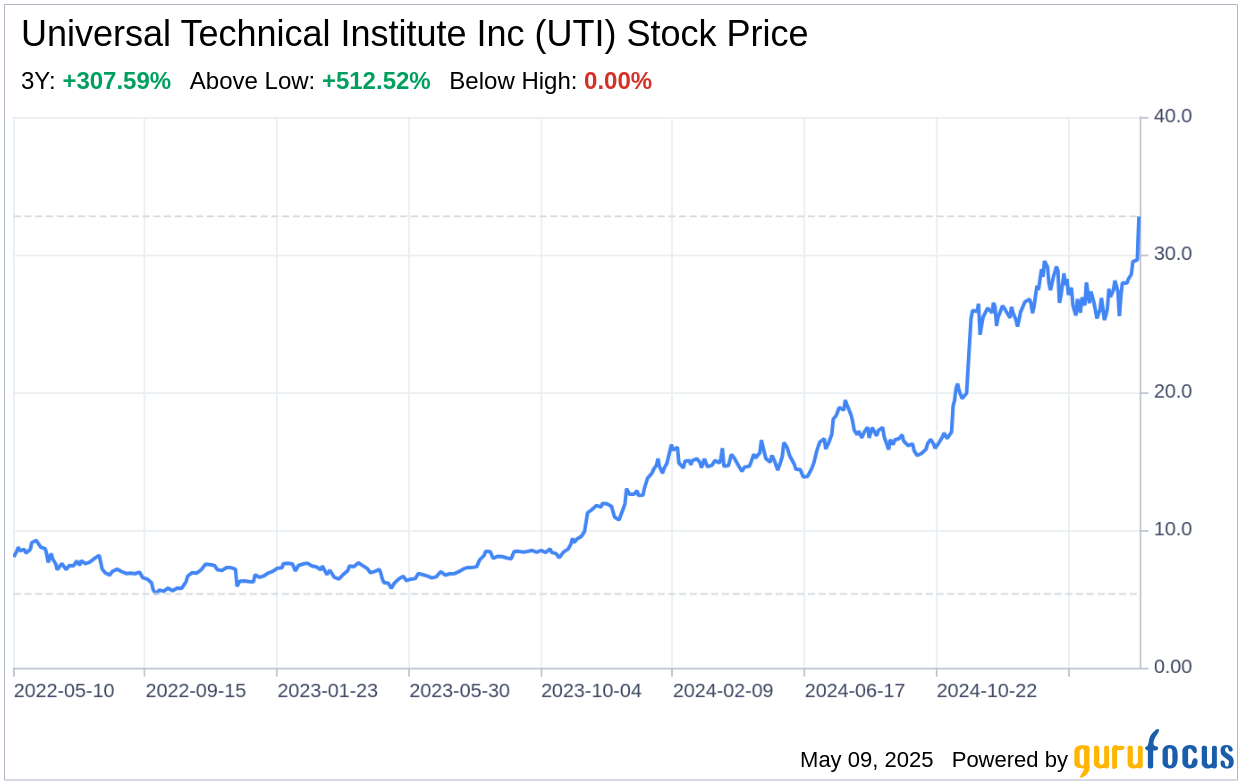

Universal Technical Institute Inc (UTI, Financial), an educational institution specializing in programs for technicians in the automotive, diesel, collision repair, motorcycle, and marine fields, reported its quarterly financials on May 8, 2025. The 10-Q filing reveals a 12.6% increase in revenues to $207.4 million, driven by a 26.4% rise in new student starts and a 7.0% uptick in average full-time active students. UTI's strategic expansion into Battery Hybrid Electric Vehicle and Electric Vehicle (EV) courses at select campuses reflects its adaptability to evolving industry demands. Despite increased educational services and facilities expenses, which climbed to $102.5 million, UTI's investments in faculty and program expansion demonstrate its commitment to providing quality education and enhancing student outcomes. The company's adherence to regulatory standards and accreditation requirements further solidifies its market position.

Strengths

Industry-Focused Educational Model: UTI's industry-focused educational model and national presence have enabled the institution to forge valuable industry relationships, providing competitive advantages and supporting market leadership. This model has been instrumental in delivering specialized education to students, resulting in enhanced employment opportunities and the potential for higher wages for graduates. The recent expansion of the automotive program to include EV courses at select campuses, such as Avondale, Arizona, and Orlando, Florida, showcases UTI's commitment to staying at the forefront of industry trends and meeting the evolving needs of the workforce.

Strong Enrollment Growth: UTI has experienced significant growth in student enrollment, with a 26.4% increase in new student starts and a 7.0% increase in average full-time active students. This growth is indicative of the institution's strong brand and reputation in the market, as well as the effectiveness of its marketing and recruitment strategies. The increase in enrollment has directly contributed to the 12.6% rise in revenues, underscoring the institution's financial strength and ability to attract and retain students.

Weaknesses

Increased Operational Costs: Despite the revenue growth, UTI has seen a rise in educational services and facilities expenses, which totaled $102.5 million for the quarter. This increase is primarily due to the costs associated with executing business strategies and supporting the growth in student population. While these investments are necessary for long-term success, they currently weigh on the institution's profitability and may require careful management to ensure sustainable financial performance.

Regulatory Compliance Risks: UTI operates in a highly regulated industry, which requires continuous compliance with extensive regulatory requirements for school operations. The institution's ability to process federal student financial assistance funds is contingent upon maintaining eligibility and adhering to Title IV Program regulations. Any failure to comply with these regulations could result in significant legal and financial repercussions, posing a risk to the institution's operational integrity and financial stability.

Opportunities

Expansion of Program Offerings: UTI's recent inclusion of EV courses in its automotive program presents an opportunity to capitalize on the growing demand for technicians skilled in electric vehicle technology. This expansion not only enhances the institution's educational offerings but also positions UTI as a leader in providing cutting-edge training for the next generation of automotive technicians. By continuing to align its curriculum with industry advancements, UTI can attract more students and meet the needs of its industry partners.

Strategic Acquisitions and Partnerships: UTI's acquisition of Concorde Career Colleges has expanded its program offerings into the allied health, dental, nursing, patient care, and diagnostic fields. This diversification presents opportunities for cross-promotion and the development of new industry relationships. Strategic partnerships with healthcare providers and institutions can further strengthen UTI's position in the education sector and drive growth in new student enrollment.

Threats

Competitive Market Landscape: The education sector is highly competitive, with numerous institutions vying for students and industry partnerships. UTI must continuously innovate and differentiate its programs to maintain its competitive edge. The institution faces the threat of losing market share to competitors that may offer similar or more advanced training programs, more attractive financial aid packages, or better employment outcomes for graduates.

Economic and Regulatory Uncertainties: Macroeconomic conditions and regulatory changes can significantly impact student enrollment and the institution's ability to secure funding. Economic downturns may affect students' ability to afford tuition, while changes in federal financial aid programs or veterans' benefits could alter the funding landscape. Additionally, ongoing legislative scrutiny of the for-profit education sector poses a threat to UTI's operational model and financial health.

In conclusion, Universal Technical Institute Inc (UTI, Financial) demonstrates a robust SWOT profile, with its industry-focused educational model and strong enrollment growth serving as key strengths. However, the institution must navigate increased operational costs and regulatory compliance risks. Opportunities for expansion and strategic partnerships are promising, but UTI must remain vigilant against competitive pressures and external economic and regulatory uncertainties to sustain its market position and financial success.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.