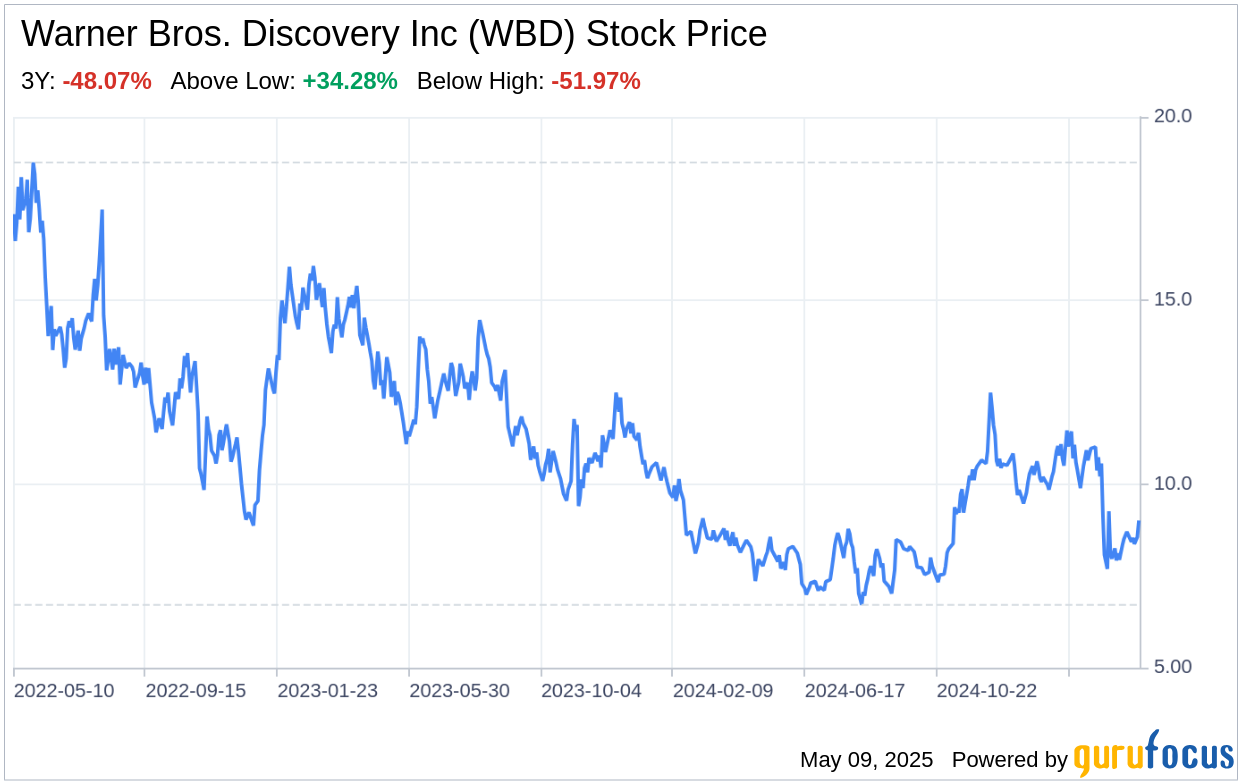

Warner Bros. Discovery Inc (WBD, Financial), a global leader in media and entertainment formed through the merger of WarnerMedia and Discovery Communications, recently filed its 10-Q report on May 8, 2025. This SWOT analysis delves into the financial health and strategic positioning of WBD, as revealed by its latest SEC filing. The company reported a decrease in total revenues from $9,958 million in Q1 2024 to $8,979 million in Q1 2025, alongside a net loss of $449 million in Q1 2025, improving from a net loss of $955 million in the same period the previous year. With a current cash and cash equivalents balance of $3,868 million, WBD is navigating a challenging financial environment with a focus on leveraging its strengths and addressing its weaknesses.

Strengths

Robust Content and Brand Portfolio: Warner Bros. Discovery Inc's strength lies in its extensive content library and well-established brands. The company's studios segment, including Warner Bros. Pictures, is renowned for producing and distributing high-quality movies and television shows. Its networks business, featuring channels like CNN, TNT, and Discovery, has a strong presence in the basic cable network space. The direct-to-consumer segment, with platforms like HBO Max and Discovery+, benefits from the rich content created within the company's other segments.

Global Reach and Diversification: WBD operates on a global scale, with its streaming services available in over 70 countries. This international presence allows the company to tap into diverse markets and mitigate risks associated with any single geographic region. Additionally, the company's three business segments provide a diversified revenue stream, which can be a buffer against market fluctuations in any one segment.

Weaknesses

Financial Performance Concerns: The company's financial performance indicates areas of concern. The latest 10-Q filing shows a decline in revenues across distribution, advertising, and content, with total revenues dropping by nearly $1 billion year-over-year. This decline, coupled with a net loss, suggests that WBD needs to address underlying issues in its revenue generation strategies.

High Debt Levels: WBD's balance sheet reflects high levels of debt, with a noncurrent portion of debt at $34,647 million as of March 31, 2025. The interest expense, net of $468 million, further underscores the financial burden of this debt. Managing this debt will be crucial for the company's long-term financial stability and growth prospects.

Opportunities

Streaming Market Expansion: The direct-to-consumer segment presents significant growth opportunities, particularly in the streaming market. With the consolidation of its streaming platforms to Max and Discovery+, WBD can focus on expanding its subscriber base and enhancing its offerings to compete effectively in the rapidly growing streaming space.

International Market Penetration: WBD's global footprint offers opportunities to further penetrate international markets. By tailoring content and marketing strategies to local tastes and preferences, the company can increase its market share and revenue from regions outside the United States.

Threats

Competitive Landscape: The media and entertainment industry is highly competitive, with numerous players vying for market share. WBD faces stiff competition from other major studios, streaming services, and cable networks, which can impact its ability to attract and retain audiences.

Changing Consumer Behavior: The shift in consumer preferences towards digital and streaming content poses a threat to traditional revenue streams, such as cable networks and theatrical releases. WBD must continue to adapt to these changes to remain relevant and profitable.

In conclusion, Warner Bros. Discovery Inc (WBD, Financial) is navigating a challenging financial environment, marked by declining revenues and a significant net loss. However, the company's strong brand and content portfolio, along with its global reach, provide a solid foundation to build upon. Opportunities in streaming and international markets are promising, but WBD must address its financial weaknesses and adapt to the competitive and changing media landscape to ensure long-term success.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.