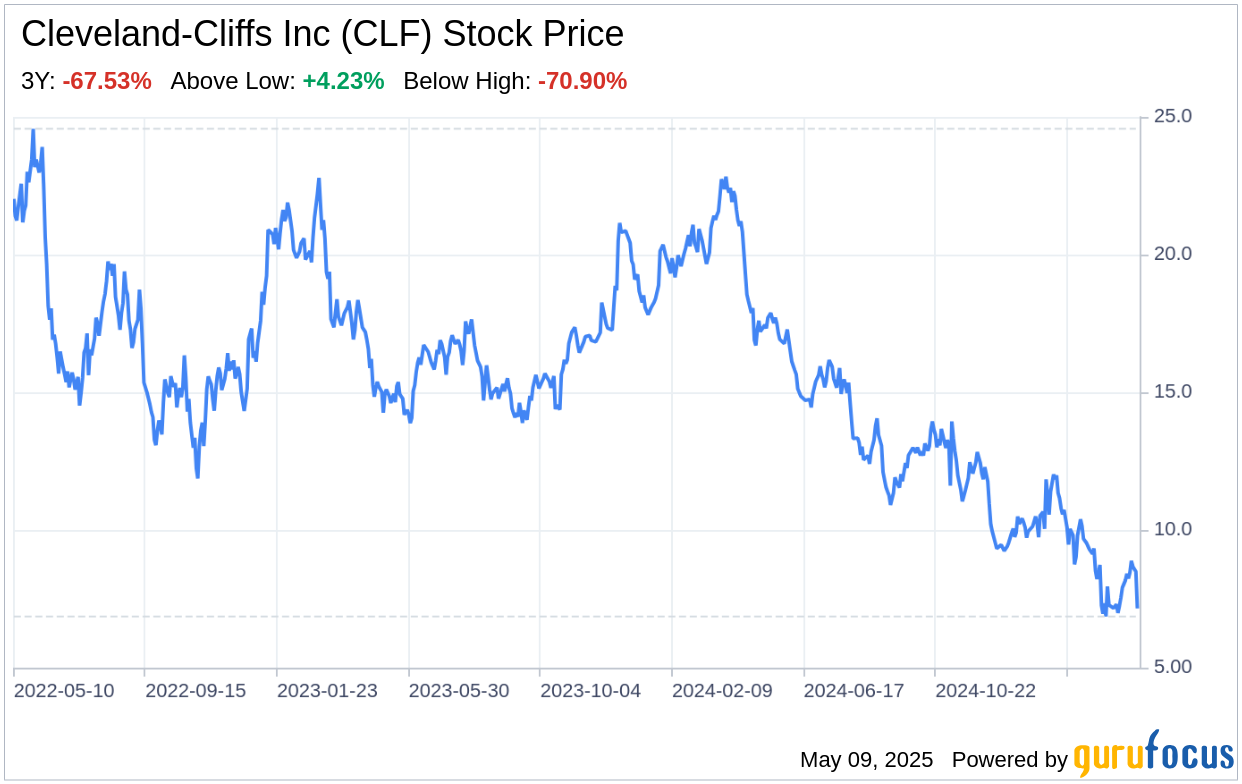

Cleveland-Cliffs Inc (CLF, Financial), a leading flat-rolled steel producer and iron ore pellet manufacturer in North America, recently filed its 10-Q on May 8, 2025. The company's financial performance for the first quarter of 2025 reveals a challenging period, with revenues decreasing to $4,629 million from $5,199 million in the same period last year. Operating costs outpaced revenues, leading to an operating loss of $538 million, a significant downturn from the $38 million loss in 2024. The net loss attributable to Cliffs shareholders widened to $495 million, or a loss of $1.00 per share, compared to a loss of $67 million, or $0.14 per share, in the prior year. These figures underscore the need for a detailed SWOT analysis to understand the company's strategic position and future outlook.

Strengths

Brand and Market Position: Cleveland-Cliffs Inc's reputation as a key supplier to the automotive industry in North America is a significant strength. The company's comprehensive offering of flat-rolled steel products and its vertical integration from mined raw materials to finished products provide a competitive edge. Its strong market position is supported by a loyal customer base, particularly in the automotive sector, where it has established long-term relationships with major manufacturers.

Operational Integration: The company's vertical integration strategy ensures more predictable costs and control over manufacturing inputs and end-product destination. This integration, from mining to steelmaking and downstream finishing, provides Cleveland-Cliffs with a unique advantage in managing supply chain efficiencies and cost structures compared to less integrated competitors.

Labor Relations: Cleveland-Cliffs boasts strong labor relations, particularly with the United Steelworkers (USW) union. This partnership is crucial for maintaining operational stability and has been instrumental in the company's efforts to combat unfair trade practices in the steel industry.

Weaknesses

Financial Performance: The recent financial performance, as indicated by the 10-Q filing, shows a significant operating loss and a widened net loss attributable to shareholders. The increased operating costs and decreased revenues highlight the need for Cleveland-Cliffs to address underlying issues that may include operational inefficiencies, cost management, and market demand fluctuations.

Debt Levels: The company's increased interest expense, as noted in the 10-Q filing, points to a high level of debt. This financial leverage can be a double-edged sword, providing capital for growth but also posing a risk to financial stability, especially in periods of economic downturn or reduced market demand.

Market Sensitivity: Cleveland-Cliffs' strong focus on the automotive industry, while a strength, also exposes the company to sector-specific risks. Any downturn in automotive production or sales can significantly impact the company's revenue streams, necessitating a diversified customer base to mitigate this vulnerability.

Opportunities

Market Recovery and Demand Growth: As the economy recovers from any downturns, Cleveland-Cliffs is well-positioned to capitalize on increasing demand for steel, particularly in the automotive sector. The company's established relationships and reputation for quality products can drive sales growth as market conditions improve.

Innovation and Product Development: Cleveland-Cliffs' Research and Innovation Center in Middletown, Ohio, presents an opportunity for the company to develop new steel products and manufacturing processes. Innovations, particularly in high-strength, lightweight steel for the automotive industry, can provide a competitive advantage and open new market segments.

Trade Policies: The company stands to benefit from protective trade policies, such as tariffs on imported steel. These policies can level the playing field against foreign competition and support domestic steel producers like Cleveland-Cliffs.

Threats

Global Overcapacity: The steel industry is characterized by global overcapacity, leading to challenges such as dumping and price suppression. Cleveland-Cliffs must navigate these market dynamics to maintain profitability and market share.

Raw Material Price Volatility: Fluctuations in the prices of raw materials, such as iron ore and scrap metal, can impact Cleveland-Cliffs' cost structure. While vertical integration provides some protection, the company is not immune to market volatility and must manage this risk effectively.

Regulatory and Environmental Pressures: The steel industry faces increasing regulatory and environmental pressures, including the need to reduce greenhouse gas emissions. Cleveland-Cliffs must continue to invest in sustainable practices and technologies to comply with regulations and maintain its social license to operate.

In conclusion, Cleveland-Cliffs Inc (CLF, Financial) faces a challenging financial landscape, as evidenced by its recent 10-Q filing. However, the company's strengths, including its market position, operational integration, and labor relations, provide a solid foundation for addressing its weaknesses and capitalizing on opportunities. The threats of global overcapacity, raw material price volatility, and regulatory pressures are significant but can be mitigated through strategic planning and innovation. Cleveland-Cliffs' forward-looking strategies, such as product development and leveraging trade policies, will be crucial in navigating the competitive steel industry and driving future growth.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.