On March 31, 2025, Pacer Advisors, Inc. (Trades, Portfolio) executed a substantial reduction in its holdings of ScanSource Inc (SCSC, Financial). The firm decreased its position by 1,711,739 shares, marking a significant change of -86.01% in its holdings of the stock. This transaction reflects a strategic decision by the firm, which now holds 278,410 shares of ScanSource Inc. The reduction had a portfolio impact of -0.14%, with the stock now representing a mere 0.02% of the firm's portfolio.

About Pacer Advisors, Inc. (Trades, Portfolio)

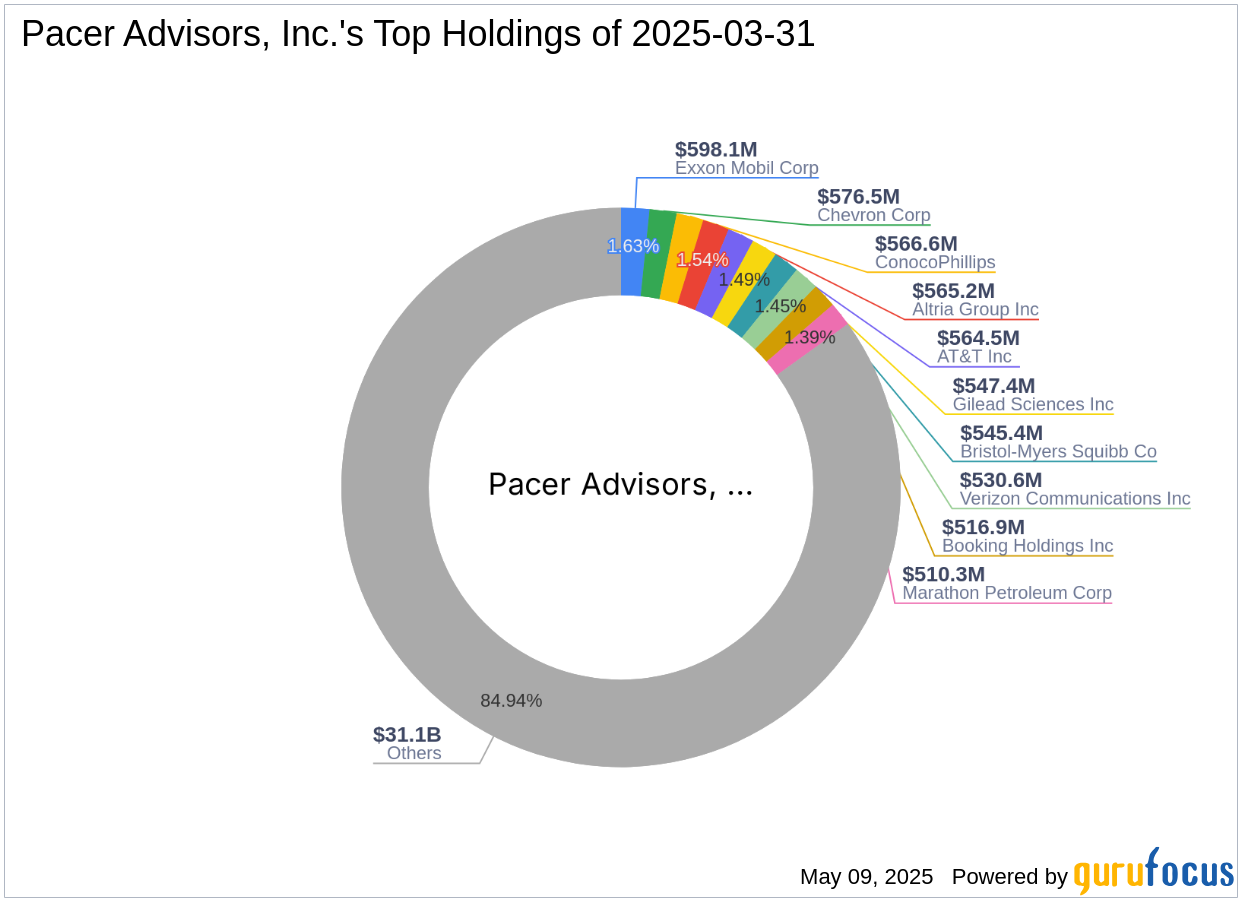

Pacer Advisors, Inc. (Trades, Portfolio) is a prominent investment firm headquartered in Pennsylvania, managing a portfolio equity of $36.66 billion. The firm is renowned for its strategic investments in major companies, including ConocoPhillips (COP, Financial), Chevron Corp (CVX, Financial), and Exxon Mobil Corp (XOM, Financial). Pacer Advisors, Inc. (Trades, Portfolio) is known for its methodical approach to investment, focusing on long-term value creation and diversification across various sectors.

Overview of ScanSource Inc

ScanSource Inc, based in the USA, provides value-added services for technology manufacturers, primarily within the Specialty Technology Solutions segment. The company boasts a market capitalization of $900.765 million and is currently trading at $38.39, with a price-to-earnings (PE) ratio of 15.11. ScanSource Inc's operations are organized into segments such as Modern Communications & Cloud and Specialty Technology Solutions, with the latter generating the majority of its revenue. The company derives most of its revenue from the United States.

Transaction Analysis and Impact

The transaction was executed at a price of $34.01 per share. Despite the significant reduction, the stock has shown a gain of 12.88% since the transaction, although it has experienced a year-to-date decline of -18.37%. The stock is considered modestly overvalued with a GF Value of $31.94 and a Price to GF Value ratio of 1.20. This indicates that the stock is trading above its intrinsic value, as calculated by GuruFocus's exclusive method.

Financial Metrics and Valuation

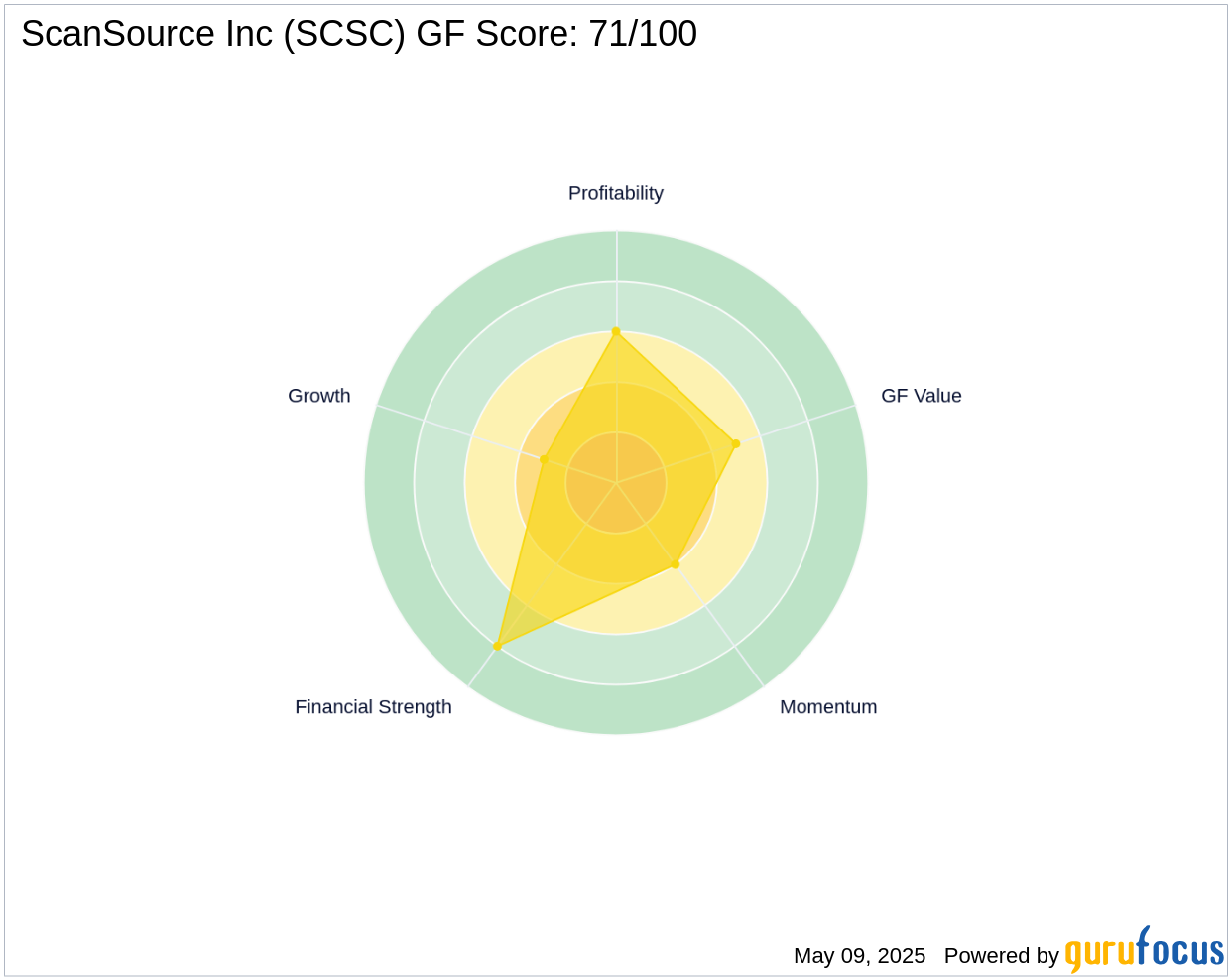

ScanSource Inc has a GF Score of 71/100, suggesting likely average performance. The company has a strong balance sheet rank of 8/10 and a profitability rank of 6/10. Notable growth metrics include a 3-year EBITDA growth of 13.30% and an earnings growth of 4.00%. The company's operating margin growth stands at 2.70%, reflecting its ability to manage costs effectively.

Market Position and Interest from Other Gurus

Hotchkis & Wiley Capital Management LLC holds the largest position in ScanSource Inc, indicating confidence in the company's potential. Other notable investors include Joel Greenblatt (Trades, Portfolio), highlighting continued interest from prominent market participants. This interest from well-regarded investors suggests a belief in the company's long-term growth prospects despite recent fluctuations in stock performance.

In conclusion, Pacer Advisors, Inc. (Trades, Portfolio)'s decision to significantly reduce its holdings in ScanSource Inc reflects a strategic portfolio adjustment. While the stock has shown some positive momentum since the transaction, its modest overvaluation and year-to-date decline present a mixed outlook. The firm's remaining investment in ScanSource Inc, along with interest from other prominent investors, underscores the ongoing evaluation of the company's potential in the evolving technology market.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.