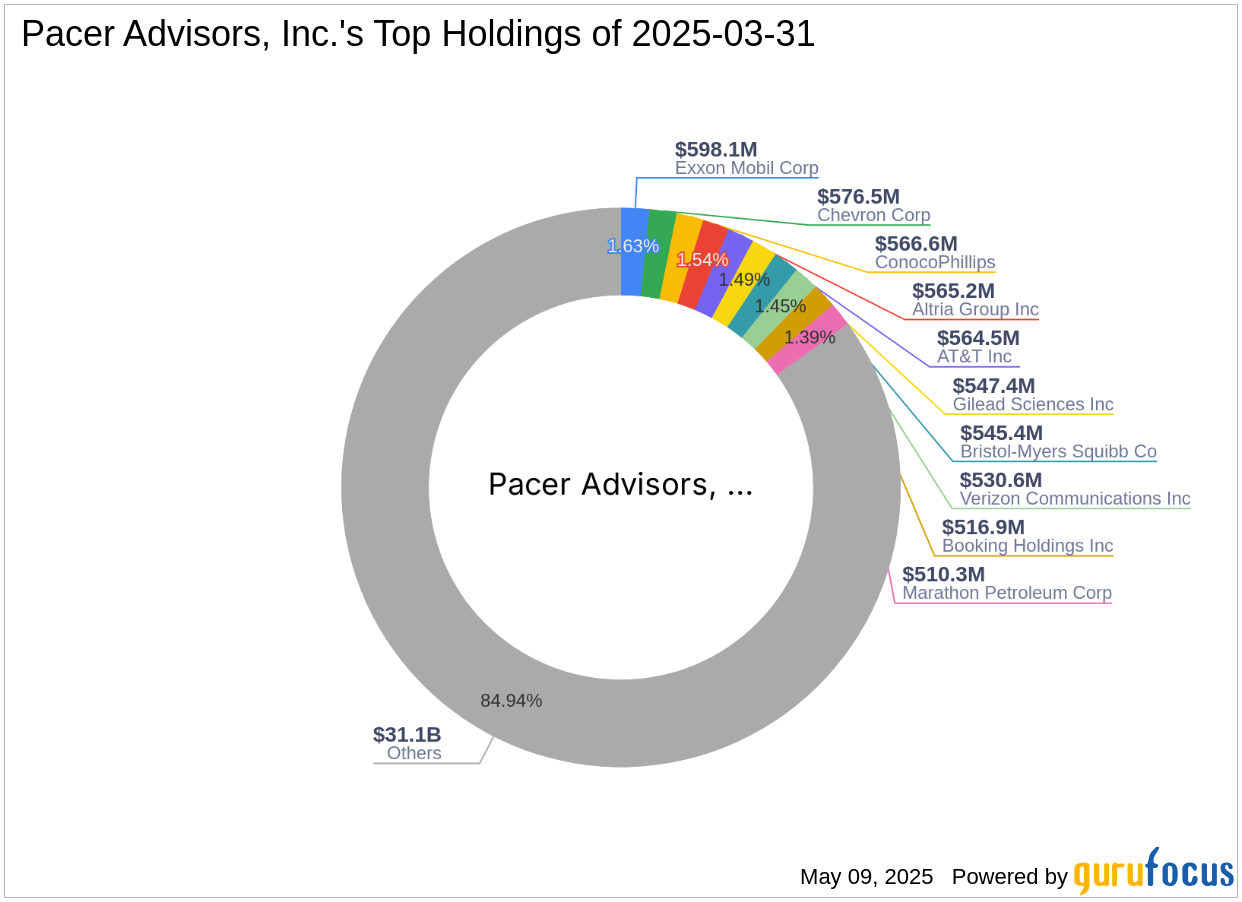

Pacer Advisors, Inc. (Trades, Portfolio) is a well-established investment firm headquartered in Pennsylvania, managing a substantial portfolio equity of $36.66 billion. Known for its strategic investments, the firm holds significant positions in major companies such as ConocoPhillips, Chevron Corp, and Exxon Mobil Corp. Pacer Advisors, Inc. (Trades, Portfolio) is recognized for its expertise in navigating complex market environments and making informed investment decisions that align with its long-term objectives.

Overview of Adient PLC

Adient PLC, headquartered in Ireland, is a prominent player in the automotive seating industry, commanding a significant global market share. The company reported a consolidated revenue of $14.7 billion for fiscal 2024, with a market capitalization of $1.16 billion. Adient PLC has a strong presence in the global market, although it faces challenges in maintaining its market share, particularly in China. The company's strategic decisions and market positioning continue to influence its financial performance and industry standing.

Transaction Details

The shares of Adient PLC were traded at a price of $17.23, resulting in a -0.01% impact on Pacer Advisors, Inc. (Trades, Portfolio)'s portfolio. Following the transaction, the firm holds 4,797,668 shares of Adient PLC, which now accounts for 0.19% of its portfolio. This adjustment reflects Pacer Advisors, Inc. (Trades, Portfolio)'s strategic approach to managing its investments and optimizing its portfolio composition.

Financial Analysis of Adient PLC

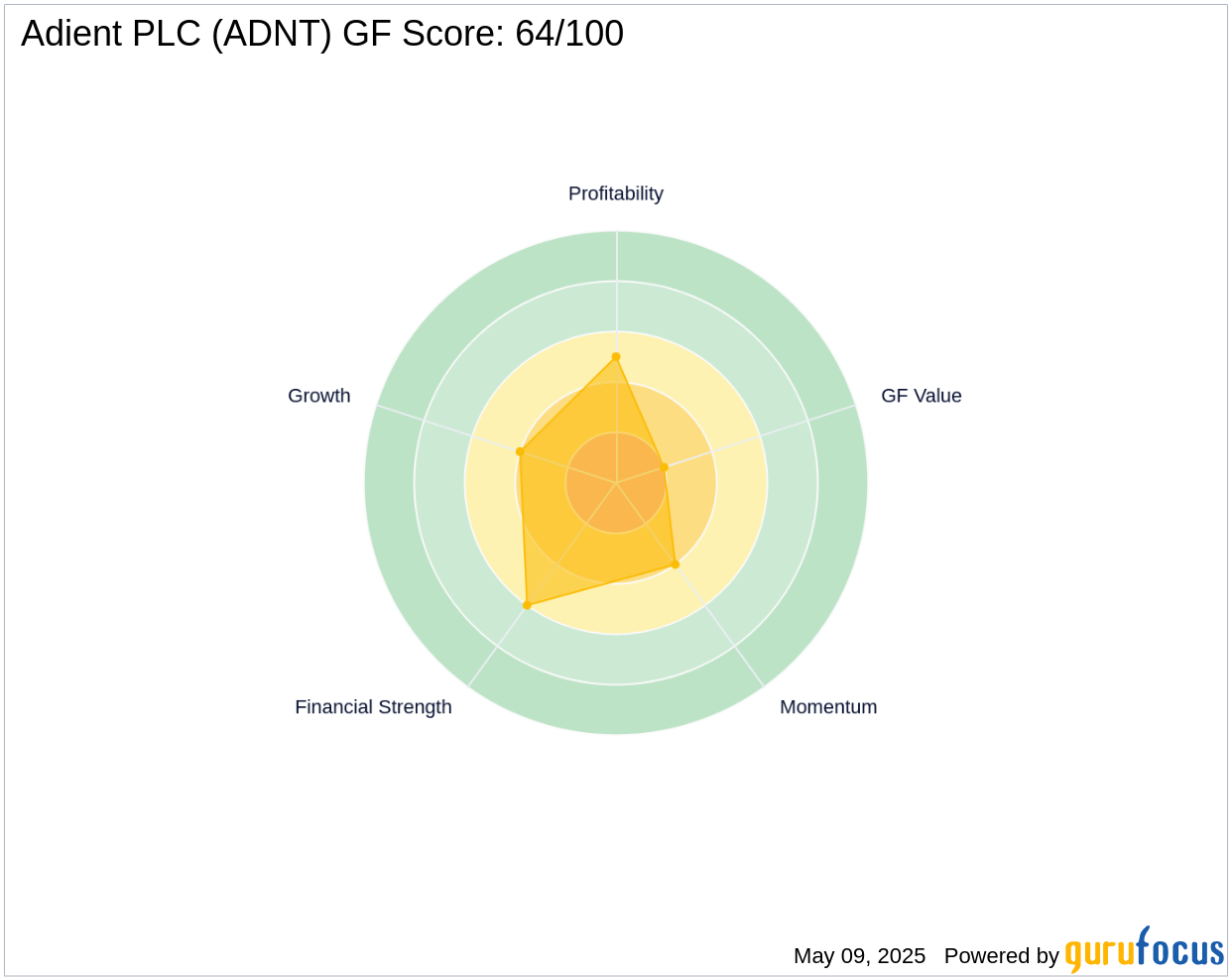

Adient PLC's current stock price stands at $13.77, with a GF Score of 64/100, indicating poor future performance potential. The company's stock is considered a possible value trap, suggesting caution for potential investors. Adient PLC's financial metrics, including a balance sheet rank of 6/10 and a profitability rank of 5/10, highlight the challenges it faces in achieving sustainable growth and profitability.

Performance Metrics and Ratios

Since the transaction, Adient PLC's stock has experienced a -20.08% price change, and a -72.79% change since its IPO. The company's financial strength is reflected in its cash to debt ratio of 0.32 and an interest coverage ratio of 2.06, indicating its ability to meet interest obligations. Despite these metrics, Adient PLC continues to face challenges in maintaining its market position and achieving consistent financial performance.

Market Position and Industry Context

Operating within the Vehicles & Parts industry, Adient PLC is navigating a competitive landscape, particularly in China, where its market share has declined. The company's Altman Z score of 1.87 suggests potential financial distress, while its Piotroski F-Score of 3 indicates limited financial health. These factors underscore the challenges Adient PLC faces in sustaining its market position and achieving long-term growth.

Other Notable Investors

Hotchkis & Wiley Capital Management LLC holds the largest share percentage of Adient PLC, reflecting confidence in the company's potential. Other investment firms, such as Barrow, Hanley, Mewhinney & Strauss, also maintain positions in Adient PLC, indicating continued interest from institutional investors despite the challenges faced by the company.

Transaction Analysis

The reduction in Pacer Advisors, Inc. (Trades, Portfolio)'s stake in Adient PLC highlights a strategic shift in its investment approach. The transaction's impact on the firm's portfolio is minimal, yet it reflects a broader strategy to optimize its holdings and align with market conditions. As Adient PLC navigates industry challenges, the firm's decision to adjust its position underscores the importance of strategic portfolio management in achieving long-term investment goals.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.