Pacer Advisors, Inc. (Trades, Portfolio) recently executed a significant transaction involving ScanSource Inc. On December 31, 2024, the firm reduced its holdings in ScanSource by 754,553 shares at a price of $47.45 per share. This move reflects a strategic adjustment in Pacer Advisors' portfolio, impacting the firm's position in the technology services sector. The transaction decreased the firm's stake in ScanSource to 1,990,149 shares, which now constitutes 0.22% of its overall portfolio. This adjustment is part of a broader strategy to optimize the firm's investment allocations.

About Pacer Advisors, Inc. (Trades, Portfolio)

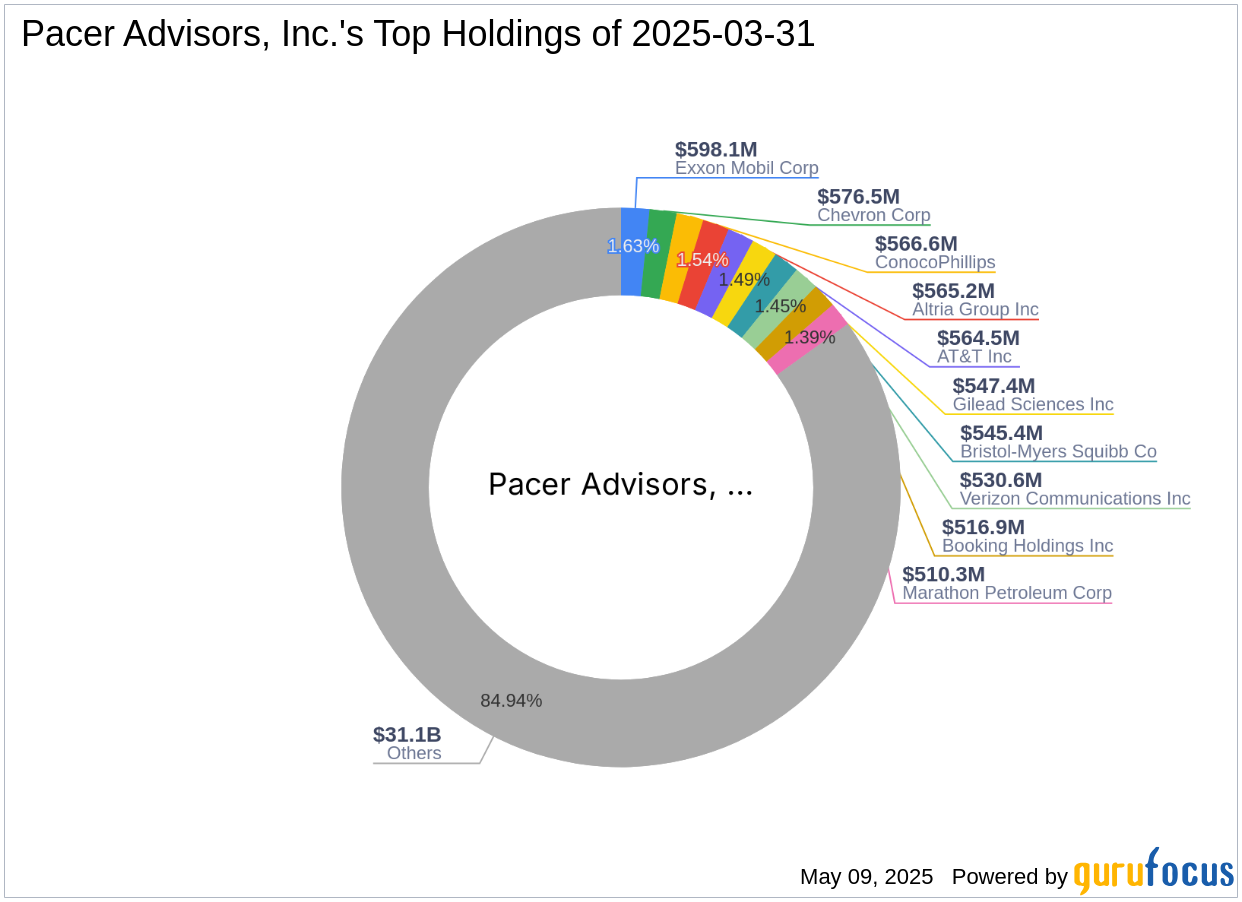

Pacer Advisors, Inc. (Trades, Portfolio) is a prominent investment firm with an equity value of $36.66 billion. The firm is known for its strategic investments in major energy companies, with top holdings including ConocoPhillips (COP, Financial), Chevron Corp (CVX, Financial), and Exxon Mobil Corp (XOM, Financial). These investments highlight the firm's focus on sectors with robust growth potential and stable returns. Pacer Advisors' investment philosophy emphasizes diversification and long-term value creation, aligning with its substantial equity base.

Introduction to ScanSource Inc.

ScanSource Inc. is a key player in providing value-added services for technology manufacturers, primarily serving resellers in specialty technology markets. The company's operations are divided into two main segments: Specialty Technology Solutions and Modern Communications & Cloud. The Specialty Technology Solutions segment, which includes mobility, barcode, POS, payments, security, and networking technologies, generates the majority of the company's revenue. With a strong presence in the United States, ScanSource continues to be a significant entity in the hardware industry.

Financial Metrics and Valuation of ScanSource Inc.

ScanSource Inc. currently holds a market capitalization of $900.765 million and a price-to-earnings (PE) ratio of 15.11. According to the GF Valuation, the stock is considered modestly overvalued, with a GF Value of $31.94. This valuation suggests that the stock's current price exceeds its intrinsic value, indicating potential caution for investors. The stock's price-to-GF Value ratio stands at 1.20, further supporting the modest overvaluation assessment.

Impact on Pacer Advisors, Inc. (Trades, Portfolio)'s Portfolio

The reduction in ScanSource shares has adjusted Pacer Advisors, Inc. (Trades, Portfolio)'s portfolio, with the stock now representing 0.22% of the firm's total holdings. Despite the reduction, the firm still holds 1,990,149 shares, accounting for 8.43% of its total investment in ScanSource. This strategic move reflects the firm's ongoing efforts to balance its portfolio and align with its investment objectives.

Performance and Growth Indicators of ScanSource Inc.

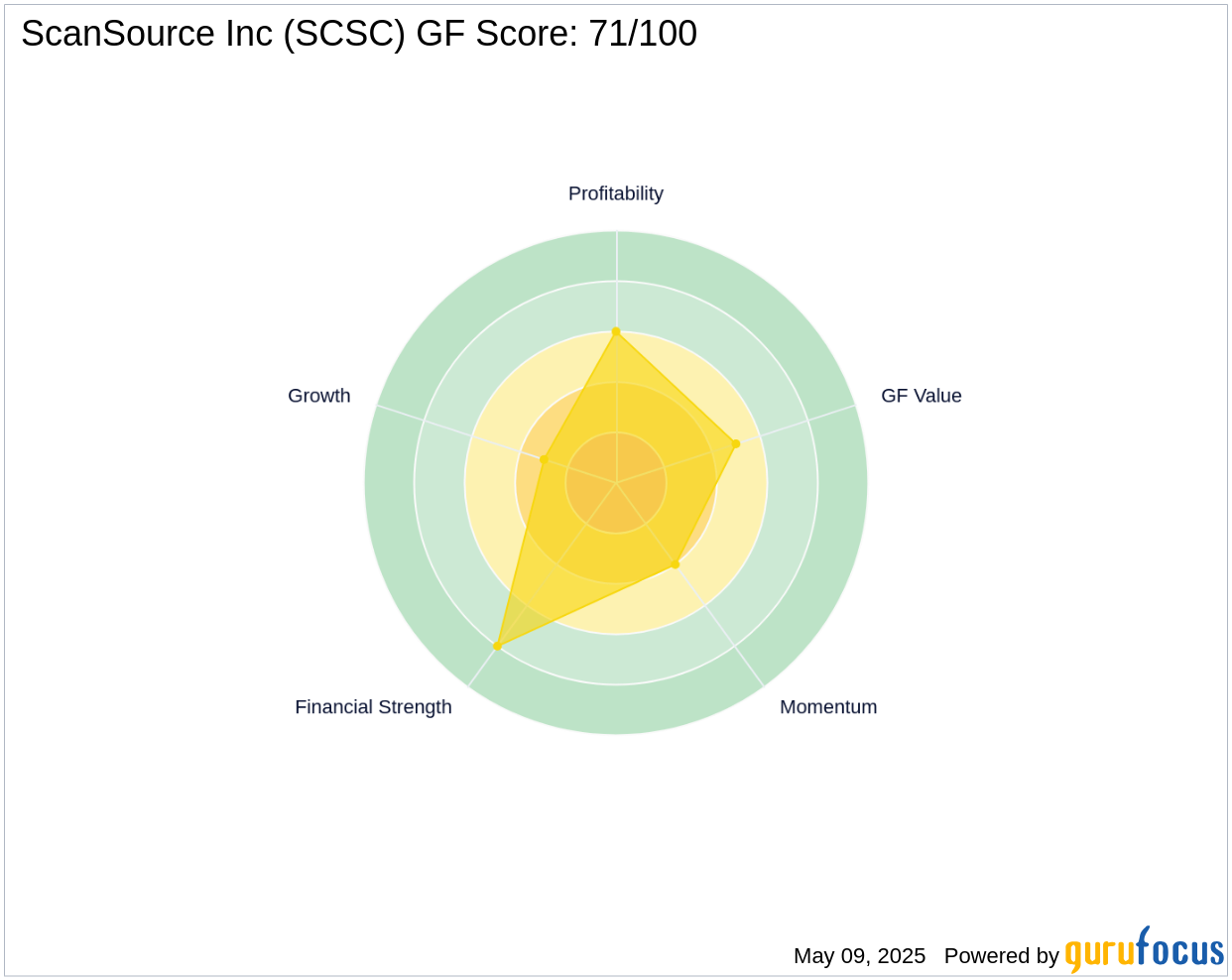

ScanSource Inc. exhibits a GF Score of 71/100, indicating likely average performance. The company's Balance Sheet Rank is 8/10, while its Profitability Rank is 6/10. Growth indicators reveal a 3-year revenue growth of 1.50% and an EBITDA growth of 13.30%, showcasing moderate expansion in its operations. These metrics highlight the company's stable financial health and potential for future growth.

Market Context and Other Investors

ScanSource Inc. has attracted interest from other notable investors, including Joel Greenblatt (Trades, Portfolio). The stock has experienced a year-to-date price change of -18.37% and a gain percent of -19.09% since the transaction. These figures reflect the stock's recent volatility and the broader market conditions affecting its performance. Despite these challenges, ScanSource remains a significant player in the technology services sector.

In conclusion, Pacer Advisors, Inc. (Trades, Portfolio)'s recent transaction involving ScanSource Inc. reflects a strategic portfolio adjustment. The firm's decision to reduce its stake aligns with its broader investment strategy, focusing on optimizing returns and managing risk. As ScanSource continues to navigate market dynamics, its financial metrics and growth indicators will be crucial in determining its future trajectory.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.